Economists are worried. That’s their second favorite pastime.

Their favorite pastime? Making bad economic predictions.

The big worry right now in Japan is that cash is piling up in record amounts. No one wants to spend it: Not corporations, not individuals.

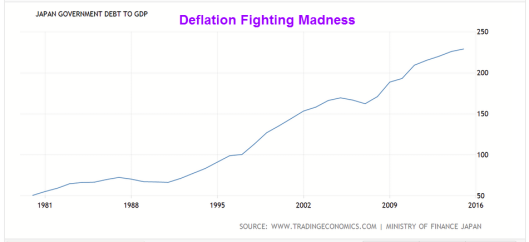

Given the massive amount of Japanese government debt, highest in the developed world, economists ought to think saving cash is a good thing, but they don’t.

It’s as if that huge pile of cash will cause a global outbreak of leprosy.

Corporate Cash Rises 29th Consecutive Quarter

Bloomberg reports Cash Piles Up in Japan While Spending and Investment Wane.

Japanese companies and households piled up cash at record levels in the last quarter of 2015, offering little support for an economy that some analysts forecast is at risk of contracting again.

Corporate assets in cash and deposits reached a record high of 246 trillion yen ($2.2 trillion), rising for the 29th consecutive quarter, according to Flow of Funds data released by the Bank of Japan on Friday. Households’ assets rose to 902 trillion yen, the highest level on record, marking nine straight years of growth.

The data adds to concerns among economists that Japan’s recovery continues to be underwhelming after the economy contracted in the fourth quarter. Households are tightening their purse strings as wages are stagnant while companies are hesitant to invest at home amid global economic uncertainty.

“Japan’s virtuous economic cycle is quite weak,” said Hideo Kumano, an economist at Dai-ichi Life Research Institute and a former BOJ official. “I expect a very fragile recovery this quarter.”

Households’ Assets at Record 902 Trillion Yen Level

Household assets up. Savings up. Debt down.

The fact of the matter is Japan has essentially forced its citizens to save simply to cover the largest debt-to-GDP ratio of any large, developed country.

Q: Why did the debt-to-GDP ratio rise so much?

A: Deflation fighting efforts arising from economist’s worry over falling prices.

Given the hyper-fear of falling prices, I have to ask: Has anyone died from it?