The euro has started the week with small gains. In the Monday session, EUR/USD is trading just below the 1.10 line. It’s a quiet start to the week, with just one indicator on the schedule. German Ifo Business Climate came in at 108.3, beating the estimate. On Tuesday, the US releases CB Consumer Confidence and New Home Sales.

German Ifo Business Climate dipped in July, dropping from 108.7 points to 108.3 points. On the bright side, the reading beat the forecast of 107.7 points. This report marked the first release after the Brexit vote, and points to softer business confidence in Germany, the Eurozone’s largest economy. On Friday, Eurozone Manufacturing PMIs came in at 53.7 and 51.9 respectively, indicating expansion. However, French Manufacturing PMI disappointed with a reading of 48.6 points. This indicator has managed to crack the 50-point threshold (which separates expansion from contraction) only once in 2016, pointing to ongoing contraction in the French manufacturing sector. France, the second largest economy in the Eurozone, continues to struggle, and weak economic conditions on the continent as well as Britain’s imminent exit from the EU could mean a bumpy ride for the French economy in the second half of 2016.

There were no surprises last week from the ECB, which followed the cue of the BoE and did not lower the benchmark rate of 0.00%. There had been some speculation that the bank might extend its QE program of €80 billion/mth beyond March 2017, but ECB head Mario Draghi did not bite. Draghi claimed that the asset-purchase program had been “quite successful”, an assertion that many market players would dismiss as positive spin, given current inflation levels are nowhere near the ECB’s stated target of around 2 percent. Draghi trotted out his usual message that the bank stood ready to act “using all the instruments available within its mandate”. The situation has become further complicated with the recent Brexit vote, as Britain, the second largest economy in Europe, will soon commence negotiations with the European Union over Britain’s exit from the club. Recent data in both the UK and Europe point to weaker consumer indicators, but the markets will have to wait until September for some hard numbers to begin to gauge the effect of Brexit on the Eurozone and British economies.

With major central banks in the spotlight, it’s the turn of the Federal Reserve this week. The Fed meets for a policy meeting on July 27 but is unlikely to announce a rate hike at that time, given current economic conditions in the US. Is the Federal Reserve leaning more towards a rate hike before the end of the year? The markets appear to think so, as the chances of a rate hike this year has been priced in at 47%, up from just 20% at the start of July. This positive sentiment is a result of improved US economic data over the past week. Another rate hike will be data-dependent, so if key indicators beat expectations, speculation of a rate hike will continue to increase. However, the Fed will be hesitant to make a move if inflation remains stuck at very low levels, nowhere near the Fed’s target of around 2 percent.

EUR/USD Fundamentals

Monday (July 25)

- 8:00 German Ifo Business Climate. Estimate 107.7. Actual 108.3

Tuesday (July 26)

- 14:00 US CB Consumer Confidence. Estimate 95.6

- 14:00 US New Home Sales. Estimate 560K

* Key releases are in bold

*All release times are GMT

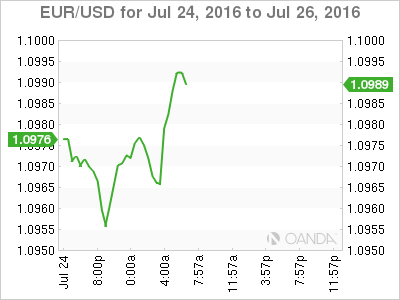

EUR/USD for Monday, July 25, 2016

EUR/USD July 25 at 9:30 GMT

Open: 1.0968 High: 1.0987 Low: 1.0951 Close: 1.0986

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0708 | 1.0821 | 1.0925 | 1.1054 | 1.1150 | 1.1278 |

- EUR/USD has shown limited movement in the Asian and European sessions

- 1.1054 is a weak resistance line

- 1.0925 is providing support

Further levels in both directions:

- Below: 1.0925, 1.0821 and 1.0708

- Above: 1.1054, 1.1150, 1.1278 and 1.1376

- Current range: 1.0925 to 1.1054

OANDA’s Open Positions Ratio

EUR/USD ratio has shown gains in long positions. Long and short positions are close to an even split, indicative of a lack of trader bias as towards which direction EUR/USD will take next.