Gold Retreats As Political Tension Fades Away, Eyes on U.S. Data

Gold shed -$16.79 yesterday with a 1273.81 weekly fresh lows due to aggressive selling and abandoning buying positions, still above 200 D1 SMA at 1255.

Last week and Monday's rallies supported by geopolitical tension, lifted gold to 1295.27 2017-highs. Although political and economical uncertainties has temporary lulled, the coming days will witness arousing events. First from the French elections round this Sunday, to PM May's call for early British elections which was approved yesterday and on May the 2nd, the Parliament will be dissolved. Add to that, Trump's and his unpredictable tweets and propaganda media announcements are always on Stand-buy position, could provoke gold yet again as traders leans to the yellow metal as a sacred haven substitute.

Fundamentals:

1- USD - Unemployment Claims today at 12:30 PM GMT.

2- French Elections This Sunday.

Technical Overview:

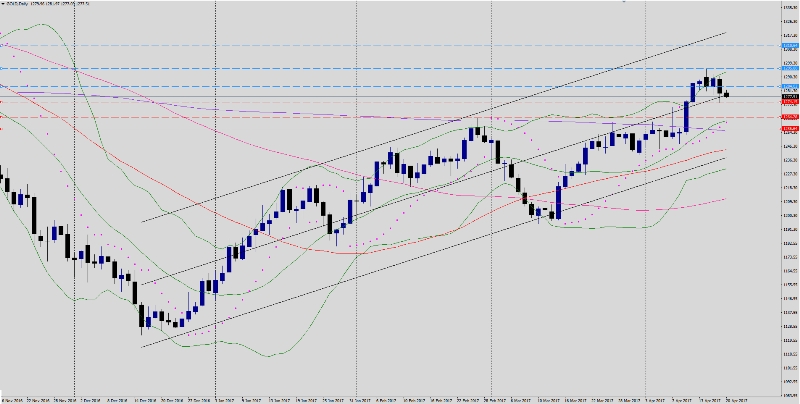

Trend: Bullish Sideways

Resistance levels: R1 1284.02, R2 1295.80, R3 1310.81

Support levels : S1 1271.15, S2 1264.28, S3 1256.64

Comment: Gold remains bullish despite yesterday's minor down correction. Staying above S1 sustains bullish forces and calls for additional rallies and a penetration for R2 level will dilate further gains towards R3. The other scenario, longing below S1 level will increase selloffs with congestion and wash towards S2&S3. A close below S3 calls for trend reversal and market to consider gold bearish. Keep an eye on U.S Index levels and French elections this Sunday with end results will have an impact on Gold.