First Solar, Inc. (FSLR) manufactures and sells solar modules with an advanced thin-film semiconductor technology. First Solar designs, constructs, and sells photovoltaic (PV) solar power systems. It operates the business in two segments: components segment and systems segment.

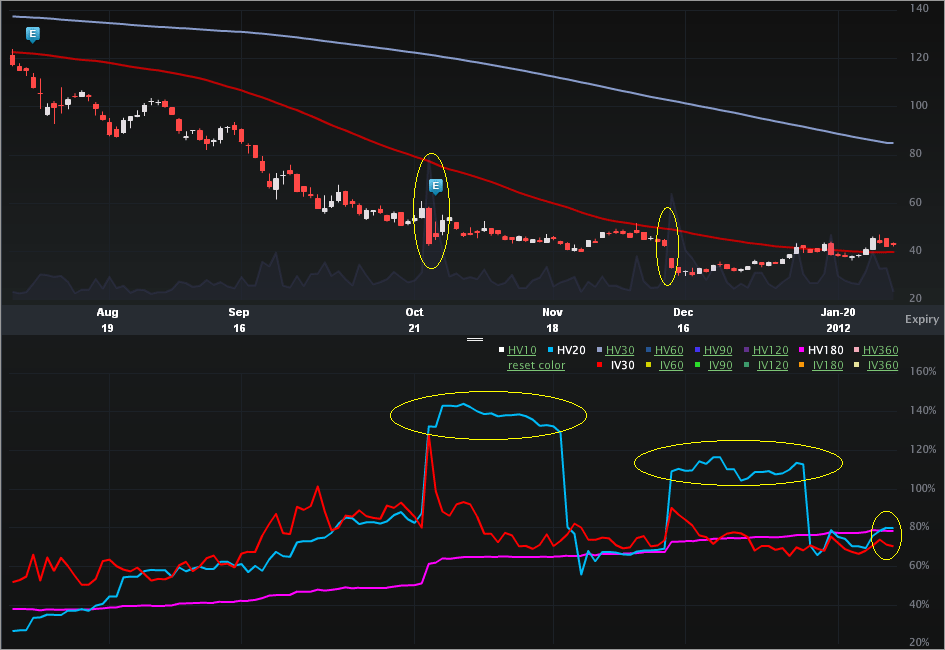

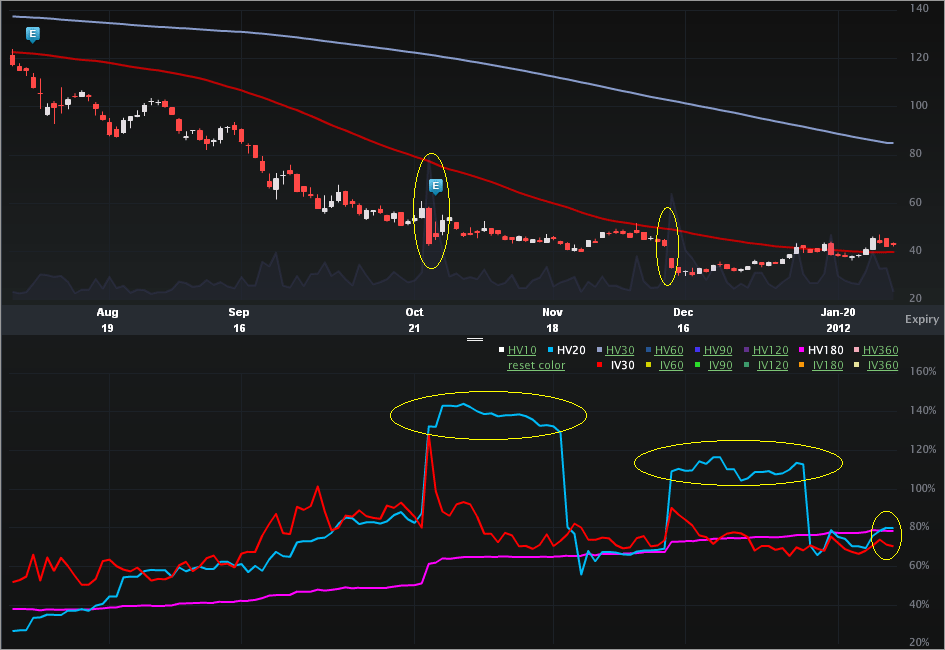

I found FSLR on a custom scan that searches for depressed vol. I was surprised to find this company on the list as it has a tendency to gap every “once in a while.” Let’s start with the Charts Tab (six months), below. The top portion is the stock price, the bottom is the vol (IV30™ - red vs HV20™ - blue vs HV180™ - pink).

On the stock side, we can see that the underlying has gapped twice in the last three months (ish). On the vol side we can see several phenomena:

1. As of right now, the implied is depressed to both historical realized measures. Specifically:

IV30™: 70.80%

HV20™: 80.22%

HV180™: 78.54%

2. The implied hit as high as 128.34% on 10-25-2011 – though that was earnings related. The 52 wk range in IV30™ is [38.29%, 128.34%], so the current level is in the 35th percentile (annual).

3. The stock gaps have resulted in HV20™ hitting over 144% in late Oct and over 116% in late Dec.

Let’s turn to the Skew Tab, below.

We can see that the weekly options expiring in two and a half days are elevated to the monthly expiries – that’s normal. All three expiries pictured show a parabolic skew reflecting both upside potential and downside risk. The next earnings report for FSLR should be after Feb expiry (and in Mar).

