While the FOMC meeting remains the key event this week, on the economic front, it is a busy week for the British pound, starting with today's inflation data. Economists polled expect consumer prices to rise 1.10% in November, following a slower pace of increase during the previous month at 0.9%. For the GBP, today's inflation marks the first release among other economic releases including retail sales, jobs, and the BoE meeting.

GBP/USD Intra-day Analysis

GBP/USD (1.2667):GBP/USD was bullish yesterday closing at $1.2678. The bullish close comes following Friday's doji close after nearly three previous daily sessions of declines. On the 4-hour chart, following the breakout from the median line, the British pound is seen posting lower highs, with price capped near 1.2699 resistance. The 4-hour Stochastics is showing a bearish divergence which could see prices posing a downside risk. Support at 1.2500 remains a key level of interest which could be tested in the near term. Despite the near term risks of a pullback to 1.2500, the overall bias in GBP/USD remains to the upside with the potential to target 1.2800.

EUR/GBP Intra-dayAnalysis

EUR/GBP (0.8390):EUR/GBP has been trading flat with price continuing to consolidate above the minor support at 0.8373. As long as this support holds, the prospects of a bullish rally remain in place with the initial rally likely to push the single currency towards 0.8469 where resistance is likely to be challenged. Above this level, the neckline resistance of the inverse head and shoulders forming on the 4-hour chart remains vital for further upside. The bullish bias could be at risk if EUR/GBP dips below 0.8330 which marks the previous low.

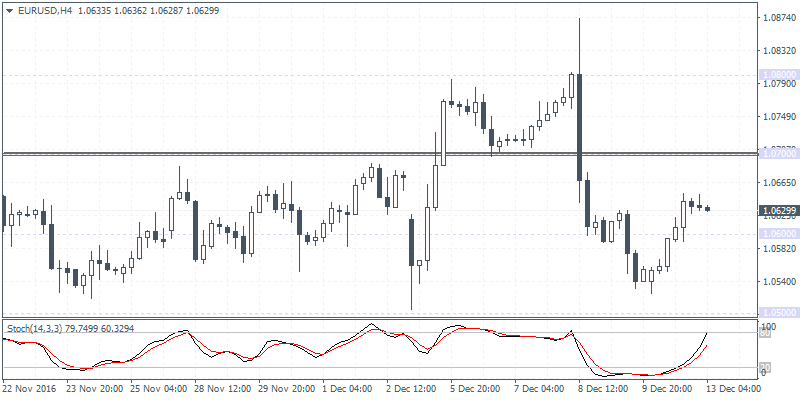

EUR/USD Intra-day Analysis

EUR/USD (1.0629):EUR/USD closed with a strong bullish engulfing pattern yesterday breaking above the price level of 1.0600. In the near term, further upside could be seen coming which could send the single currency higher to test 1.0700. Any pullbacks ahead of the rally to 1.0700 could be seen capped near 1.0580. As long as the previous low at 1.0524 is not breached, the bias remains to the upside. Above 1.0700, the previous resistance level at 1.0765 is likely to be targeted once again.