USD/JPY has dropped in the Tuesday session, as the dollar is trading at 108.60 yen in the North American session. In economic news, there are no Japanese events on the schedule. In the US, construction numbers were mixed. Building Permits improved to 1.26 million, edging above the forecast of 1.25 million. Housing Starts dropped to 1.22 million, shy of the forecast of 1.25 million.

North Korea has been a flash-point in recent weeks causing volatility in the markets as the war of words between the US and North Korea has escalated, with North Korea warning it will respond with a nuclear strike if attacked by the US. The crisis has been bullish for the safe-haven Japanese currency, which has climbed 2.2% in April. US vice-president Pence is in Tokyo to discuss bilateral trade relations as well as North Korea.

President Trump has said that he wants the US to have greater access to Japanese markets and is looking for Japanese investment to help fund his infrastructure program. In the past, Trump has complained about the large trade deficit that the US has with Japan, and has complained that Japan has manipulated its currency for trade purposes.

US March consumer indicators, released on Friday, were softer than expected. CPI declined 0.3%, and Core CPI dropped 0.1%, as both indicators missed their estimates. Consumer spending followed suit, as Retail Sales and Core Retail Sales also missed estimates with readings of 0.2% and 0.0%, respectively. Earlier in the week, UoM Consumer Sentiment improved to 98.0, beating expectations and hitting a 3-month high.

What is unusual is this data is that consumer confidence levels improved in March, yet consumer spending declined. The US consumer behavior continues to be marked by a “hard/soft discrepancy”, as confidence levels (“soft data”), has not translated into actual spending numbers (“hard data”). The odds of a June rate hike from the Fed has fallen to 46%, down from 64% earlier in April. Janet Yellen & Co. will likely want to see stronger inflation numbers before pressing the rate trigger.

USD/JPY Fundamentals

Tuesday (April 18)

- 8:30 US Building Permits. Estimate 1.25M. Actual 1.26M

- 8:30 US Housing Starts. Estimate 1.25M. Actual 1.22M

- 9:15 US Capacity Utilization Rate. Estimate 76.3%. Actual 76.1%

- 9:15 US Industrial Production. Estimate 0.5%. Actual 0.5%

*All release times are GMT

*Key events are in bold

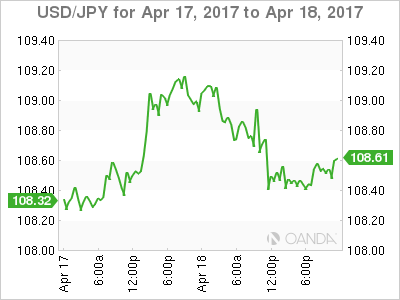

USD/JPY for Tuesday, April 18, 2017

USD/JPY April 18 at 11:00 EST

Open: 109.13 High: 109.22 Low: 108.65 Close: 108.63

USD/JPY Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 106.14 | 107.49 | 108.54 | 109.77 | 110.94 | 112.57 |

USD/JPY was flat in the Asian session. The pair lost ground in European trade and is choppy in North American trade

- 108.54 is a weak support level

- 109.77 is the next line of resistance

- Current range: 108.54 to 109.77

Further levels in both directions:

- Below: 108.54, 107.49 and 106.14

- Above: 109.77, 110.94, 112.57 and 113.80

OANDA’s Open Positions Ratio

In the Tuesday session, USD/JPY is showing long positions with a majority (62%). This is indicative of trader bias towards USD/JPY reversing directions and moving higher.