Extending the Fed's good-cop, bad-cop routine, Chairwoman Yellen brought the sugar in her speech to the Economic Club of New York Tuesday and tamped down last week’s more hawkish tone brought on by comments from a few of the Fed’s regional bank presidents – namely, Dennis Lockhart from the Atlanta Fed, who speculated that the strength of recent US economic data could justify a rate increase as early as April.

... Whatever.

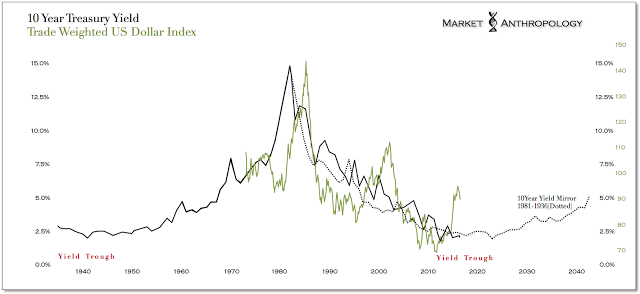

Tacking downwind from Lockhart’s comments and following the line extended from the Fed’s March policy statement, Yellen reinforced that “economic and financial conditions remain less favorable than they did” in December, when the Fed raised its funds rate modestly off ZIRP. Warning that if oil prices began falling again it could create “adverse spillover effects to the rest of the global economy”, the Chairwoman seemingly embraced the underlying reflationary spirit in the markets over the past several weeks – greatly buttressed by the gathering downturn in the US dollar.

