Good day to all, after the long weekend we are back into trading action with the dollar weakened at the end of last week but bulls still hoping for a full scale reversal. For me the key level to watch out for is the 101.50 in the short-term Dollar Index chart and the 98.80 support and March lows. For a Dollar Index analysis follow this link.

I have also posted some EUR/USD and USD/CAD analysis which you can read.

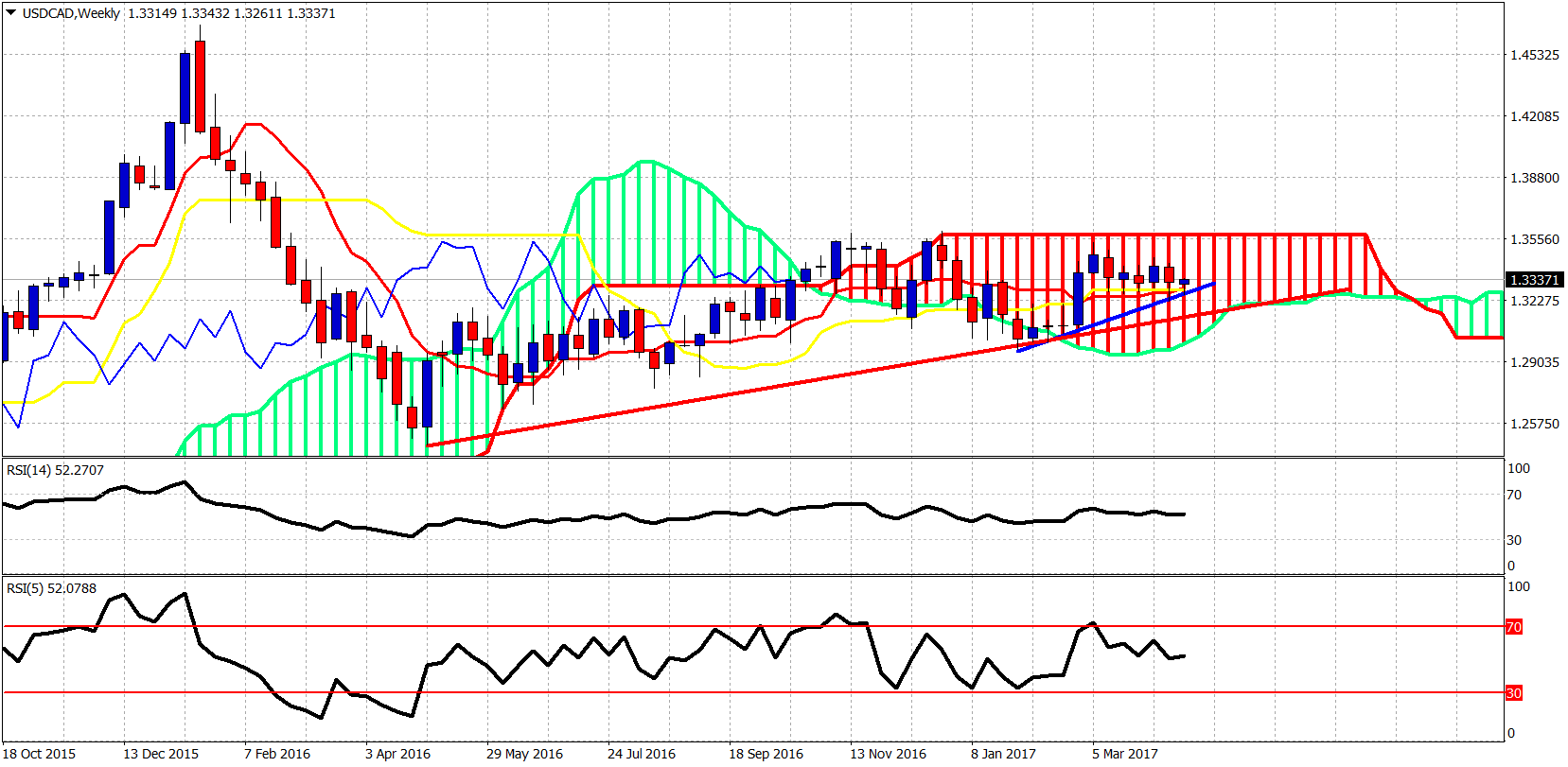

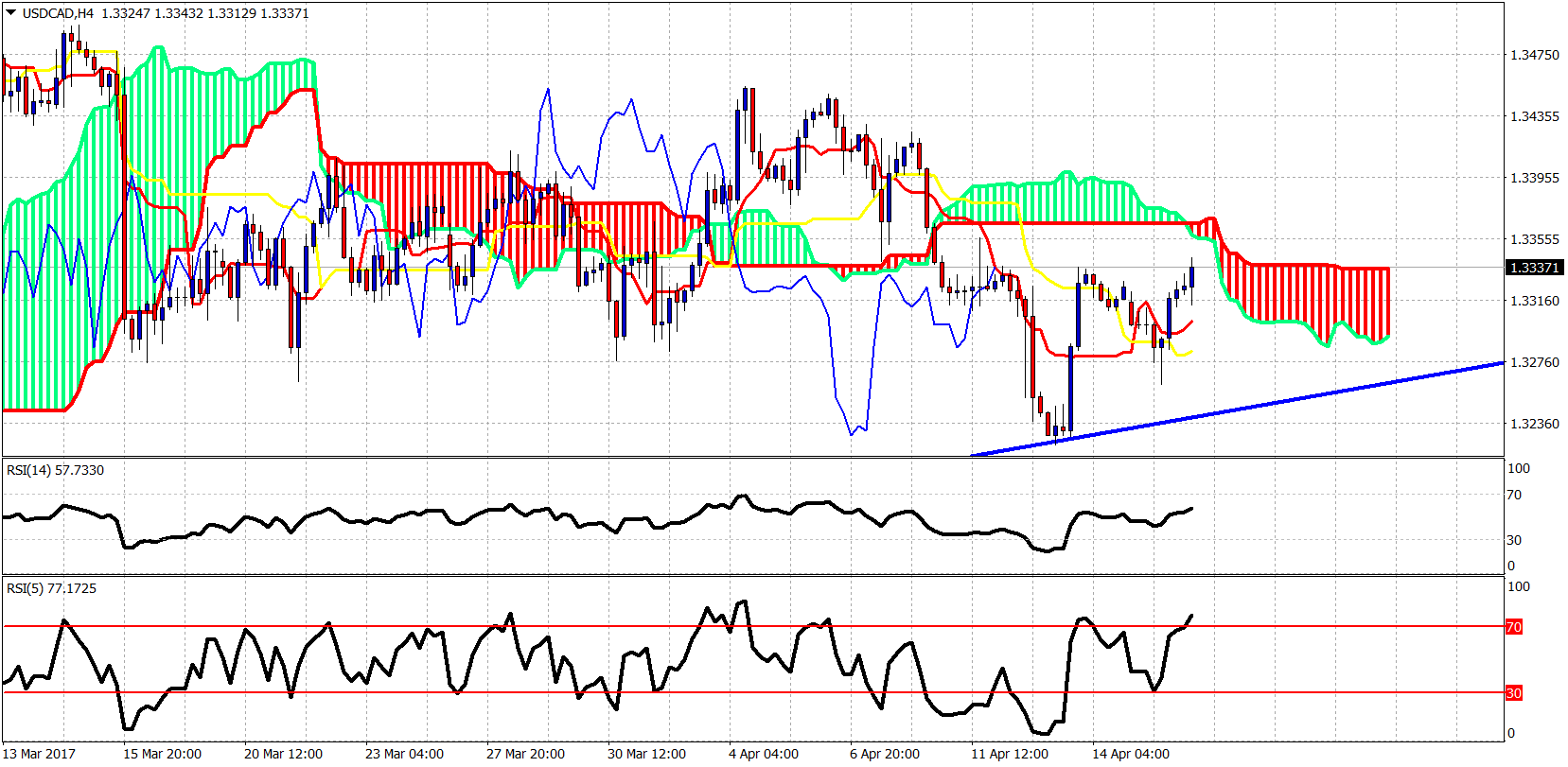

