Delta Air Lines (NYSE:DAL) Industrials - Airlines | Reports January 12, Before Market Opens

Key Takeaways

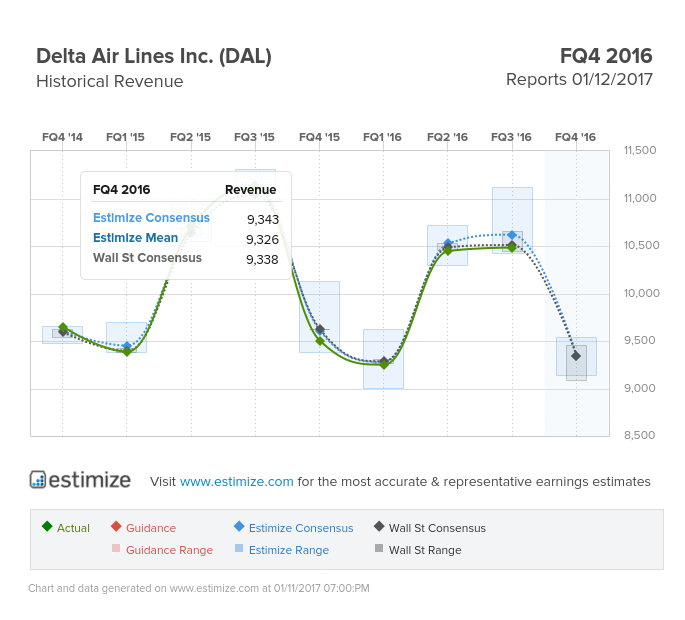

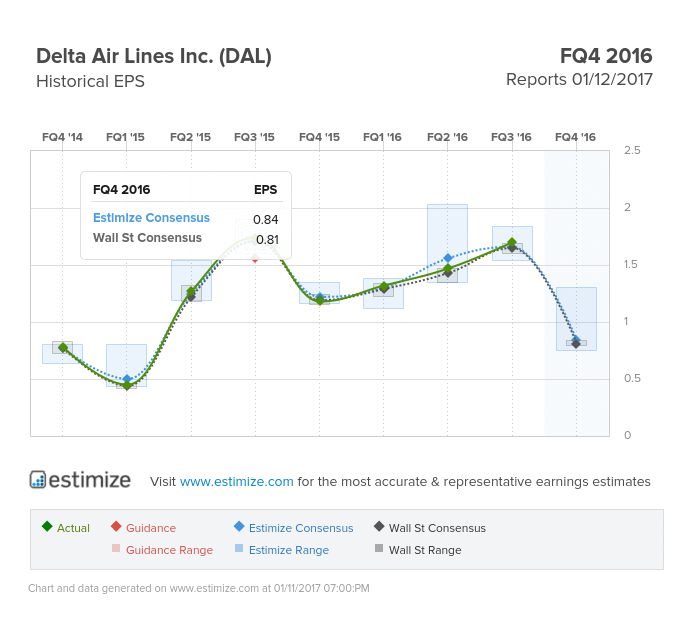

- The Estimize consensus is calling for earnings per share of 84 cents on $9.34 billion in revenue, roughly 3 cents higher than Wall Street on the bottom line and right in line on the top

- Delta expects key PRASM metrics to drop 2.5-3% for the December quarter which compares favorably to initial reports of a 3-5% decline guided in October

- Moving forward, Delta must balance rising fuel costs and ticket prices in order retain market share from discount airlines

Delta kicks off earnings season for the airlines with its scheduled fourth quarter report taking place Thursday morning. Major airlines bounced back in the second half of 2016 by offering deeper discounts and a broader recovery in the travel industry. With all indications pointing to strong travel during the holiday months, Delta looks poised to close fiscal 2016 on a strong note.

The Estimize community is calling for earnings per share of 84 cents, 26% lower than the same period last year. That estimate has edged lower 32% in the past 3 months. Revenue for the period is forecasted to drop by 2% to $9.34 billion, reflecting a slight improvement from a 6% decline in the third quarter.

Despite weak comparisons, Delta stock typically thrives during earnings season. Immediately through an earnings report shares tend to rise by 1% and continue upwards about 5% in the month following. At the moment shares are up about 30% in the past 3 months from increased optimism.

In an investor update on January 4, 2017, Delta indicated that Q4 metrics outpaced guidance deliver in October. Passenger unit revenue, or PRASM, for the December quarter is expected to drop between 2.5-3.0%, which compares favorably to initial reports of a 3-5% decline. Average seat miles also saw a significant uptake, increasing 1.5% from a year earlier. A large portion of the increase was credited to strong demand trends, improving domestic yields and more efficient revenue management strategies.

Moving forward, Delta still faces a number of near term headwinds. Discounters remain the number one threat to major airlines especially as fuel costs start to increase in the coming months. Expect names like Southwest and JetBlue to capture greater market share as Delta struggles to balance increasing fuel costs with low ticket prices.