The USD/JPY pair continued to show some kind of consolidation after achieving sharp collapse after FOMC last week.

Stable moves below 112.15 resistance in addition to stable actions below moving averages suggest potential bearish scenario, and we may witness acceleration below 111.05 and 110.65 respectively.

On the upside, the main resistance of 112.65 should hold to protect bears.

Support: 111.05-110.65-110.00

Resistance: 112.00-112.40-113.00

Direction: Bearish

USD/CHF has respected the bearish scenario during the previous week, reaching the technical objective of our last week’s setup at 0.9670, and after that it bounced mildly from this important support seen on the chart.

We see RSI moving within a sideways range near the value of 30.00, while ADX shows mixed signals.

In result, we will be neutral today, as risk is very high.

On the upside, 0.9800 is the key for reversing the strong bearishness.

Support: 0.9670-0.9600-0.9500

Resistance: 0.9760-0.9800-0.9840

Direction: Neutral

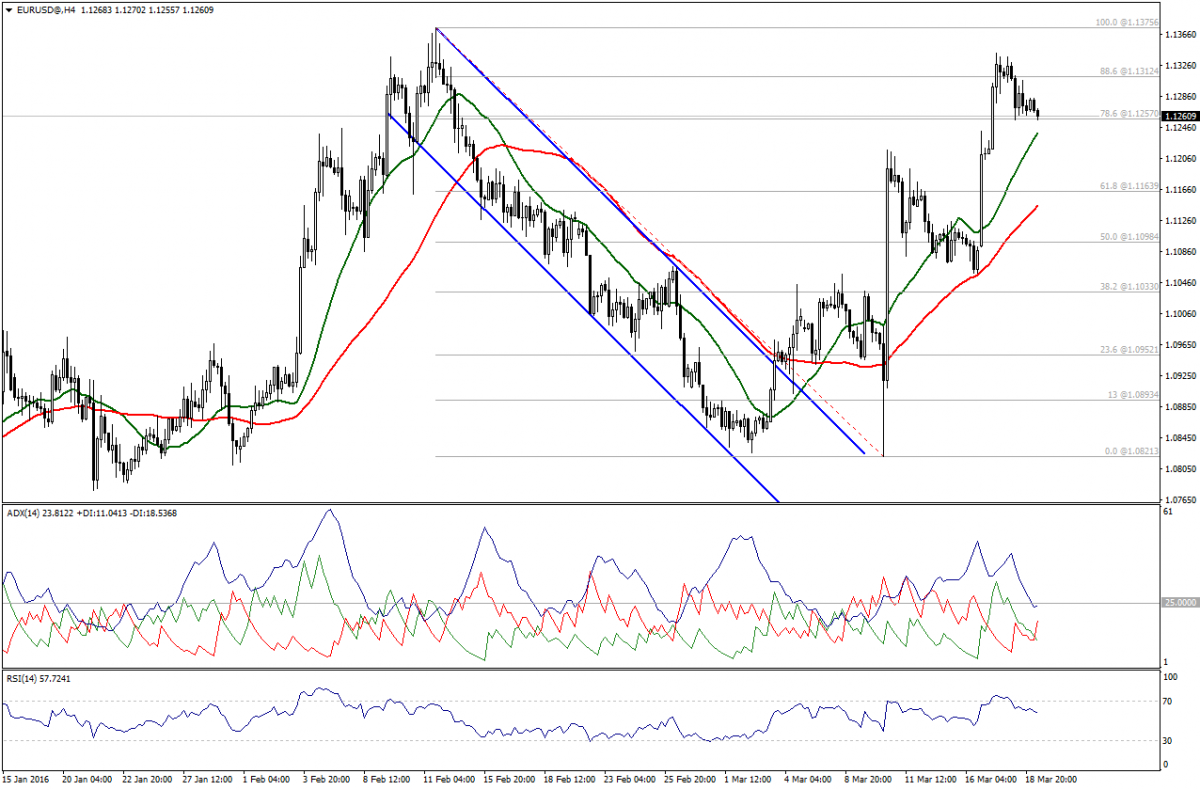

Euro attempts to decline, influenced by the negative signs on ADX with the European session opening.

