For the 24 hours to 23:00 GMT, the GBP jumped 3.2% against the USD and closed at 1.2403, following Theresa May’s speech that outlined Britain’s plans for leaving the European Union (EU).

During a speech at Lancaster House in London, the UK Prime Minister, Theresa May, confirmed that Britain would leave the EU single market, which guarantees the free movement of goods, services and people within the bloc. The Prime Minister made it clear that Britain is determined to regain control of immigration and law-making from the EU and that leaving the single market was the inevitable consequence. Further, she hopes to complete a final deal with the EU by March 2019 and pledged to give both houses of Parliament a vote on the final Brexit deal.

In economic news, the consumer price index (CPI) in UK climbed more-than-anticipated by 1.6% on an annual basis in December, hitting its highest level in more than two years, driven by Brexit-fuelled drop in the Pound. Meanwhile, market expectations was for the CPI to rise 1.4%, after advancing 1.2% in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.2341, with the GBP trading 0.5% lower against the USD from yesterday’s close.

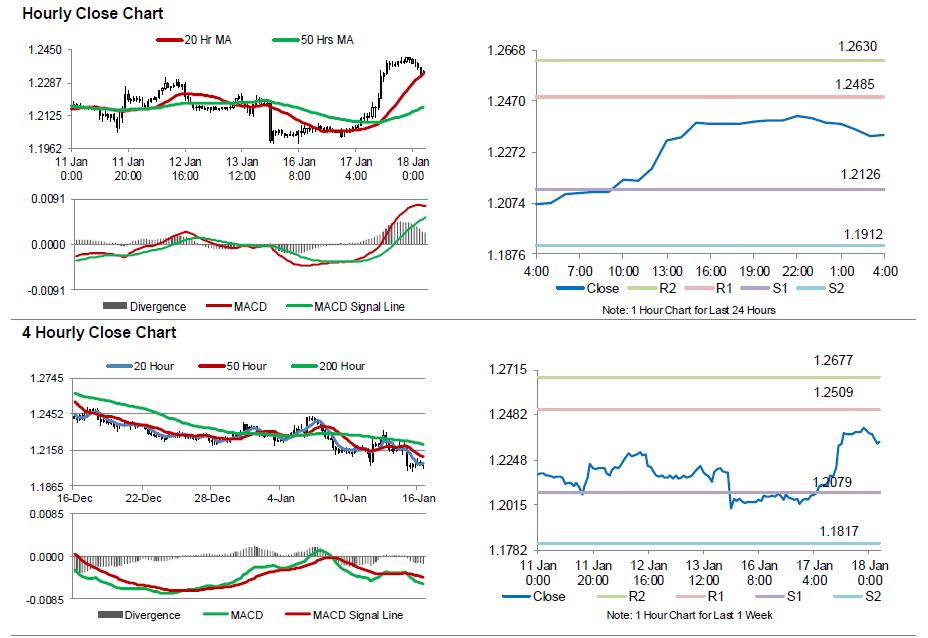

The pair is expected to find support at 1.2126, and a fall through could take it to the next support level of 1.1912. The pair is expected to find its first resistance at 1.2485, and a rise through could take it to the next resistance level of 1.2630.

Ahead in the day, investors will look forward to UK’s ILO unemployment rate for the three months ended November, to get better insights into the nation’s labour market.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.