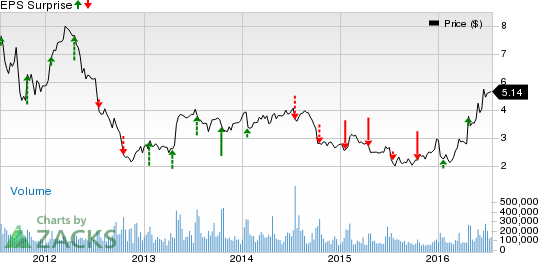

Advanced Micro Devices, Inc. (NASDAQ:AMD) is set to report second-quarter 2016 results on Jul 21. Last quarter, the company posted a positive earnings surprise of 6.67%.

Let’s see how things are shaping up for this announcement.

Factors to Consider

Advanced Micro reported decent first-quarter results with both revenues and earnings exceeding the Zacks Consensus Estimate. However, revenues were down 13.2% sequentially and 19.2% year over year due to lower sales of semi-custom System on Chip (SoC). Lower client processor sales led to the year-over-year decline.

The decline in global PC demand could impact profits in the upcoming quarter. However, the company is strengthening its position in key markets with the introduction of several APUs and GPUs. It has also taken initiatives in immersive computing markets like virtual and augmented reality which could boost its second-quarter results.

Moreover, the company had issued better-than-expected second-quarter guidance. Revenues are expected to increase 15% sequentially (+/- 3%) driven by a strong demand for Semi-Custom and Graphics products. The Zacks Consensus Estimate is pegged at $888.0 million.

Earnings Whispers

Our proven model does not conclusively show that Advanced Micro will beat estimates this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

Zacks ESP: Both the Most Accurate estimate and the Zacks Consensus Estimate is pegged at a loss of 11 cents. Hence, the difference is 0.00%.

Zacks Rank: Advanced Micro has a Zacks Rank #3 (Hold), which increases the predictive power of ESP. But a 0.00% makes surprise prediction difficult.

We caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

You could consider the following stocks with a positive Earnings ESP and a favorable Zacks Rank:

Coeur Mining, Inc. (NYSE:CDE) , with an Earnings ESP of +600.0% and a Zacks Rank #1. The company is slated to report second-quarter 2016 earnings results on Jul 27.

CalAtlantic Group, Inc. (NYSE:CAA) , with an Earnings ESP of +9.21% and a Zacks Rank #1. The company is slated to report second-quarter 2016 earnings results on Jul 28.

Casella Waste Systems Inc. (NASDAQ:CWST) , with an Earnings ESP of +20.0% and a Zacks Rank #1. The company is slated to report second-quarter 2016 earnings results before the market opens on Jul 28.

ADV MICRO DEV (AMD): Free Stock Analysis Report

COEUR MINING (CDE): Free Stock Analysis Report

CASELLA WASTE (CWST): Free Stock Analysis Report

CALATLANTIC GRP (CAA): Free Stock Analysis Report

Original post

Zacks Investment Research