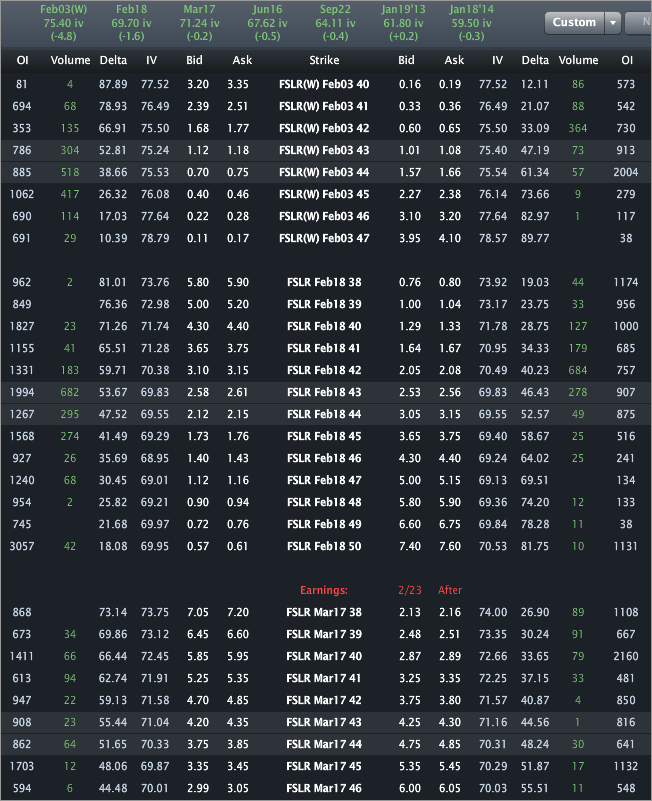

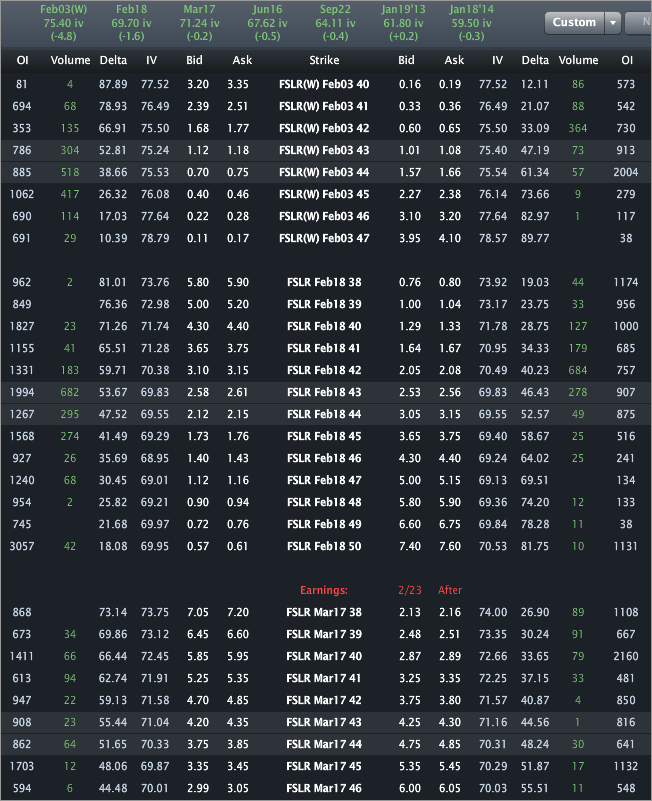

Let’s finally turn to the Options Tab.

I wrote about this one for TheStreet (OptionsProfits), so no specific trade analysis here. I can see that we can see the expiries are priced to 75.40%, 69.70% and 71.24% for Feb03 weekly, Feb monthly and Mar, respectively. While Feb and Mar show depressed vol to the historical measures, that gamma in the Feb3 weekly options is still significant -- that is, the premia aren't trivial although the options expire in less than half a week.

FSLR is a highly volatile stock with a pattern of stock gaps -- trader beware.

This is trade analysis, not a recommendation.

I found FSLR on a custom scan that searches for depressed vol. I was surprised to find this company on the list as it has a tendency to gap every “once in a while.” Let’s start with the Charts Tab (six months), below. The top portion is the stock price, the bottom is the vol (IV30™ - red vs HV20™ - blue vs HV180™ - pink).

On the stock side, we can see that the underlying has gapped twice in the last three months (ish). On the vol side we can see several phenomena:

1. As of right now, the implied is depressed to both historical realized measures. Specifically:

IV30™: 70.80%

HV20™: 80.22%

HV180™: 78.54%

2. The implied hit as high as 128.34% on 10-25-2011 – though that was earnings related. The 52 wk range in IV30™ is [38.29%, 128.34%], so the current level is in the 35th percentile (annual).

3. The stock gaps have resulted in HV20™ hitting over 144% in late Oct and over 116% in late Dec.

Let’s turn to the Skew Tab, below.

We can see that the weekly options expiring in two and a half days are elevated to the monthly expiries – that’s normal. All three expiries pictured show a parabolic skew reflecting both upside potential and downside risk. The next earnings report for FSLR should be after Feb expiry (and in Mar).

Let’s finally turn to the Options Tab.

I wrote about this one for TheStreet (OptionsProfits), so no specific trade analysis here. I can see that we can see the expiries are priced to 75.40%, 69.70% and 71.24% for Feb03 weekly, Feb monthly and Mar, respectively. While Feb and Mar show depressed vol to the historical measures, that gamma in the Feb3 weekly options is still significant -- that is, the premia aren't trivial although the options expire in less than half a week.

FSLR is a highly volatile stock with a pattern of stock gaps -- trader beware.

This is trade analysis, not a recommendation.