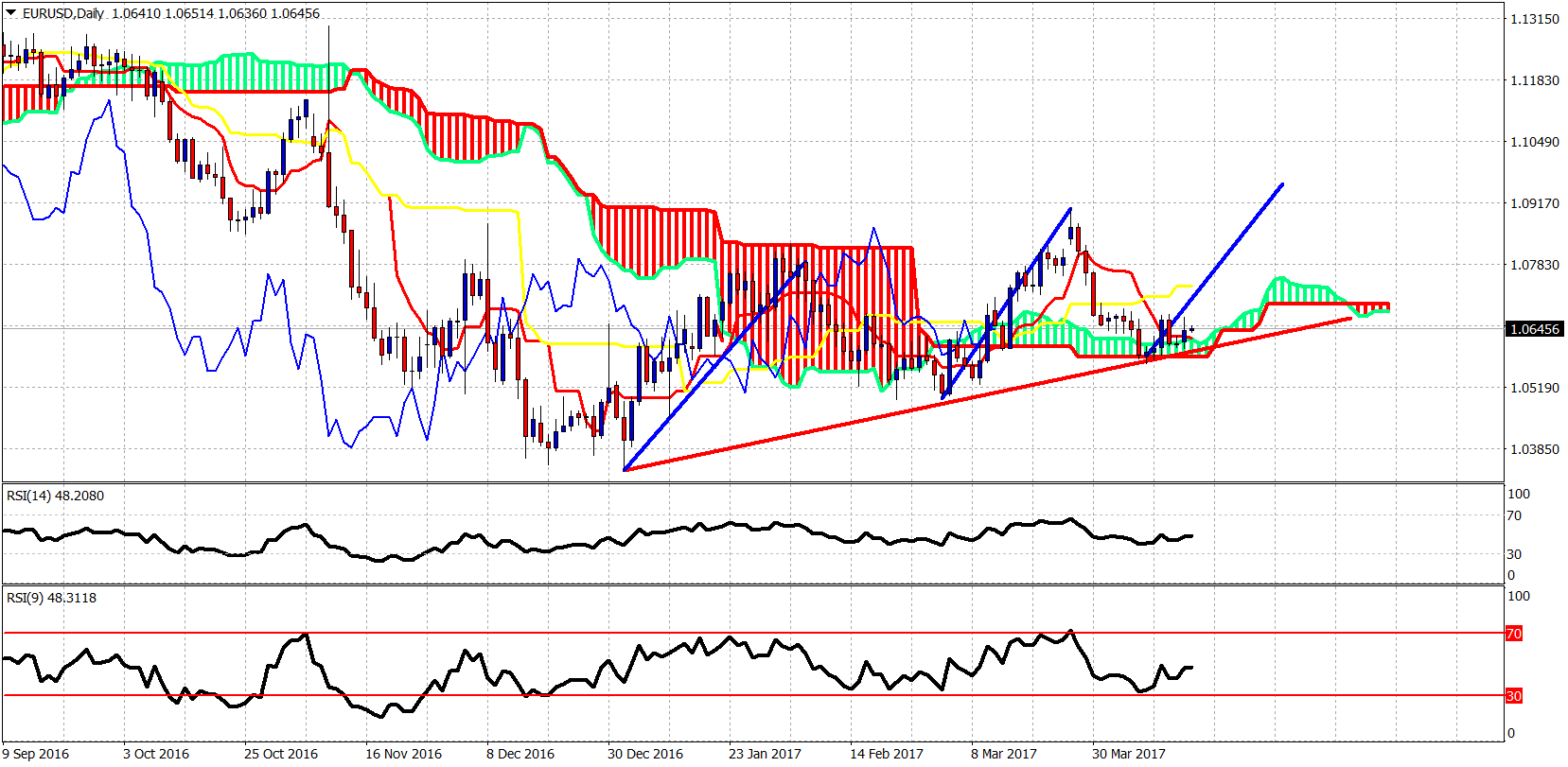

Here are the charts from these posts. General view remains bullish for both pairs looking for 1.10 and 1.40 respectively with important support levels at 1.30-1.31 for USD/CAD and 1.05 for EUR/USD.