However, SMA20 at 1.1235 is still offering good support and thus, without affirming a break below 78.6% at 1.1225 we will be neutral and we will update the report in the proper time.

Support: : 1.1255 – 1.1200 – 1.1160

Resistance: 1 1.1315 –1.1375 – 1.1445

Direction: Neutral

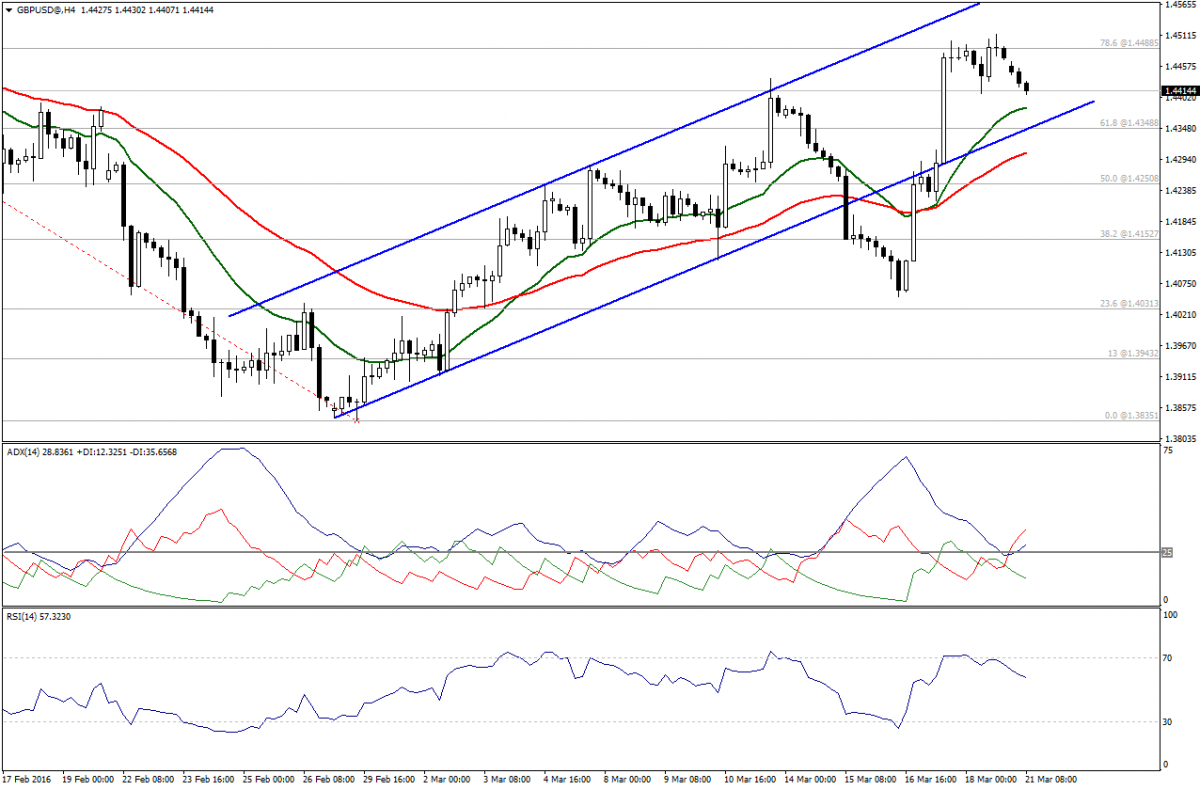

GBP/USD corrects within the upside channel along with negative signals on ADX and RSI.

Meanwhile, we can’t depend on those signals to be bearish as a break below SMA20 at 1.4380 is required, while risk versus reward ratio is inappropriate.

We will not suggest potential positions although we see chances for achieving additional correction.

On the upside, coming above 1.4490 will be bullish sign.

Support: 1.4380 – 1.4345 – 1.4300

Resistance: 1.4490 – 1.4520 – 1.4570

Direction: Bearish but we will avoid trading.