- The bearish structure in the pound is still intact

- The Pound rallied 110 pips against the US Dollar after after good CPI /Inflation numbers

- Short term bullish reaction is news driven by momo

- We remain bearish until our bull / bear level breaks

Even though we have been trapped inside a big range in the GBP/USD post Brexit, there is also very important to note that price is making lower highs and lower lows whilst the Pound slides to test the post Brexit lows at the 1.2800 / 1.2850 level against the US dollar. We are definitely still in a bear market.

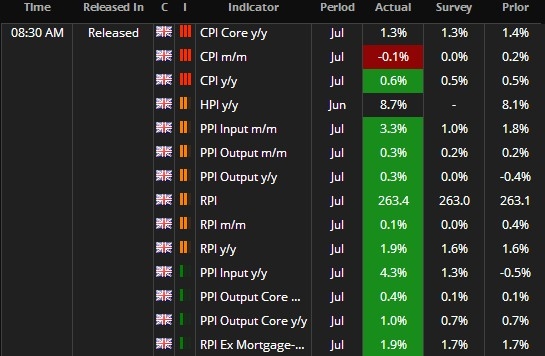

Today in early APAC session we hit our mid term short targets at the 1.618% around the high of the post Brexit lows high-range at 1.2850. This was an extremely important tech level where profit taking was going to take place as well as some short term bulls stepping in. Not only that but we were also testing the bear structure´s resistance (white channel). Then the inflation reports hit the wires, it was a huge beat on expectations.

CPI rose to 0.6% year-on-year against 0.5% expected and PPI rose to 3.3% month-on-month against 1.8% expected. Needles to say Pound bulls started to bid price up and the Pound is now up 0.88% against the US Dollar.

This rally is not only fuelled by the short term strength in the Pound but also by a huge sell off in the US Dollar. The Dollar Index ($DXU16) is down 1.06% breaking the previous lows at 94.96 in early European session.

Now to the GBP/USD. This currency has rallied 115 pips from the lows today and we are waiting for a test of the previous cycle short level at around 1.3077 which is also the 50% of the last leg down, cycle wise. This would put us in a position to trade lower and break the post Brexit lows. If the US Dollar weakness continues we can expect a break of this level and a test of the bull / bear level at around 1.3280 which is also the 88.6% of the last leg up.

We remain bearish for the time being and will closely monitor this currency pair as it can yield excellent risk to reward scenarios to trade high probability setups.