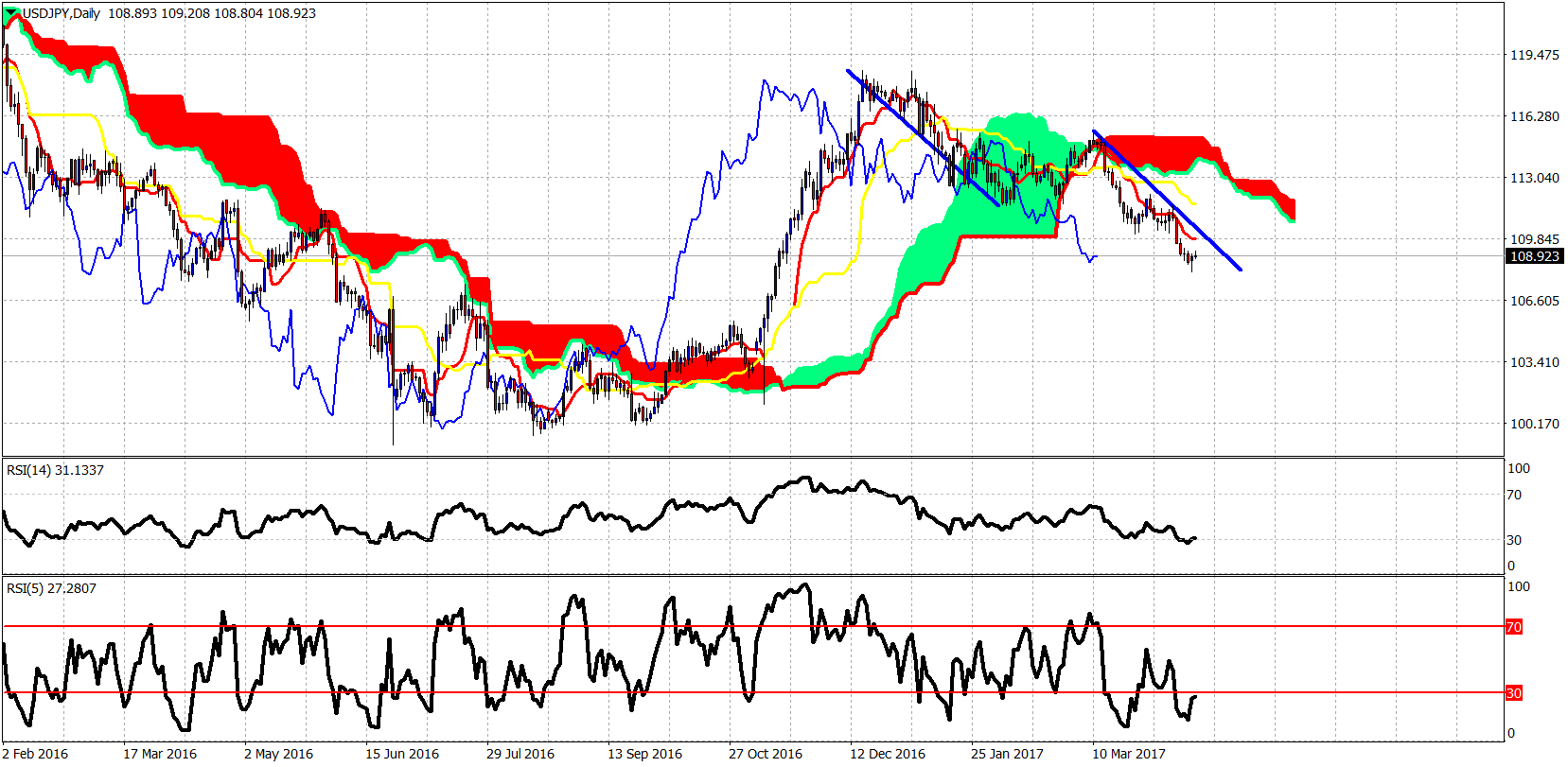

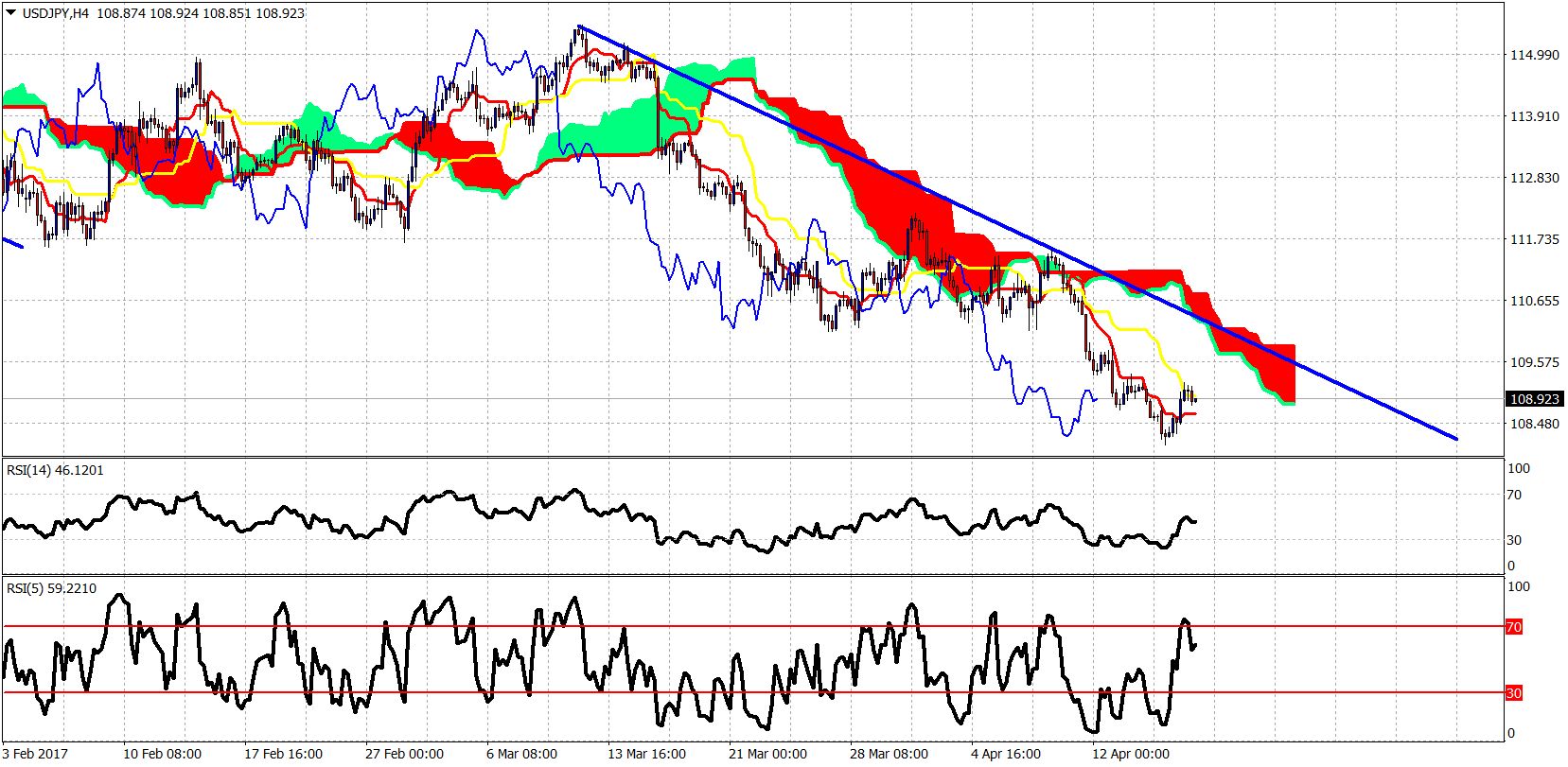

The USD/JPY is very close to my target and a bigger bounce could come from the 108 area. I cannot rule out an extension lower towards 104-105 but for this to play out, we need to remain below 112-112.50.

