The euro is showing little movement in the Thursday session, and with German and French banks closed for a holiday, this trend will likely continue throughout the day. On the release front, OPEC members are meeting in Vienna, and the US releases unemployment claims, with the indicator expected to rise to 238 thousand.

The much-anticipated Fed minutes were released on Wednesday, but traders hoping for confirmation of a June rate hike came away disappointed, as the minutes conveyed a less hawkish tone than the markets had expected. Policymakers were careful in their message, saying that a rate hike was coming “soon”. Does that mean a move at the June policy meeting? The markets think so, as Fed funds futures for a June hike remained at 78% after the minutes were released. At the same time, the Fed has given itself some wiggle room, and could opt to delay a hike until the second quarter if inflation or consumer indicators take an unexpected nosedive. The minutes stated that policymakers wanted to see additional evidence that the recent slowdown in the economy was temporary before raising rates. As for additional hikes in 2017, the markets remain skeptical. The odds for a September rate stand at just 37%. This pessimism is a result of a weak performance from the US economy in Q1, as well as doubts that President Trump, who is facing congressional investigations over his connections with the Russian government, will be able to pass his agenda of cutting taxes and government spending.

Earlier in the week, the White House presented President Trump’s 2018 budget proposal to lawmakers in Congress. Trump has promised to slash government spending, and much of the funds for the budget would come from huge cuts to the Medicaid health program. The budget, which makes cuts to other social programs such as food stamps, is unlikely to remain in its present form for very long, as Democrats will want nothing to do with it, and Republicans will not want to make drastic cuts to federal programs that will incur the wrath of voters. Still, the Trump administration, which has been in damage-control mode for weeks over the firing of FBI director James Comey, can point to the budget as a step forward in trying to implement Trump’s pro-business agenda.

EUR/USD Fundamentals

Thursday (May 25)

- All Day – OPEC Meetings

- 8:30 US Unemployment Claims. Estimate 238K

Friday (May 26)

- Day 1 – G7 Meetings

- 8:30 US Core Durable Goods Orders. Estimate 0.4%

- 8:30 US Preliminary GDP. Estimate 0.9%

- 10:00 US Revised UoM Consumer Sentiment. Estimate 97.6

*All release times are EDT

*Key events are in bold

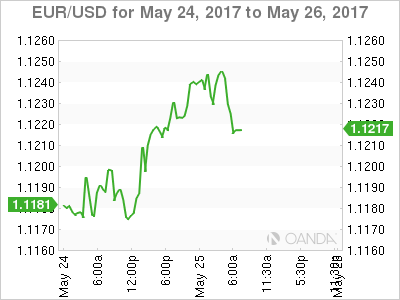

EUR/USD for Thursday, May 25, 2017

EUR/USD Thursday, May 25 at 6:30 EDT

Open: 1.1219 High: 1.1250 Low: 1.1211 Close: 1.1227

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0873 | 1.0985 | 1.1122 | 1.1242 | 1.1366 | 1.1465 |

EUR/USD was flat in the Asian session. In European trade, the pair edged higher but has since retracted

- 1.1122 is providing support

- 1.1242 was tested earlier in resistance and is a weak line

Further levels in both directions:

- Below: 1.1122, 1.0985 and 1.0873

- Above: 1.1242, 1.1366, 1.1465 and 1.1534

- Current range: 1.1122 to 1.1242

OANDA’s Open Positions Ratio

EUR/USD ratio is almost unchanged in the Thursday session. Currently, short positions have a majority (69%), indicative of EUR/USD reversing directions and moving lower.