NZD/USD has posted gains on Wednesday, erasing the losses from the Tuesday session. In the European session, the pair is trading at 0.6780. In economic news, it’s a busy day at the Royal Bank of New Zealand. The RBNZ will release a rate statement and a monetary policy statement, with a follow up conference from RBNZ Governor Graeme Wheeler. Then, Wheeler will testify on the Monetary Statement before a parliamentary committee. In the US, there are just three events, highlighted by Crude Oil Inventories.

All eyes are on New Zealand’s central bank, which will set interest rates at its meeting on Thursday. The markets are expecting the benchmark rate to remain steady at 2.50%, where it has been pegged since December. However, the RBNZ has maintained an easing bias, so a rate cut remains a slight possibility. The RBNZ will also publish economic and financial market forecasts, which should provide the markets with some insights into the central bank’s views on the health of the economy. The economy has been humming reasonably well, despite the slowdown in China, New Zealand’s largest trading partner. At the same time, inflation levels remain low and the New Zealand dollar remains at high levels. With the two statements from the RNBZ followed by Wheeler’s testimony before the Finance and Expenditure Select Committee, it promises to be an interesting day, and traders should be prepared for possible volatility from NZD/USD.

A strong US Nonfarm Payrolls is often bullish for the US dollar, but an excellent January report failed to buoy the greenback against its major rivals late last week. The indicator impressed with a reading of 242 thousand, much higher than the estimate of 195 thousand. This was much stronger than the previous (revised) reading of 171 thousand. The US economy has added an average of 225,000 jobs per month since December, an impressive number considering that the economy has softened in the early part of 2016. Why then, did a stellar NFP release not impress the markets? The reason was that wage growth, which has consistently lagged behind other employment indicators, surprised the markets with a decline of 0.1% in January, the first drop in wages since December 2014. This indicator is closely linked to inflation, since an increase in wages means workers have more money to spend. The indicator’s decline means that that Federal Reserve’s inflation target of about 2.0% remains far off, so the Fed, which is keeping a close eye on the weak inflation picture, is unlikely to press the rate trigger at its policy meeting later this month.

NZD/USD Fundamentals

Wednesday (March 9)

- 15:00 RBNZ Official Cash Rate. Actual 2.50%

- 15:00 RBNZ Rate Statement

- 15:00 RBNZ Monetary Policy Statement

- 10:00 US Wholesale Inventories. Estimate -0.2%

- 10:30 US Crude Oil Inventories. Estimate 3.0M

- 13:01 US 10-year Bond Auction

- 15:05 RBNZ Press Conference

- 18:10 RBNZ Governor Graeme Wheeler

*Key releases are highlighted in bold

*All release times are EST

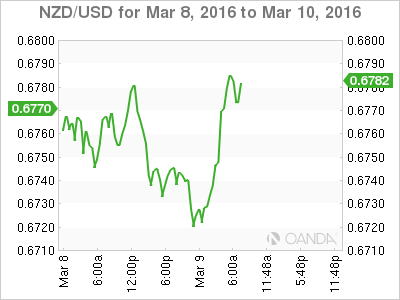

NZD/USD for Wednesday, March 9, 2016

NZD/USD March 9 at 7:00 EST

Open: 0.6741 Low: 0.6715 High: 0.6787 Close: 0.6776

NZD/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.6449 | 0.6605 | 0.6738 | 0.6897 | 0.7011 | 0.7100 |

- NZD/USD posted small losses in the Asian session. The pair has recovered and posted gains in European trade

- 0.6738 is a weak support line. It was tested earlier and could see further action during the day

- There is strong resistance at 0.6897

Further levels in both directions:

- Below: 0.6738, 0.6605, 0.6449 and 0.6344

- Above: 0.6897, 0.7011 and 0.7100

OANDA’s Open Positions Ratio

The NZD/USD ratio is showing short positions with a slight majority (54%). This is indicative of slight trader bias towards NZD/USD reversing directions and heading to lower ground.