The Australian dollar is steady on Thursday, as the pair trades at the 0.72 line in the European session. On the release front, Australian Private Capital Expenditure posted a respectable gain of 0.8%. Later in the day, the US releases two key events – Core Durable Goods Orders and Unemployment Claims. Core Durable Goods Orders is expected to improve to 0.2%, while Unemployment Claims is forecast to jump up to 271 thousand.

AUD/USD Fundamentals

Wednesday (Feb. 24)

- 19:30 Australian Private Capital Expenditure. Estimate -3.1%. Actual 0.8%

Thursday (Feb. 25)

- 8:30 US Unemployment Claims. Estimate 271K

- 8:30 US Durable Goods Orders. Estimate 3.0%

- 9:00 US HPI. Estimate 0.5%

- 10:30 US Natural Gas Storage. Estimate -125B

Upcoming Key Events

Friday (Feb. 26)

- 8:30 US Preliminary GDP. Estimate 0.4%

*Key releases are highlighted in bold

*All release times are EST

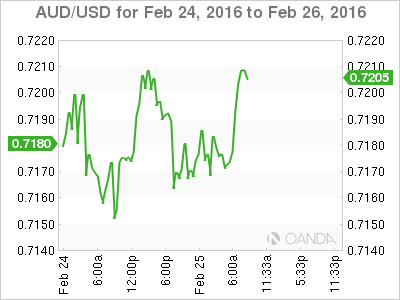

AUD/USD for Thursday, February 25, 2016

AUD/USD February 25 at 7:55 EST

AUD/USD Open: 0.7191 Low: 0.7154 High: 0.7214 Close: 0.7206

AUD/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.6931 | 0.7012 | 0.7100 | 0.7213 | 0.7385 | 0.7440 |

- 0.7213 is under strong pressure as a resistance line.

- The round number of 0.71 is providing strong support

- Current range: 0.7100 to 0.7213

Further levels in both directions:

- Below: 0.7100, 0.7012 and 0.6931

- Above: 0.7213, 0.7385, 7440 and 0.7533

OANDA’s Open Positions Ratio

AUD/USD ratio has shown movement towards long positions, which currently are a majority (55%). This is indicative of trader bias towards AUD/USD moving upwards.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.