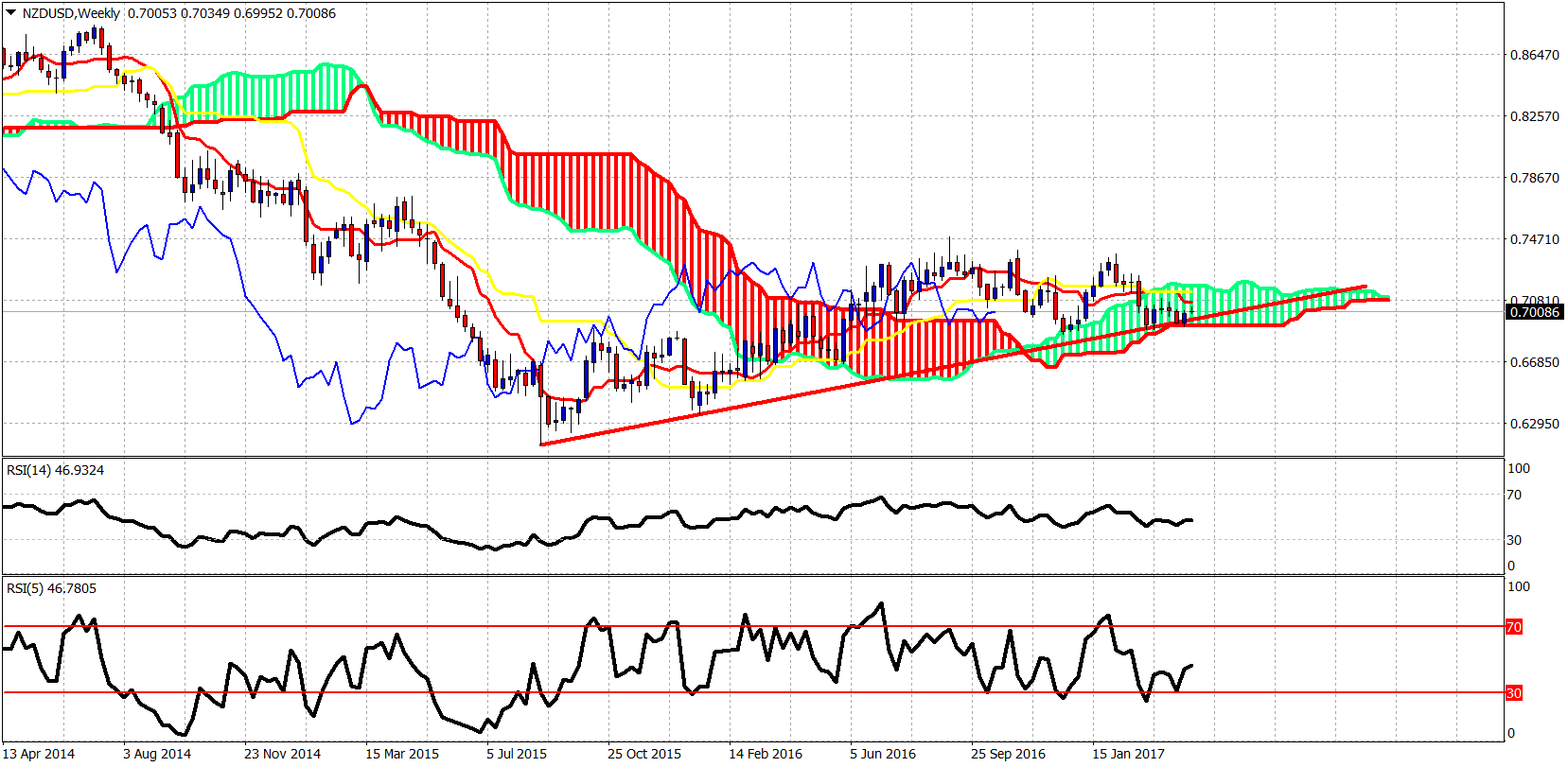

NZDUSD remains above critical trend line support. 0.69 is key. If broken, we will see 0.67.

