EUR/USD continues to have a quiet week, as the pair trades at the 1.06 line. On the release schedule, Germany releases Preliminary CPI, with the markets expecting a small gain of 0.1%. The US will publish Preliminary GDP for the third quarter, with the estimate standing at 3.0%. As well, we’ll get a look at CB Consumer Confidence, which is expected to improve to 101.3 points.

Eurozone inflation numbers remain low, despite the ECB cutting interest rates to record low levels. German Preliminary CPI came in at 0.2% in October and is expected to edge lower to 0.1% in the November report. On Monday, ECB President Mario Draghi addressed an ECB parliamentary committee. Draghi said that the Eurozone growth had been “moderate but steady” despite the effects of global economic and political uncertainty. Draghi also said that he expected the economy’s recovery to continue. The ECB will meet for a policy meeting next week.

It’s a virtual certainty that the Fed will raise interest rates a quarter-point in December, with the odds of a rate hike at 93 percent. The Fed minutes were released on Thursday, indicating that policymakers felt it appropriate to raise rates “relatively soon”. Earlier this month, Fed Chair Janet Yellen used the same phrase in her testimony before a congressional committee. The minutes indicated that some members argued that the Fed needs to raise rates in December in order to preserve the bank’s credibility – despite some broad hints of rate hikes during 2016, the Fed has stayed on the sidelines throughout 2016, causing significant disappointment and frustration in the markets.

EUR/USD Fundamentals

Tuesday (November 29)

- 7:00 German Import Prices. Estimate 0.6%. Actual 0.9%

- All Day – German Preliminary CPI. Estimate 0.1%

- 7:45 French Consumer Spending. Estimate 0.2%. Actual 0.9%

- 8:00 Spanish Flash CPI. Estimate 0.5%. Actual 0.7%

- 10:16 Italian 10-year Bond Auction. Estimate 1.97%

- 13:30 US Preliminary GDP. Estimate 3.0%

- 13:30 US Preliminary GDP Price Index. Estimate 1.5%

- 14:00 US S&P/CS Composite-20 HPI. Estimate 5.3%

- 14:15 US FOMC Member William Dudley Speech

- 15:00 US CB Consumer Confidence. Estimate 101.3 points

- 17:40 US FOMC Member Jerome Powell Speech

*All release times are GMT

* Key events are in bold

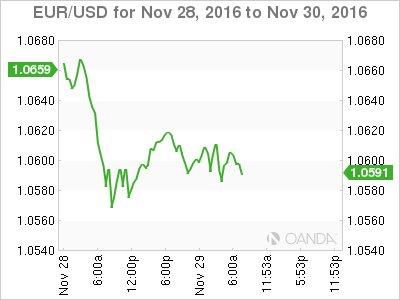

EUR/USD for Tuesday, November 29, 2016

EUR/USD November 29 at 6:40 GMT

Open: 1.0618 High: 1.0620 Low: 1.0582 Close: 1.0601

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0287 | 1.0414 | 1.0506 | 1.0616 | 1.0708 | 1.0821 |

- EUR/USD has shown limited movement in the Asian and European sessions

- 1.0506 is a strong support level

- 1.0616 is fluid and is currently a weak resistance line

Further levels in both directions:

- Below: 1.0506, 1.0414 and 1.0287

- Above: 1.0616, 1.0708, 1.0821 and 1.0957

- Current range: 1.0506 to 1.0616

OANDA’s Open Positions Ratio

EUR/USD ratio is unchanged in the Tuesday session. Currently, short positions have a majority (65%), indicative of trader bias towards EUR/USD continuing to move lower.