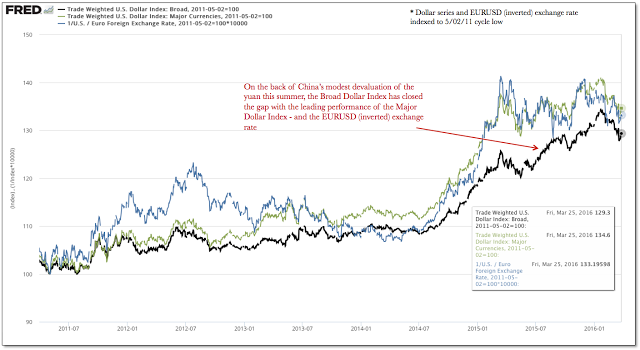

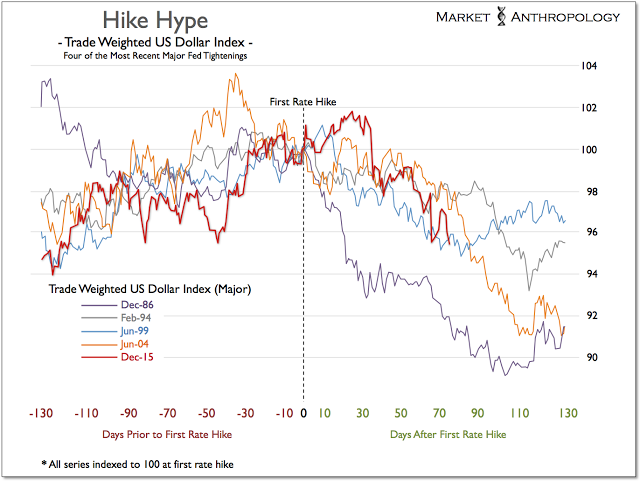

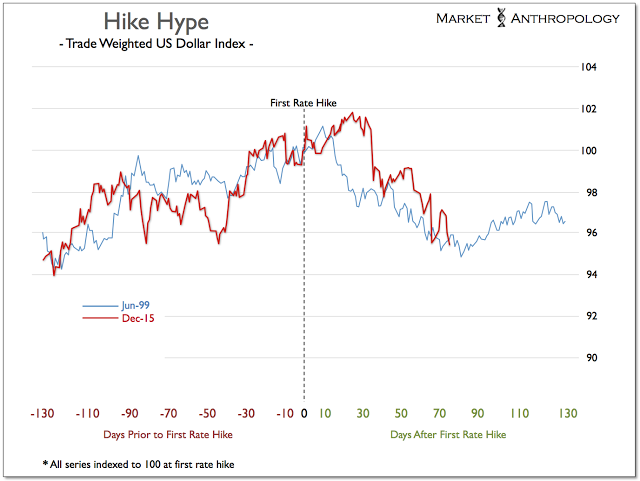

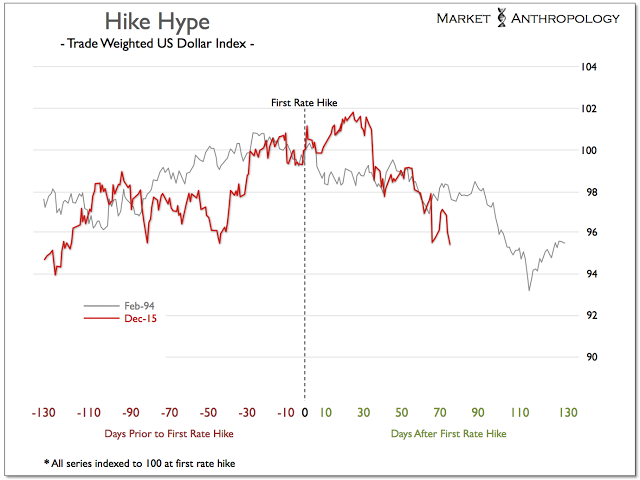

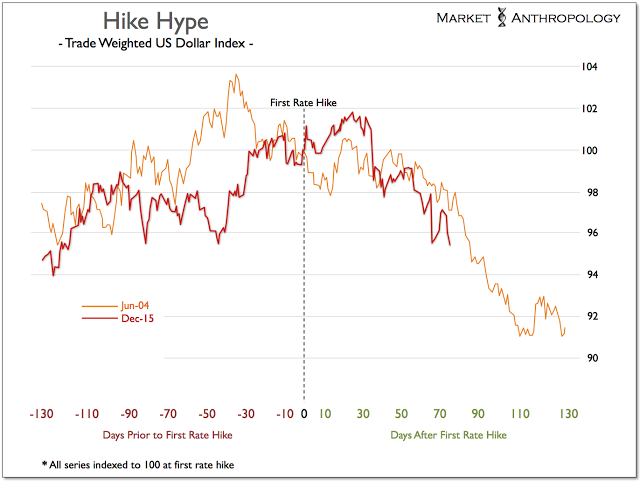

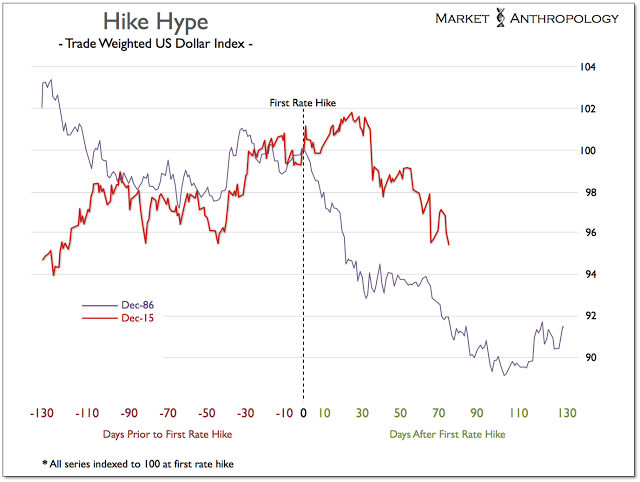

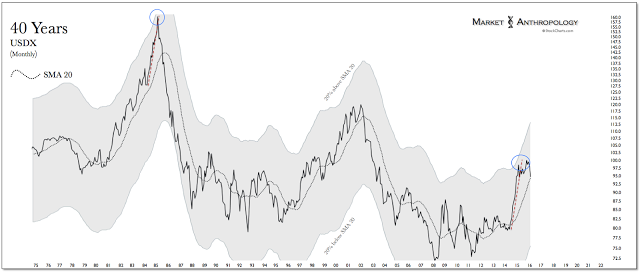

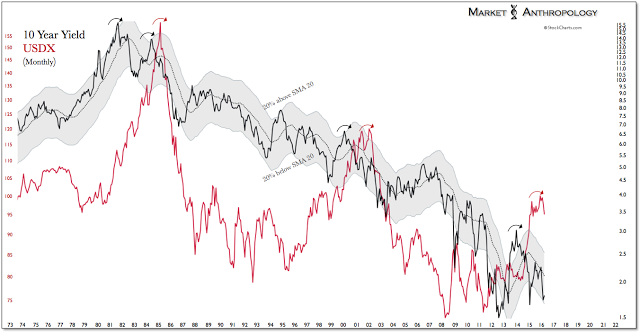

With the dollar's broad benchmark falling the most in March since the April 2011 cycle low, we thought we would reassess possible bearings; as we have speculated that the dollar was pivoting lower from a cyclical high and, to boot, with mirrored affinity with the dollar's Q3 2011 pivot.