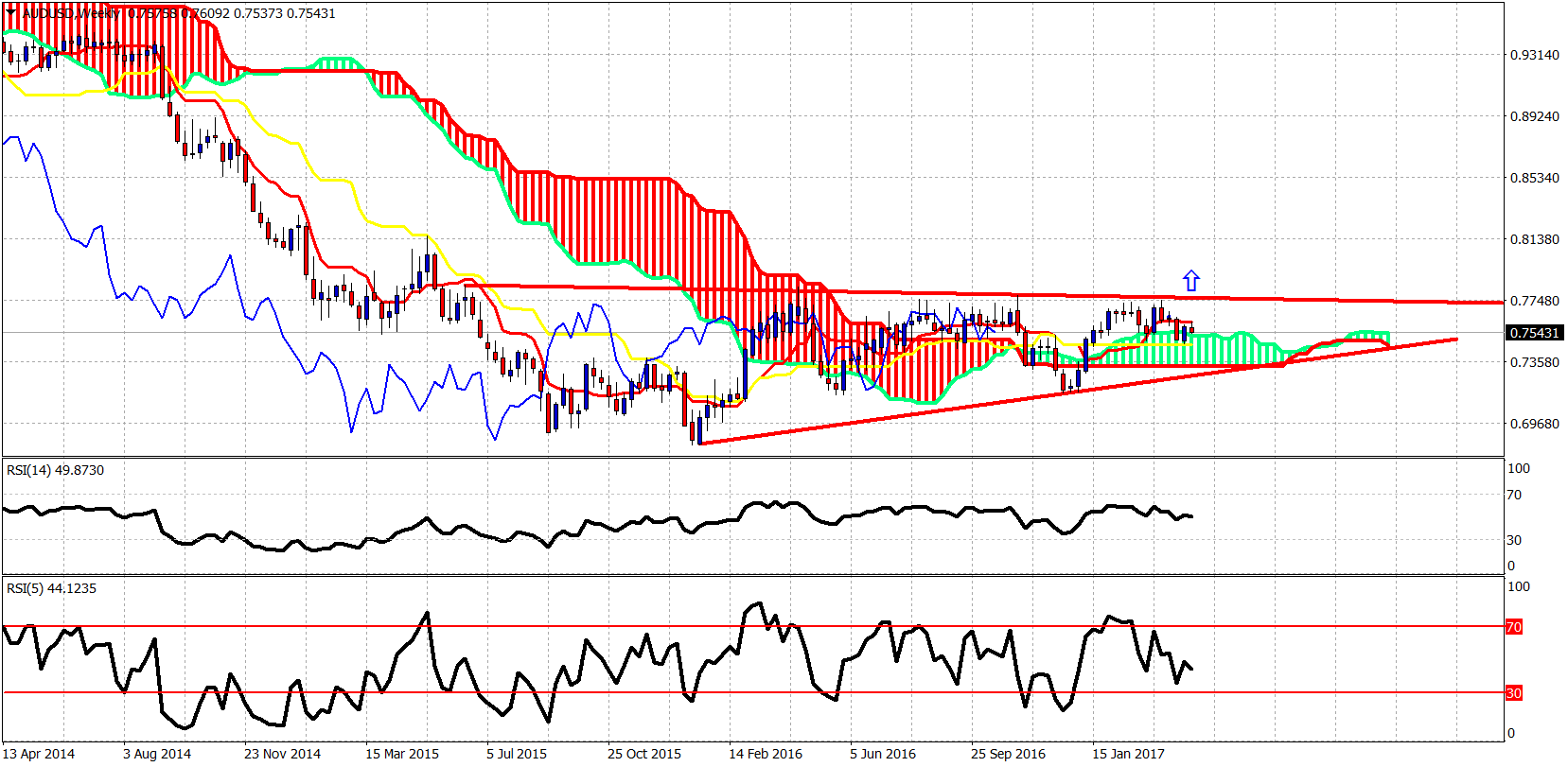

AUD/USD key resistance remains at 0.7750. As long as we trade below it, in danger of pushing towards 0.73.

Thank you for taking the time to catch up on my thinking.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.