New initiatives and corporate targets

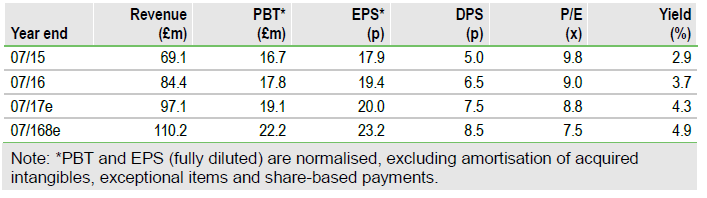

Utilitywise (LON:UTW) has developed a range of new strategic initiatives and set itself demanding targets for future growth. The plan will be implemented in the period FY18-21 and evidence of progress towards the targets will be required before any valuation uplift associated with this new growth trajectory is likely to be awarded. However, the current rating remains modest and we suggest it does not yet reflect the current prospects.

Priorities, initiatives and targets

At its capital markets day on 2 March 2017, UTW set out a number of new strategic initiatives and established targets for growth. “Optimising the Core” focuses on the approach to market (sales channels), improvements in the operating model and productivity, some of which is already evident (H117 order book +25%, headcount +7%). A “Digital Initiative” will seek to exploit the untapped market of 1.5m SME customers (84% of the market) that have never switched energy supplier. The “Multi-Utility” initiative is designed to allow businesses to manage all their interactions with utilities on a single platform (UTW’s research suggests that 70% of customers want a multi-utility service). The “Service Proposition” will seek to drive recurring revenue from developing customer service plans using UTW’s IoT “Wiselife” platform which is scheduled for rollout in the summer of 2017. “Energy Services” is seen as an opportunity for developing UTW’s internet-enabled control devices while “International Expansion” remains a medium-term objective.

To read the entire report Please click on the pdf File Below