Too often I hear new traders talk about how they like to buy options that are cheap because they think it’s a good investment. I can understand where they are coming from because they relate option pricing to how stocks are priced. Cheap stocks are seen as a good investment because they can quickly rise in price – but it’s not the same case with options trading.

Cheap Compared To What?

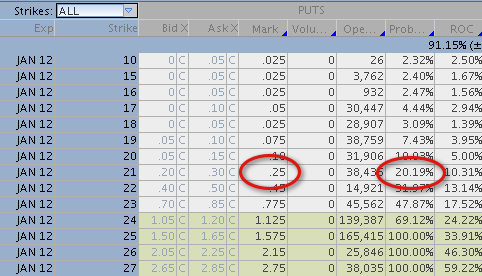

When someone says they buy cheap options they typically mean that the absolute price is low. They will buy options around $25 each for example and think they are just “stealing money” somehow from the market. But in reality this option below on has a 20% chance of making money at expiration.

You see they are not comparing the pricing to any historical guide or point or reference. Just because an option is priced low doesn’t mean that it’s cheap. And likewise, just because an option is expensive doesn’t mean that it a great investment either.

How To Evaluate Option Pricing

As you start to plan out your next options strategy, there is one main factors you should evaluate before making the trade. Again it’s important to have a frame of reference before you go blindly buying options all over the place that are $25 each and wasting your hard earned money.

Implied vs. Historical Volatility

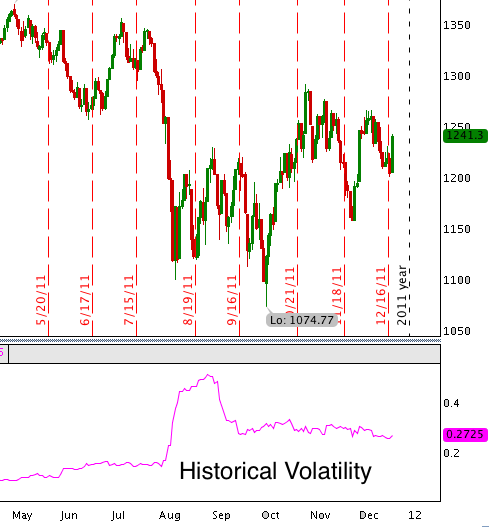

As option traders we measure how expensive or cheap options are using a parameter called implied volatility, or IV for short. All the data point shows is what the market is pricing in for future volatility of a particular stock.

High IV is synonymous with expensive options and thus shows that there is a lot of fear in the market which is driving up prices due to increased risk. Low IV is synonymous with cheap options and shows either complacency and/or greed in the market.

The implied volatility of the option will indicate the market’s expected trading range for the stock going forward. Since historical volatility can be plotted on the charts you can see how it compares to current implied volatility levels.

Remember, this doesn’t mean that the market will always do what you want it too just because the historical trends are in your favor. It’s all about odds and probabilities. Over time, making the right trade and managing risk will lead to profits.

Spend Your Time Analyzing The Stock

The reality is that the market is going to sniff out any easy profits (always has and always will). There are big banks and large traders who have much more time and money to spend searching for these little pricing inequalities than you or I do.

I suggest you spend your precious time looking at the technical indicators and analyzing the underlying stock. Timing your trade properly is much easier than digging for a mispricing in the options market.