The euro slid back to 1.10 support but failure to close below the support is likely to see a near term correction to the upside. GBPUSD has formed a minor bullish head and shoulders and could see price retrace back to around 1.38 levels. Today's ECB meeting will be the main fundamental catalyst for prices in the near term.

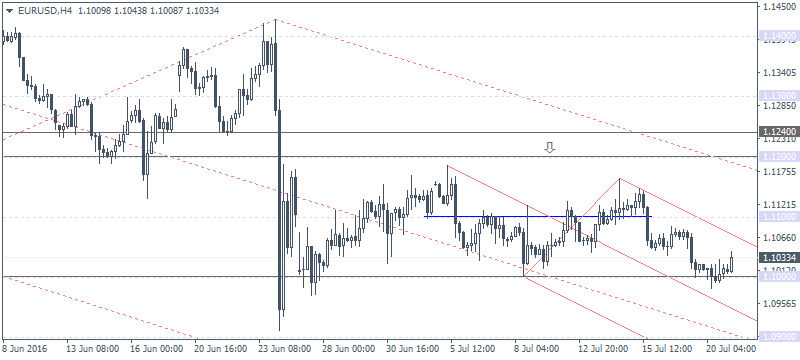

EUR/USD Daily Analysis

EUR/USD (1.103):EUR/USD briefly tested 1.10 support yesterday before managing to close above the support. The currently bullish price action today could see near term upside if prices close on a bullish note. This is validated by the bullish divergence seen on the daily chart and points to a correction to 1.120. Of course, a daily close below 1.10 support could invalidate the above view with EUR/USD likely to test the next support at 1.09. On the 4-hour chart, the price action is clearer with price bouncing off 1.10 support. Watch for the intermediary resistance at 1.110 ahead of a move to 1.120.

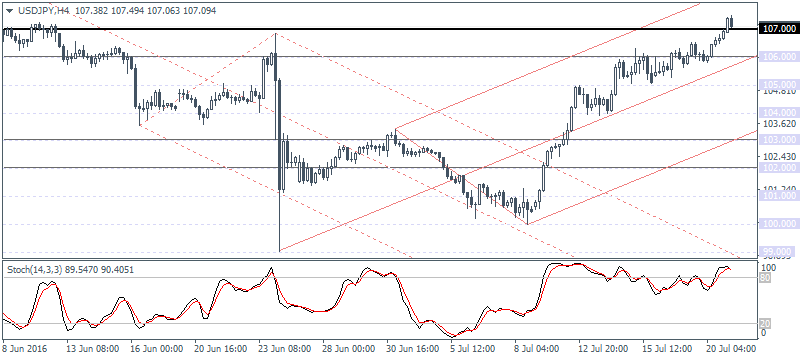

USD/JPY Daily Analysis

USD/JPY (107.09):USD/JPY broke above 106 resistance yesterday with the rally picking up steam on news wires reporting that the BoJ could add another 20 trillion yen to its stimulus package when it meets later in July. Support is seen at 104.5 - 104.0 and could potentially keep price from pushing lower. On the 4-hour chart, USD/JPY is seen trading near 107 resistance, but further upside can be expected only on a retest of 107 for support, which leaves USD/JPY vulnerable for a correction. Below 104 - 104.50 support next, main support levels are seen at 103 - 102.

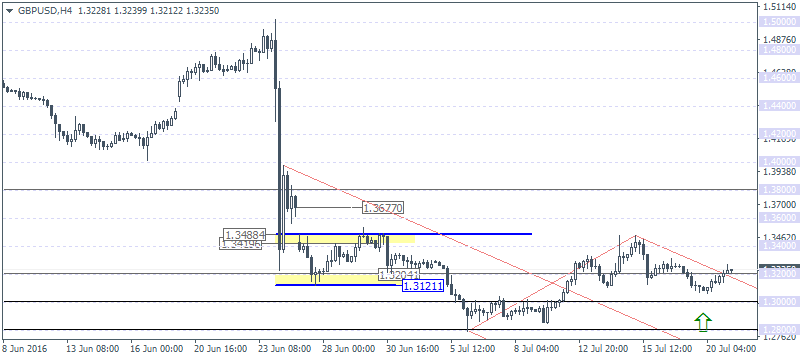

GBP/USD Daily Analysis

GBP/USD (1.323):GBP/USD has managed to bounce back after testing lows of 1.306 yesterday. Price action shows a modest inverse head and shoulders pattern at the current level with the minor neckline resistance seen at 1.34. A bullish close above 1.34 could signal a near term rally towards 1.38, which will eventually fill the June 24 unfilled gap as well. To the downside, price action seems well supported near 1.32 - 1.30 support zone.

Gold Daily Analysis

XAU/USD (1314.76):Gold prices continued to slide yesterday with price action closing below the inside bar's low of 1320.31 formed last Thursday. Support at 1300 remains the next key level of importance. On the 4-hour chart, the dip to 1300 - 1310.50 marks the completion of the breakout from broadening wedge. To the upside, resistance at 1327.50 remains vital and a break out above 1327.50 could see gold prices extend their gains towards 1350.