Key Points:

- Ascending channel remains intact.

- The pair is approaching a strong zone of support.

- Stochastics neutral.

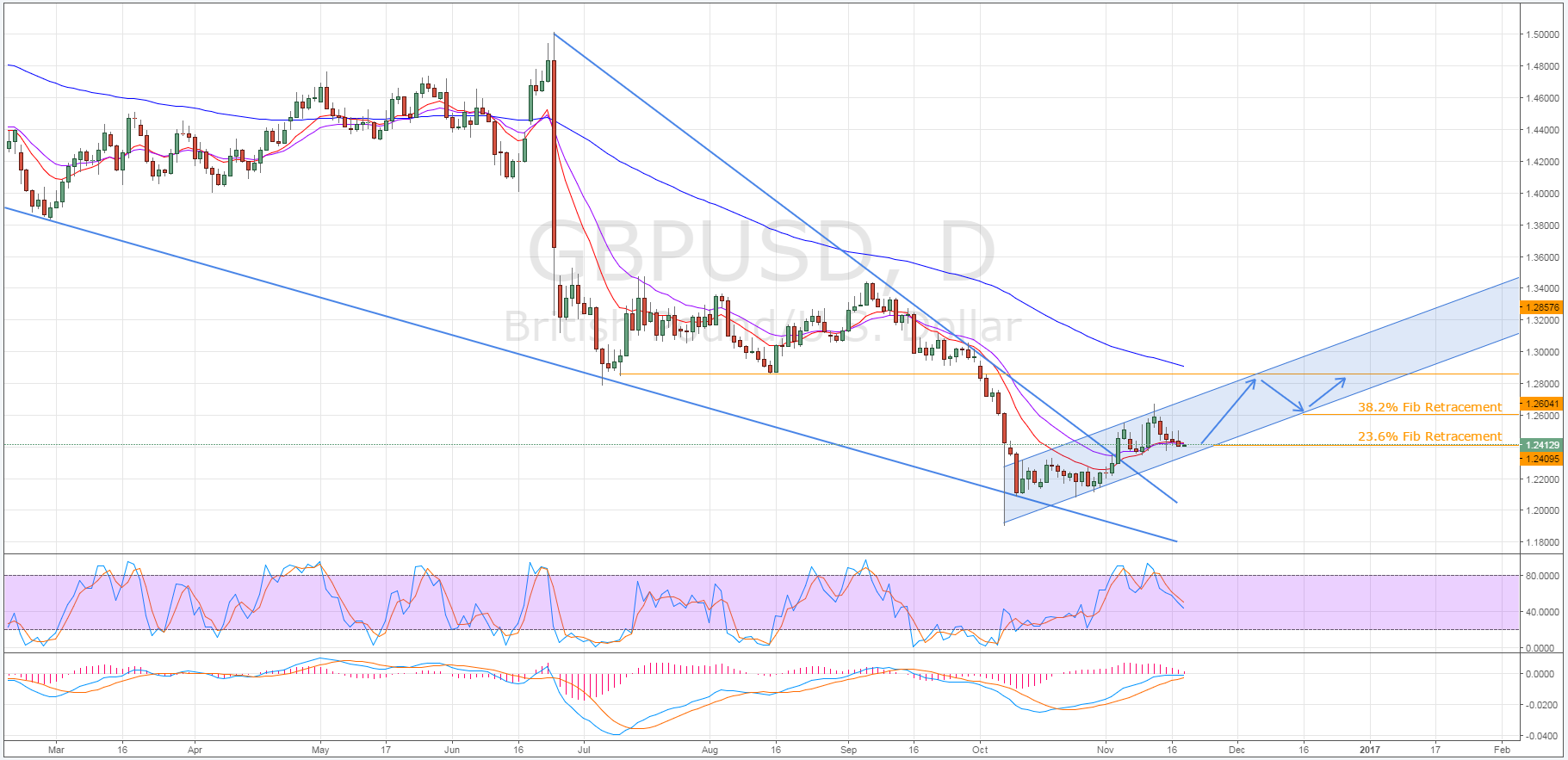

The cable has been faring better than most other pairs in the shadow of the resurgent greenback, although it is still in a modest and near-term decline. Despite this, the pair retains a bullish medium to long-term bias which is poised to bring the pair back above the 1.28 handle. In fact, the recent challenging of support around the 1.2410 mark should prove to be a turning point for the cable which could, in turn, result in another near term surge in buying pressure.

As illustrated below, the prior week’s slide to the downside has resulted in two important technical developments. Firstly, as has been mentioned, the pair is now in conflict with the 1.2410 level which also represents the 38.2% Fibonacci retracement. Consequently, further downside risks should be capped moving forward which, in the absence of a preemptive rally, should see the cable remain relatively flat until reaching the lower constraint of the ascending channel.

This brings us to the second technical development worth mentioning, namely, the channel structure that formed as the pair broke free of the long-term falling wedge. As stated, last week’s move lower has brought the cable into rather close proximity to the downside constraint which is likely to become even more the case as the week winds down. As a result of this, there will be a growing consensus that the pair needs to track higher once again, especially given the presence of the 23.6% Fibonacci level.

Once the GBP/USD has resumed its ascent, it should move back towards the 1.28 handle in a oscillating fashion. Specifically, it expected that the pair ranges between the constraints of the channel which could bring it as high as the 1.2857 mark before the 100 day EMA slaps it lower. Subsequently, the cable will likely move back to the 38.2% Fibonacci level before recovering a second time and moving back in to that 1.28 to 1.34 handle range seen in the wake of Brexit.

Ultimately, given the recent slew of strong UK fundamental results, the cable is well due for a boost regardless of the technical bias. However, as the technicals seem to be in agreement with the fundamentals, we could be in store for a more significant recovery than might have been predicated in the wake of the US election.