The last 3 months currency classification from a longer-term perspective updated on February 28, 2016 are provided here for reference purposes:

Strong: USD / JPY / NZD. The preferred range is from 6 to 8.

Average: CHF, EUR, AUD. The preferred range is from 3 to 5.

Weak: GBP, CAD. The preferred range is from 1 to 2.

The charts are provided in the following article: "Forex Currency Score Classification for Wk9".

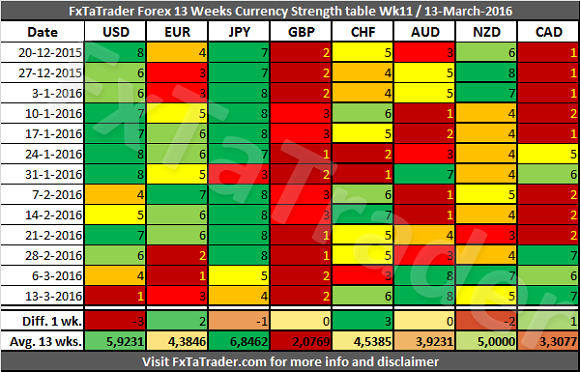

13 Weeks Currency Score Strength for Week 11 / March 13, 2016

The 13 Weeks Currency Strength and the 13 Weeks Average are provided here below. This data and the "3 months currency classification" are considered for choosing the preferred range. Because it is not ideal nor desired to change the range for a currency every single week, we can make several checks to avoid this.

- First of all the 13 weeks average and the strength over a period of 13 weeks. Both, the average and the strength can be seen in the table below.

- Besides this, the "13 weeks currency classification" chart of each currency is also consulted. These have been updated and can be found in the following article: "Forex Currency Score Classification for Wk9".

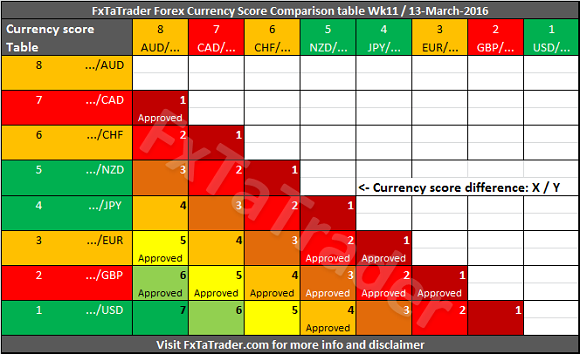

FxTaTrader Forex Weekly Currency Score Comparison for Week 11 / March 13, 2016

"Comparison table" and the "Ranking and Rating list"

The Forex Currency Comparison Table compares each currency with its counterpart based on the currency score. For more information about the currency score of this week you can read the article "Forex Ranking, Rating and Score" which is published every week together with this article.

By using the comparison table here below, you have a view where no volatility and statistics are used for comparing the currencies and strength. Only the strength of each currency against the counterparts has been analyzed by using the technical analysis charts of the 4 time frames also used for the "Ranking and Rating List". The information from the comparison table is the source for calculating the "Ranking and Rating List" with the volatility and statistics measured for creating the best and worst performers in the list from number 1 to 28.

The additional analysis of this table compared to the Currency Score table is that the Comparison table compares the strength between the currencies of each pair. By subtracting the strength of the weaker currency from the stronger currency we have a way to compare each pair combination.

The comparison table provides a way to compare currencies from a longer term perspective of 13 weeks, and at the same time taking the current development also into account. By coloring the currencies according to their Classification, see "Forex Currency Score Classification for Wk9", we can show what the best combinations are. In doing this we apply 2 rules to make it all clear.

- First of all only better classified currencies in combination with weaker classified currencies are "Approved"

- The only exception is when 2 currencies are similarly classified but the Currency Score difference is equal to or more than 4.

- It means that each currency must be far separate from each other in the range from 1 to 8. This can mean that the classification of the currencies in question may change in the longer term. By using the difference of 4, which is exactly half of the range, it seems a safe approach for trading 2 currencies similarly classified.

- Since each classification covers only 2 or 3 scores at the most, it means that the currencies are at least one classification separated from each other in the current week.

- Even though they are in the same classification when looking at the 13 weeks average a currency may be in a weaker/stronger period and may even change of classification in the future. See the current classification for the coming period at the top of this article.

Disclaimer: The articles are my personal opinion, not recommendations, FX trading is risky and not suitable for everyone.The content is for educational purposes only and is aimed solely for the use by ‘experienced’ traders in the FOREX market as the contents are intended to be understood by professional users who are fully aware of the inherent risks in forex trading. The content is for 'Forex Trading Journal' purpose only. Nothing should be construed as recommendation to purchase any financial instruments.