Boeing Company (NYSE:BA) - Aerospace and Defense | Reports April 27, After Market Closes

Key Takeaways

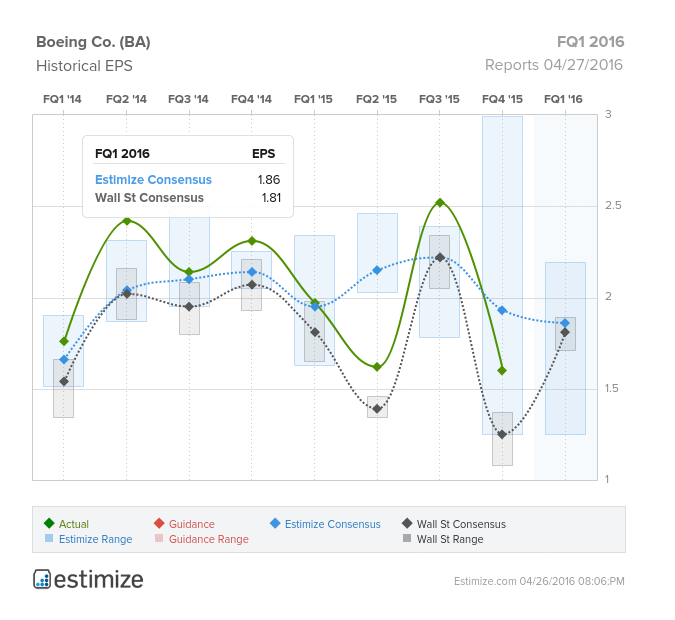

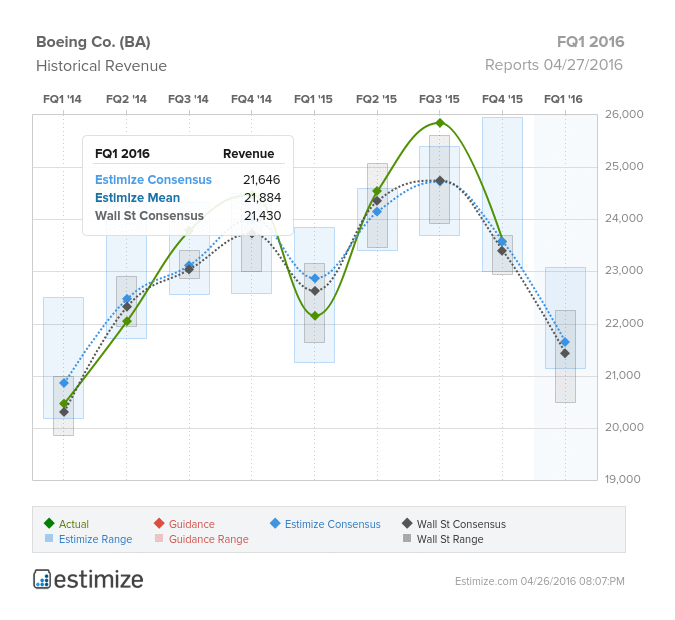

- The Estimize consensus is calling for earnings per share of $1.86 on $21.65 billion in revenue, 5 cents higher than Wall Street on the bottom and $220 million on top

- Boeing currently reports in three segments: Commercial Airplanes, Defense & Space, and Boeing Capital

- Boeing recently announced they would be cutting 8,000 airplane jobs in an effort to cut costs.

- What are you expecting for BA?

Aircraft manufacturer, Boeing, is scheduled to report first quarter earnings tomorrow, before the market opens. Boeing is best known for its 747 plane used by all major airlines in the U.S. today. Besides aircrafts, the company also reports in key segments including defense and space and financial services. The industrials company is coming off a handful of favorable quarters and is riding an 8 quarter streak of beating on the bottom line. Revenue has performed just as well, beating in 3 of the 4 quarters of fiscal 2015. Unfortunately, the stock has tracked downward despite robust earnings, falling 20% in the last 12 months.

Expectations this quarter have been remarkably low, with EPS estimates down 18% and sales sliding 8% since the last report. As a result, the Estimize consensus is calling for earnings per share of $1.86 on $21.65 billion in revenue, 5 cents higher than Wall Street on the bottom and $220 million on top. Compared to a year earlier, current estimates are forecasting a 6% decline in profits while revenue should remain flat.

Last quarter, Boeing saw mixed results in its three major reported segments. Commercial Airplanes and Boeing Capital were down while Defense, Space and Security performed well. Commercial Airplane deliveries in Q4 were down to 182 from 195 a year earlier. During the quarter however, Boeing won orders for its new 737 and 787 airplanes, which expect to be key growth drivers moving forward. Meanwhile defense, space and security reported 3% gains in revenue and 5% from operations. Unfortunately, lower overall defense spending and near term production cuts on the 747 program pose immediate risks to earnings. Boeing has also announced they would be cutting 8,000 airplane jobs in an effort reduce costs. Mixed results from Delta, Jetblue and American Airlines earlier this season might also be indicative of what to expect from Boeing tomorrow.

Do you think BA can beat estimates?