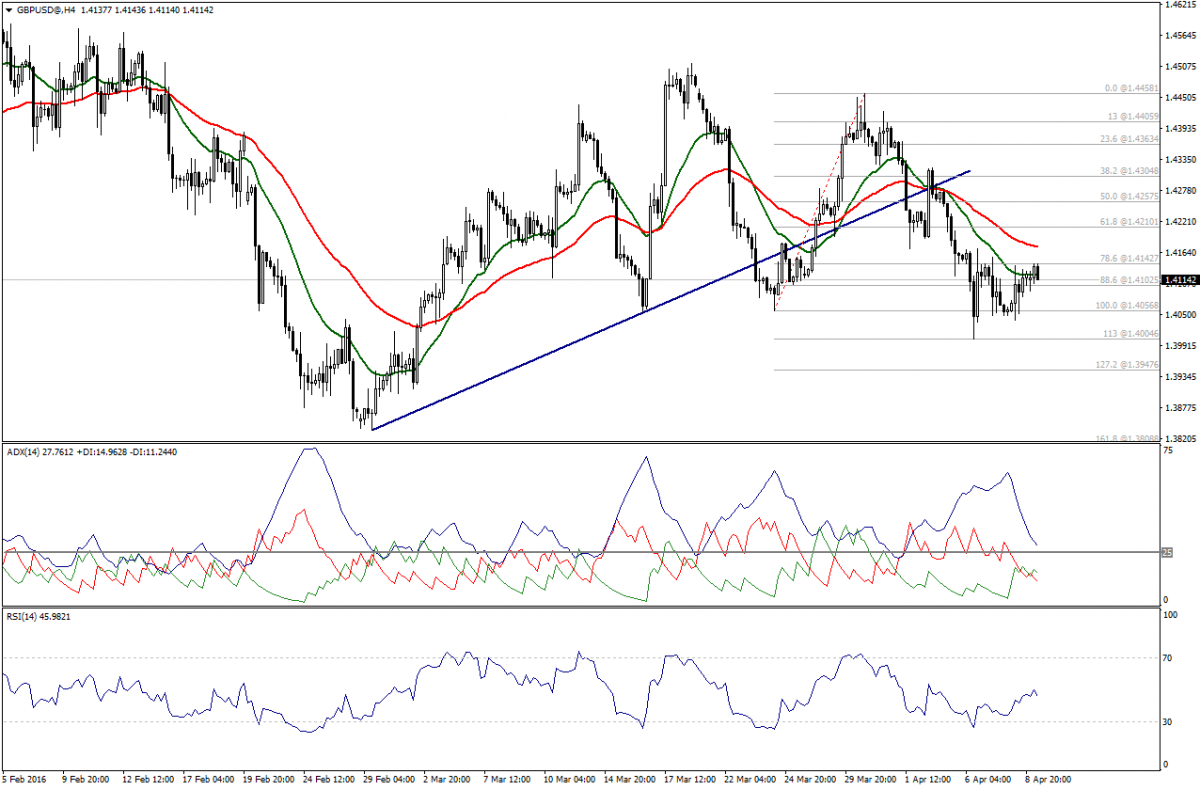

GBP/USD stabilized around 1.4100 after failing to hit 1.4145 - Fib. of 78.6% - and is now trading near SMA20.

RSI hovers around 50.00 levels and ADX shows decrease in bears’ power, and therefore, we will be neutral now.

