With the World Economic Forum’s talking shop now over we have to rely on European leaders to provide us with meeting after meeting and press conference after press conference. Luckily enough there is a meeting of EU leaders going on today to provide us with all headlines and financial obfuscation anyone could want. The topic that needs talking about but nobody seems willing to address is, once again, Greece.

Over the weekend a document was released showing supposedly German proposals to make it compulsory for the Greek parliament to pass all fiscal decisions, tax and spending, via a so-called “Budget Commissioner”. This provoked a fair bit of anger in Athens over the weekend and we would reckon that Greco-German relations are as frosty as London’s street’s this morning. This is the so-called price that Greece would have to pay for a fresh EUR130bn bailout.

There were also rumours last week that a debt deal between Greece and private sector investors had been agreed but has not been signed as yet as the ECB still remains steadfast in its belief that it will be the only investor in Greek debt that does not take losses on its holdings. Everyone knows that the deal must be signed and in place by March 20th as Greece must repay EUR14.4bn of bonds then; how much it costs Greece is the issue.

This has hit the euro overnight, after it had moved higher at the Asian open. EURUSD moved through the 1.32 mark while GBPEUR touched a low of 1.1890. It was probably inevitable that following so many tests of the support at 1.1930 a break may be forthcoming. It has come in illiquid markets however and I would expect it to move back into its range of 1.1930 to 1.2030 over the coming days. That being said, the risk is definitely to the downside as poor EU data or sentiment towards the Eurozone is not affecting EUR like it was last year and positive surprises may see investors cover shorts heavily.

The dollar is the main winner so far in trade as equity markets remain offered in light of the lack of a Greek resolution. Today’s volatility will likely come from Spanish GDP, due at 8am, and an EUR8bn auction of Italian debt over 5 and 10yr maturities. Spanish GDP is expected to slip by 0.3% in the provisional reading of Q4, only a smidge worse than the UK’s Q4 number of -0.2% released last week. We also receive the final reading for January consumer confidence in the Eurozone at 10am.

Data from the US was slightly weaker than the market expected on Friday but GDP matched our estimates of 2.8% annualised expansion in Q4. Most of the growth was made up by inventories it seems and concerns will remain as to whether this is sustainable or not. The dollar was relatively unmoved by the news as bulls and bears, or those looking for a 3rd round of QE versus those who don’t, slugged it out for little gain.

The calendar is quiet today but picks up towards the close of the week as we get the latest round of PMI numbers from the UK, Europe and US and Friday’s Non-Farms number.

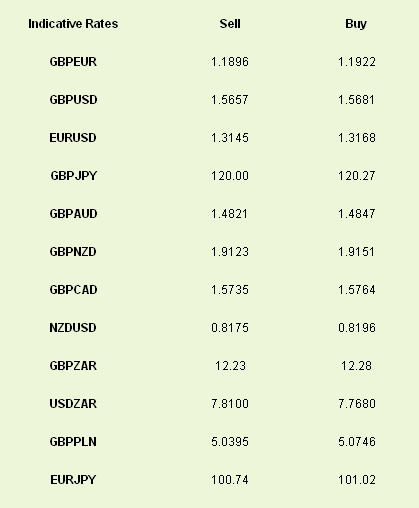

Latest exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

World First Morning Update 30th January 2012: EU Summit to Focus on Greek Issues

Published 01/30/2012, 09:36 AM

Updated 07/09/2023, 06:31 AM

World First Morning Update 30th January 2012: EU Summit to Focus on Greek Issues

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.