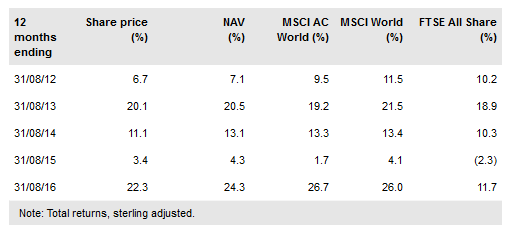

Jpmorgan Global Growth & Income PLC (LON:JPGI), previously JPMorgan (NYSE:JPM) Overseas IT, uses a disciplined and research-intensive approach to identifying 50-90 ‘best ideas’ from around the world, with the aim of achieving capital appreciation in excess of the MSCI AC World index. It has recently adopted a new distribution policy whereby at the start of each year it will announce a dividend equivalent to at least 4% of NAV, to be paid in quarterly instalments. The board and management see this level of distribution – which may come from capital or income returns – as sustainable, and the predictability of the income stream as well as the higher yield should increase the attraction of the trust from investors who seek income as well as growth, potentially leading to a narrowing in the discount.

Investment strategy: Disciplined and research-driven

JPGI has a research-driven investment process, with manager Jeroen Huysinga drawing on the expertise of a 70-strong analyst team. Using J.P. Morgan Asset Management’s dividend discount model approach, the analysts assess stocks’ long-term earnings growth potential. Companies are ranked into valuation quintiles for each sector and the initial universe of c 2,500 stocks is narrowed down to c 500 by focusing on stocks in the cheapest two quintiles that have at least 25% profit growth potential. Catalysts for revaluation should be present within the next six to 18 months. The final portfolio contains 50-90 stocks from around the world.

To read the entire report Please click on the pdf File Below