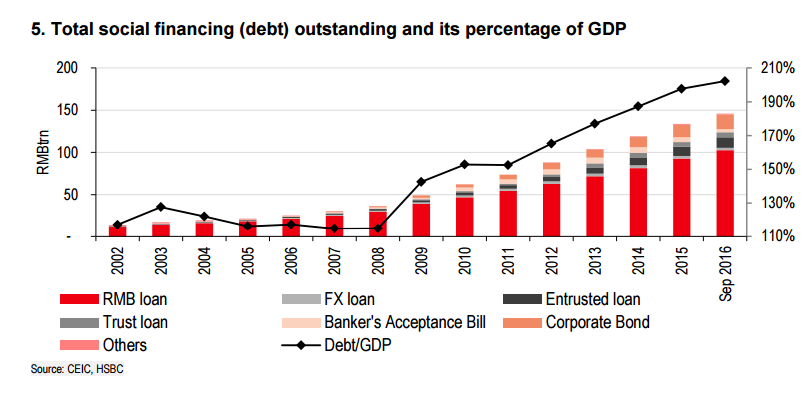

China is facing a world where getting rid of bad debt is a top priority, an HSBC Asian economic report notes. In order to be successful, China will need to carefully balance its capital flows as it appears to bend the rules of free market capitalism.

China’s Debt Bubble Threatens Global Growth As Debt To GDP Nears …

China Bad Debt – After volatility in early 2016, conditions changed

Concerns regarding China’s dramatic asset boom and debt, witnessed in significantly volatility in early 2016, may come back to center stage, HSBC’s Head of China Research Zhi Ming Zhang and Analyst Helen Huang wrote.

After the debt led volatility in early 2016, there was a period of calm where the US dollar rose and the Chinese yuan fell.

China Bad Debt – An accommodative environment emerged, one where there is no apparent penalty failure

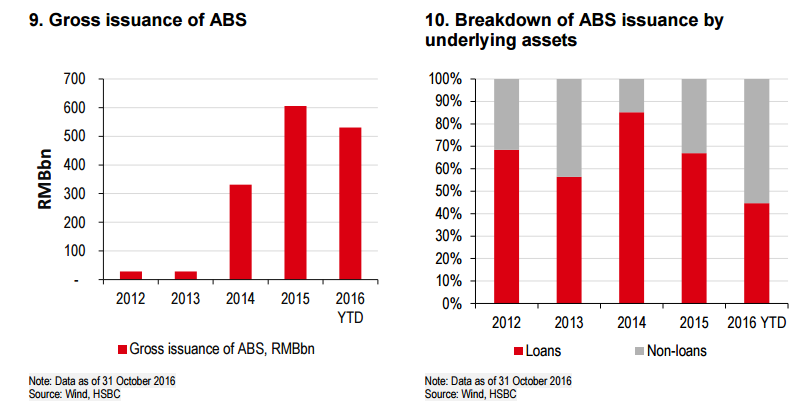

As pressure on growth subsided, China worked to reduce industrial overcapacity and bad debt, introducing programs such as local government asset management companies, debt-to-equity swaps, securitization of non-performing loans, as well as debt write-offs. In part the nonperforming loans were packaged into asset backed securities much like what was done leading up to the 2008 financial crisis, but other programs were instituted as well and were tested to various results.

Does China’s debt bomb or industries in other countries collapse first?”

Among these programs the debt-to-equity swaps seem interesting from two levels. Unlike a free market system, the debt was bought at full value, allowing the lenders to the company to exit without loss and violating a free market principle. The associated loan risk was fully shifted to the public sector from the private sector.

Calling this tactic “questionable,” the report noted that the buyback clause makes the swap appear more like another loan rather than an equity investment as advertised.

China Bad Debt – Who is going to take the pain? Right now investors

China Debt Default Looms As Growth Options Run Out: Nomura

The key a free market system is that failure leads to pain. As HSBC says, with bad debt “someone has to take the pain.” The issue is who?

That who appears to be investors, as HSBC points out:

The shared purpose of all these initiatives is to solve the problem of bad debt without any significant write-offs. Large write-offs or bankruptcies would mean immediate losses for the lenders, which may make them scale back loans, pushing up lending costs in the process. And system-wide write-offs could shake the stability of certain financial institutions, a most unwelcome outcome in the current environment. So the only solution is to sell the bad debt to savers through wealth management institutions.

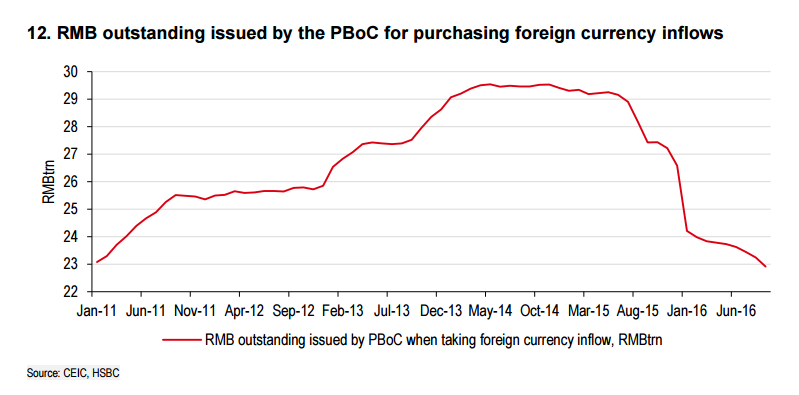

What this does is buy time to re-shuffle the debt structure and in this existing environment there are three of four economic factors working in their favor. Underpinning the current accommodative environment are a high saving rate, access to these savings, low inflation and a net external surplus. The only aspect out of China’s control is net external surplus. The report stated,

Under such conditions, an accommodative monetary environment with low interest rates and ample liquidity can be maintained, creating considerable room to manage bad debt.

The Big Short 2: Hedge Funds Bet Billions On China’s Fall

Govt looking for accommodative environment to dispose of China Bad Debt

Looking into the future, HSBC thinks overall debt levels could be set to rise with an accommodative environment important for China’s debt disposal plans to work. Without such an environment, selling investment products would be difficult as the key source of money needed to purchase, restructure and hold the bad debt would not be available.

With expansion in the number and type of entities holding bad debt, so, too increases the borrowers expanding the debt. An accommodative environment leads to a search for yield. The problem is the accommodative level for debt creates a self-fulfilling prophecy as easy money creates more debt. The report said,

We believe it will be difficult to break away from this trend under the current monetary and policy environment, which is supportive of borrowing.

The current accommodative environment that results in low yields and “ample liquidity,” is supportative of bad debt disposal through “new funding schemes.” Issues are on the horizon, as export numbers are weak, “which is certainly not helpful.”