The markets were trading mixed yesterday on busy economic data from the U.S. the ADP/Moody's private payrolls data showed a better than expected headline print of 263k compared to forecasts of 184k. The FOMC meeting minutes that was released yesterday focused more on the unwinding of the Fed's balance sheet, which in a way is seen as a rate hike itself due to its widespread market impact. The U.S. dollar closed mixed yesterday.

Looking ahead, the economic calendar today is relatively light with no major releases scheduled. From the Eurozone, the ECB's meeting minutes will be released while later in the afternoon, ECB president Draghi is expected to speak.

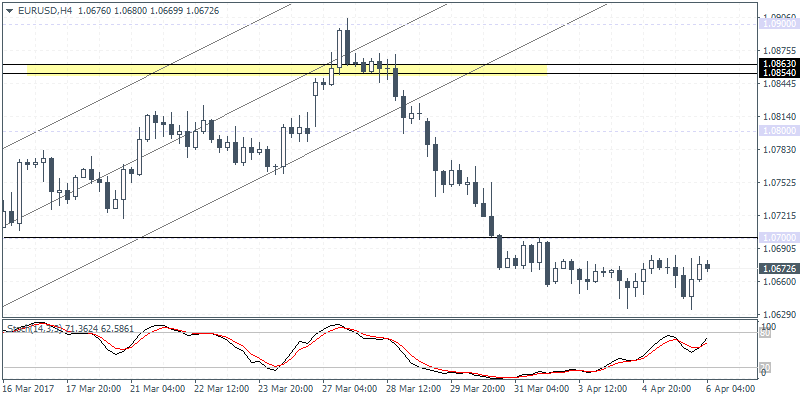

EUR/USD intra-day analysis

EUR/USD (1.0672) has been trading rather flat yesterday with the consolidation likely to result in a break out from the ranges anytime soon. The flat price action could continue through to Friday's payrolls report.

Price action on Wednesday posted an outside bar pattern, and we can expect a break out from this range in the near term. The bias is now shifting to the downside, with the potential target towards 1.0600 which is a strong support level. In the intermediate term, EUR/USD could remain trading within 1.0800 and 1.0600 levels. A breakout from one of these levels will signal further continuation.

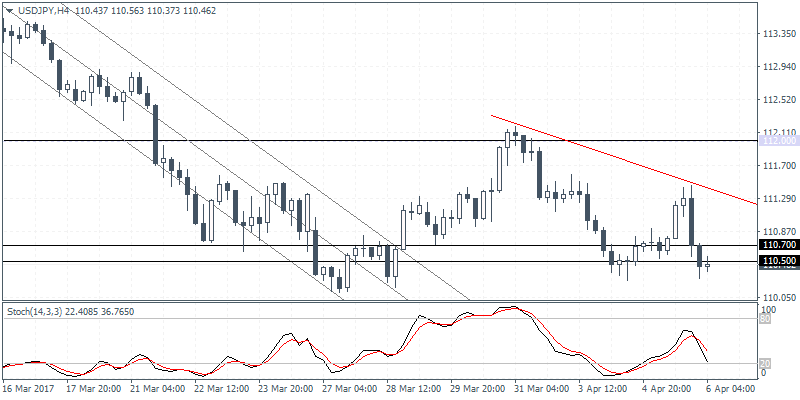

USD/JPY intra-day analysis

USD/JPY (110.46) attempt's to reverse off 11.50 - 110.70 support failed as prices fell back to the support yesterday. Still, there is potential to see further upside with a breakout from the falling trend line.

Resistance at 112.00 could be tested in the near term with further gains coming above this level. Despite the modestly bullish outlook in USD/JPY, there are significant risks of a decline to 110.00. However on the 4-hour chart, there is a possible bullish divergence that is formed with the lows in price reflected by the higher lows on the Stochastics oscillator.

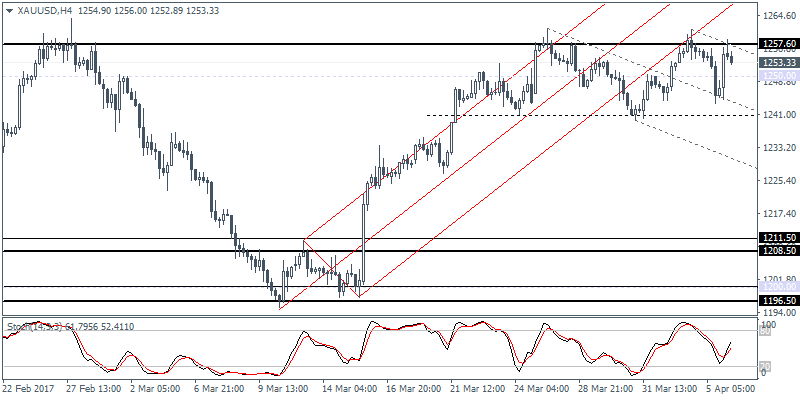

XAU/USD intra-day analysis

XAU/USD (1253.33) gold prices continue to remain hovering near the 1260.00 region but repeated attempts on an intra-week basis to breach 1257 - 1260 levels have failed. This could possible indicate a near term weakness in price.

Initial support at 1250 can be tested with further downside likely to extend towards the 1210 - 1200 levels where support is most likely to be tested. With the U.S. payrolls due tomorrow, gold prices could remain range bound for the near term.