Daily Forex and Market Report

FOREX

The Euro (1.3328) is trading above 1.33 after having falling to 1.3212 in the US session on Friday. The market is hearing reports that the IMF may be ready to support Italy.

USDCHF (0.9270) has come off of Friday's high of 0.9330 and could test towards 0.92.

The Aussie (0.9880) bounced off strong support on the monthly charts. The Cable (1.5525) is also consolidating a little.

EQUITIES

The US markets closed lower on Friday. The Dow (11231.78) was down 0.23% and the Nasdaq (2441.51) was down 0.75%. Dow has a chance of a break below 11000 and testing 10700-600 in the coming days. On the other hand Nasdaq can test 2400-300.

The Asian markets are higher today. Nikkei (8310.69) is up 1.85%, Shanghai (2383.57) is up 0.14%, Hong Kong (17967.36) is up 1.57%, Taiwan (6887.32) is up 1.52% and Australia (4129.40) is up 1.77%.

COMMODITIES

Crude (98.31) has found support near 95 and is also moving near its 21 DMA (96.71). We might see a chance of a rise to 100-102 in the coming days.

Gold (1707) has risen above 1700. Resistance is near current levels at 1710. A break above that can test 1750.

Asian Markets Rise

Asian markets rose. This comes as investors reacted to reports of an IMF plan designed to get a grip on Europe’s debt crisis.

Hong Kong’s Hang Seng Index rose 1.9%, while the Shanghai Composite Index was up 0.1%.

Japan’s Nikkei Stock Average jumped 1.7%, South Korea’s Kospi rose 1.9%, and the Australian S&P/ASX 200 index also roie 1.9%.

Europe has served as a main source of uncertainty in the markets as of late. It is now rumored that the International Monetary Fund may provide financial support for Italy, which saw its government bond yields surge Friday.

Such an IMF plan would give Italy’s Prime Minister Monti at least 12 to 18 months to implement finance reforms without having to refinance the country’s existing debt.

The week is an important for European bond issuance. Belgium, Italy, Spain and France expected to issue up to a combined total of €19.5 billion ($26 billion) in bonds this week, as well as another €9 billion to €9.5 billion in bills.

The Cable Breaks Support @ 1.5492

GBP/USD appears to be making a strong retest of the broken support at 1.5492. This is the 50% Fibonacci extension, next we could end up testing the 61.8% level at 1.5492.

However, the extent of the current selling has pushed relative strength studies uncomfortably close to oversold levels and the correlation between the Cable and the S&P 500 might hint that the recent decline could be overbought.

Although a break of triple bottom support at 1.5326 which dates back to August 2010 may accelerate.

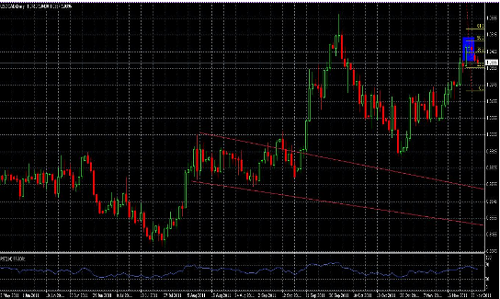

The Loonie Sees Initial Support at 1.0369

USD/CAD put in a bearish Harami candlestick pattern below the resistance seen at 1.0516. This is the 50% Fibonacci extension level and might be hinting a pullback is ahead.

Initial support is at 1.0369. This is the 38.2% extension level.

The Kiwi Puts in Inverted Hammer Above .7391

The NZD/USD put in a bullish Inverted Hammer candlestick above support at 0.7391. This is the 61.8% Fibonacci extension where the prices bouncing to meet resistance at 0.7554, the 50% Fib level.

The upside level is reinforced by the top of a falling channel from late October. Alternatively, a break higher might test the 38.2% extension at 0.7716.

The Euro Hits 13360

The EUR/USD has reached 13360. However it is important to reinforce the bigger picture view. A major topping process appears to be forming since November 2010 (head and shoulders). This might be increasing the probability we could see a move lower.

The long term bearish model appears to be bolstered by the negative 13, 52 SMA cross on the weekly.

A break below the neckline and 13145 might trigger an even sharper EURUSD decline.

Looking up we see short term resistance at 13370 and 13420.

The European Unions Agrees on Rescue Fund

European officials have agreed on how to leverage a key rescue fund. This comes as Germany and France are looking at how to deepen a fiscal integration in the Euro zone.

Finance ministers from the Euro zone are scheduled to meet Tuesday and are expected to agree to rules for borrowing against the European Financial Stability Facility (EFSF), as well as guidelines for intervening in the Euro zone bond markets; thus providing credit lines to governments.

Such an agreement would mark a key milestone for the €440-billion strong ($586 billion) EFSF, after European leaders agreed to leverage the fund last month.

An IMF inspection team was due in Rome in the coming days.