Support: 1.4105 – 1.4055 – 1.4000

Resistance: 1.4145 – 1.4210 – 1.4260

Direction: Sideways

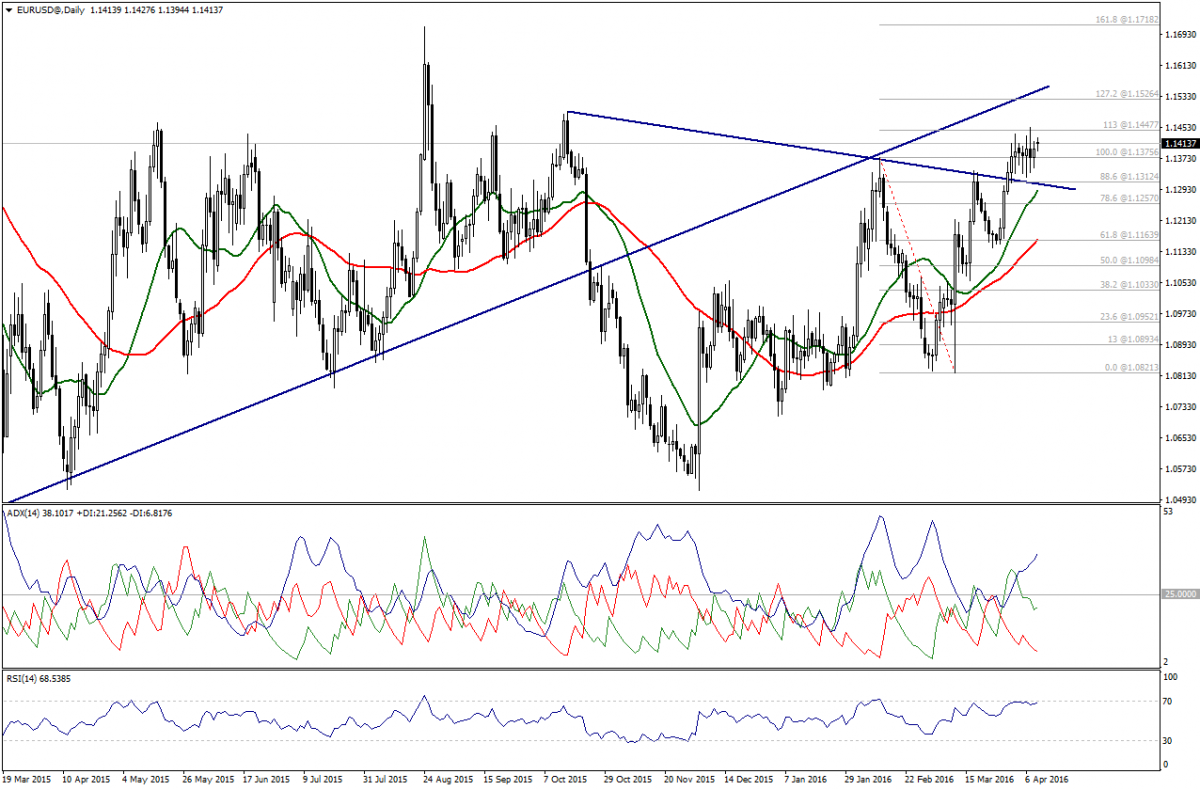

Euro stabilized above 1.1375 with a daily closing, which is positive and would bring upside wave sooner or later.

All we need is a break above 1.14550 to target 1.1500-1.1525.

Trading above 1.1450 will prove the bullishness as far as 1.1310 holds and preferably as far as 1.1360 holds.

Support: 1.1360 – 1.1315 – 1.1255

Resistance: 1.1450 –1.1500 – 1.1525

Direction: Bullish

USD/CHF started to show signs of pause for the bearish trend near strong support, while RSI offers extreme oversold probability.

Actually, there could be a chance for achieving upside recovery, but it needs a confirmation with a break above 0.9580.

As for now, we will stand aside due to the sensitivity of current trading levels.

Support: 0.9500-0.9460-0.9375

Resistance: 0.9600-0.9690-0.9720

Direction: Neutral

As we discussed last Friday, bears have taken the pair towards all of our previous defined downside targets or the last week, and it started the week slightly to the downside, as seen on the graph.

Actually, ADX shows a signal of downtrend exhaustion alongside RSI moving inside oversold areas.

Hence, we see chances of achieving some kind of upside correction, which could be under preparation as far as the classical support of 106.90 holds.

Support: 107.60-107.25-106.90

Resistance: 108.30-108.80-109.35

Direction: Potential recovery