Familiar Dollar Pattern

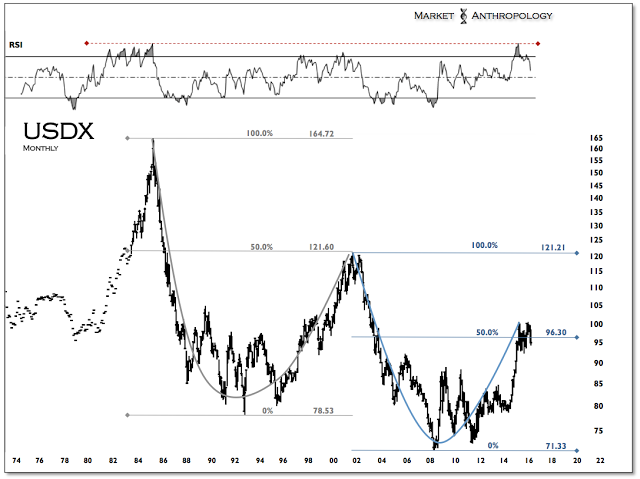

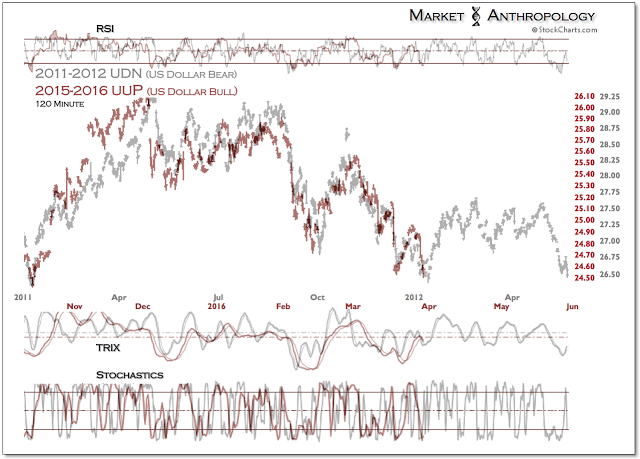

As we have observed over the years in various markets, you can find that an asset will transpose structure for a period with mirrored symmetry to a corresponding -- but inverse -- pivot. Although the potential top over the past year in the US dollar index has been much broader than the structure of the cyclical low, the breakdown has followed a very similar pattern with the index's breakout in 2011 and 2012.

While we remain steadfast and long-term bears on the greenback and agree its prospective fall would help hasten the “adverse spillover effects” Yellen noted to the underlying global economy, the inverse cycle comparative from the dollar's cyclical low in 2011 is now approaching another retracement bounce in the pattern over the next few sessions.

Should the pattern remain prescient, we'd expect the broader commodity sector – that was led higher by gold and silver over the past quarter, to retrace lower as the markets trade into April. From an intermarket perspective, gold is expressing a divergence with the dollar, as it so far has failed to make new highs even as the US currency has extended the lows from two weeks back. All things considered – and despite this morning's healthy bid, gold still appears to have some unfinished business with its retracement decline.

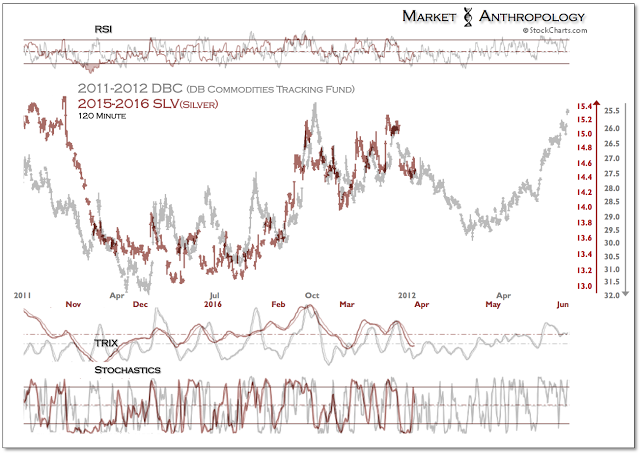

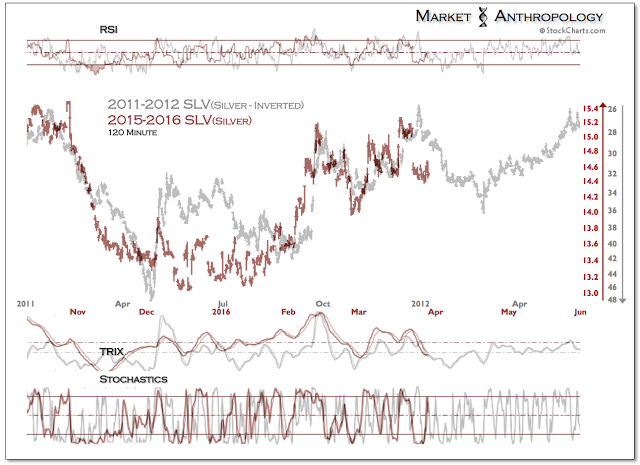

Moreover, by extrapolating the mirror from the corresponding cyclical peak in commodities from 2011-2012, you find a relative congruence in the broader pivot structure in an asset such as silver that exhibited an acute negative correlation with the dollar back in 2011 and 2012.

When you contrast the structure in silver today with a wider benchmark of commodities from that period, you see a closer fit – as the heightened volatility in silver from that period is smoothed out by the broader index.