S&P 500 futures surged before the market opened on news of a coordinated bailout by central banks. The index popped at the open, up 2.7% and never looked back. The rally accelerated twice during the day, mid-morning and during the final hour, to close up 4.33%. That's the best daily performance since the August 11th gain of 4.63%

The index has cut its year-to-date loss to a fractional 0.85%, although it is 8.55% off the interim high of April 29. It has now soared 40 points above its 50-day moving average and is only 19 points below its 200 day moving average.

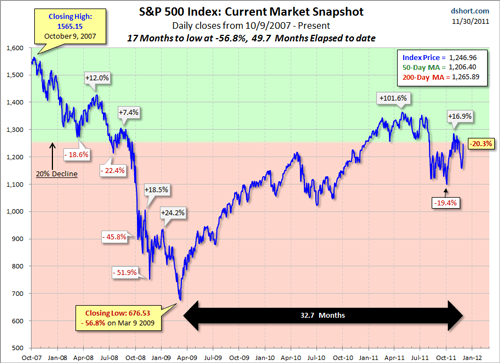

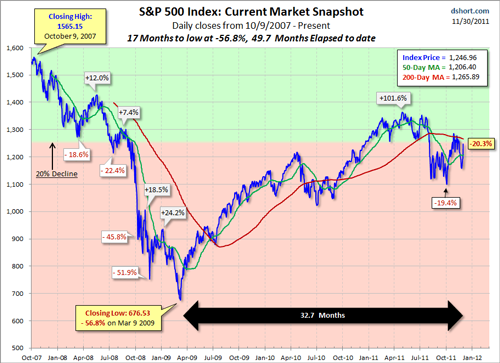

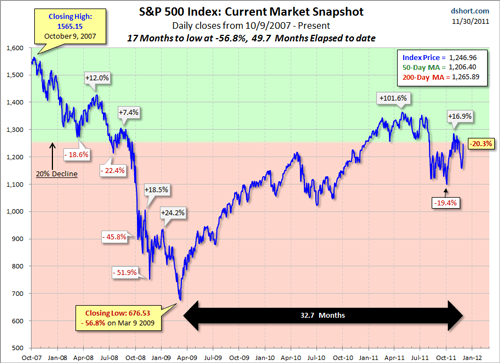

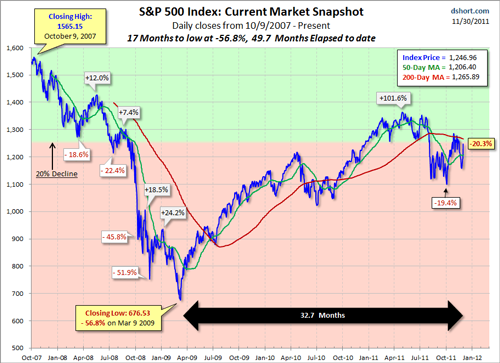

From an intermediate perspective, the index is 84.3% above the March 2009 closing low and 20.3% below the nominal all-time high of October 2007.

Below are two charts of the index, with and without the 50 and 200-day moving averages.

The index has cut its year-to-date loss to a fractional 0.85%, although it is 8.55% off the interim high of April 29. It has now soared 40 points above its 50-day moving average and is only 19 points below its 200 day moving average.

From an intermediate perspective, the index is 84.3% above the March 2009 closing low and 20.3% below the nominal all-time high of October 2007.

Below are two charts of the index, with and without the 50 and 200-day moving averages.