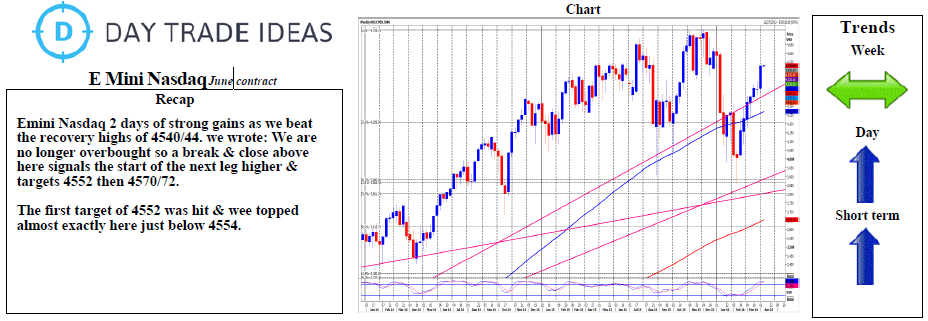

E-mini Nasdaq must hold above 4540/44 to keep the bulls in control and re-target 4552/54. If we continue higher, look for 4570/72 then 4579/80 and 4583/84.

Failure to hold above 4544/40 risks a slide to support at 4525/21. Longs need stops below 4515 with further losses to meet support at 4505/00. Try longs with stops below 4494.