Zynga Inc. (Zynga), formerly Presidio Media LLC, is a social game developer with 232 million average monthly active users (MAUs) in 166 countries. The Company’s games are accessible on Facebook, other social networks and mobile platforms to players globally, wherever and whenever they want.

The stock is moving off of the disclosures made by Facebook in the IPO disclosures, specifically that ZNGA accounts for 12% of Facebook's revenues. Here's a great all encompassing snippet:

SAN FRANCISCO (MarketWatch) — The filing of Facebook’s IPO papers seem to have changed investors’ attitudes about social game maker Zynga Inc.

Zynga shares jumped as much as 20% Thursday following Facebook’s IPO filing.

Since going public on Dec. 16 of last year at $10 a share, Zynga has been largely seen as a disappointment on the market, with its shares falling as low as $7.97 on Jan. 9, and not even getting back to its IPO level until late January.

And then came Facebook, with its $5 billion IPO filing late Wednesday, and its disclosure that Zynga was responsible for 12% of Facebook’s revenue of $3.7 billion in 2011. The filing boosted confidence in Zynga, and sent the shares up by as much as 20% on Thursday. The stock pulled back from its high point, but remained up by almost 17% at $12.37 by Thursday afternoon. Read full story on Facebook's IPO filing.

Source: MarketWatch via Yahoo1 Finance, Facebook lifts Zynga, Groupon, LinkedIn, written by Rex Crum.

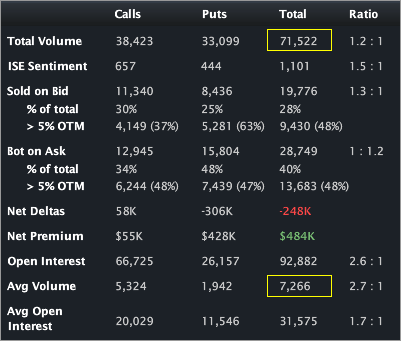

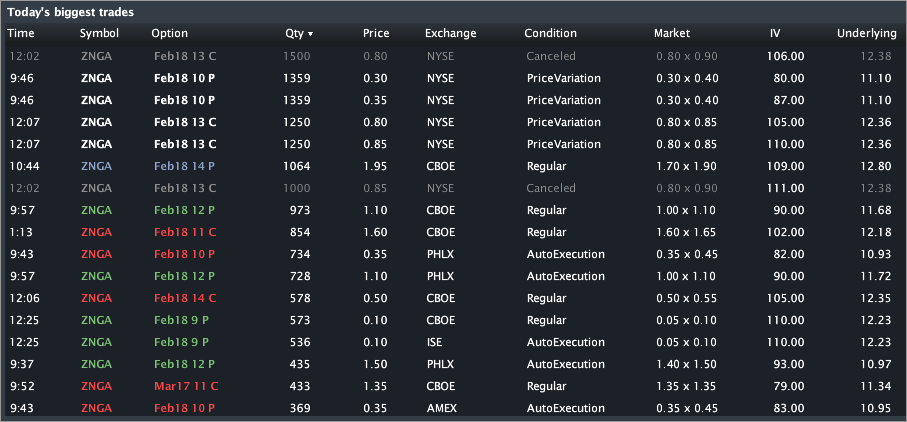

For all the poo-pooing of ZNGA equity, as of this writing, it's up 25.5% since its IPO on 12-16-2011. The move in stock and vol is accompanied by heavy options order flow. The company has traded more than 71,500 contracts on total daily average option volume of just 7,266. The Stats Tab and Day's biggest trades snapshots are included (below).

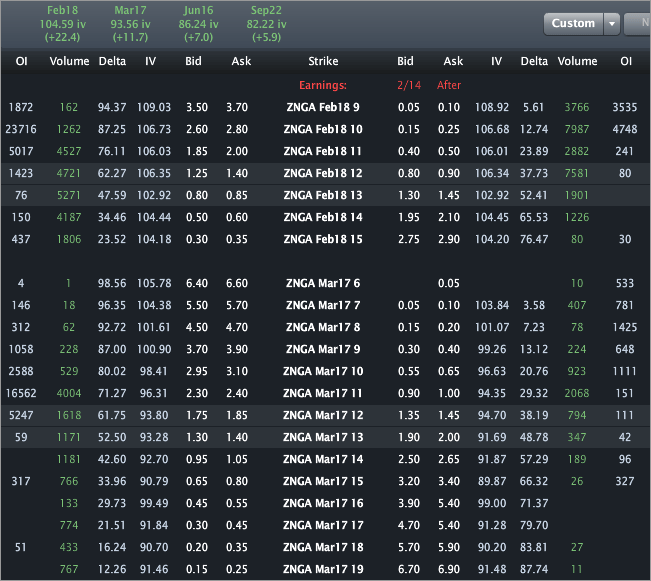

The Options Tab (below) illustrates the action. Feb 10 and 12 puts have traded over 7,500x, while the Feb 12 and 13 calls have traded 4,700x and 5,271x, respectively. The Feb 12 puts look like purchases while the Feb 10 puts look like sales. The Feb 12 calls look like sales while the Feb 13 calls are ambiguous. The Feb 14 calls also look like sales though I have read some reports that those were purchases. I just don't see that, honestly. Those look like someone was offering inside the NBBO and finally just hit the bid. Whatever the case, the Options Tab (across the top) shows rising vol in Feb (22.4 vol points) and Mar (11.7 vol points) -- so the circumstantial evidence is premium purchases overall.

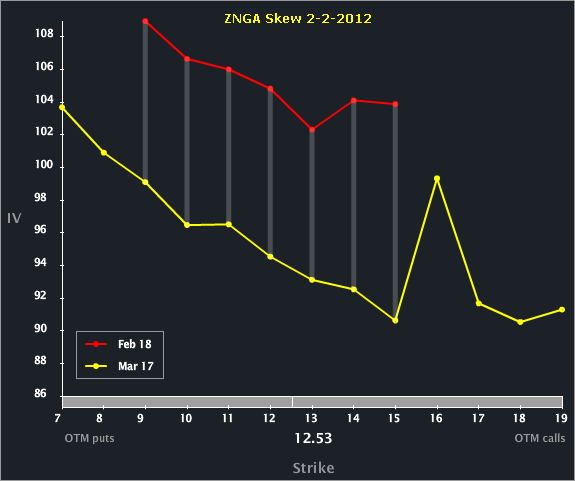

The Skew Tab snap (below) illustrates the vols by strike by month.

ZNGA has earnings due out on 2-14-2012 AMC, so the Feb options should be elevated (in vol) to Mar. That vol diff will actually increase as we approach the earnings announcement unless there's some sort of pre-announcement or other revelation. The spike in the Mar 16 calls is interesting, for sure.

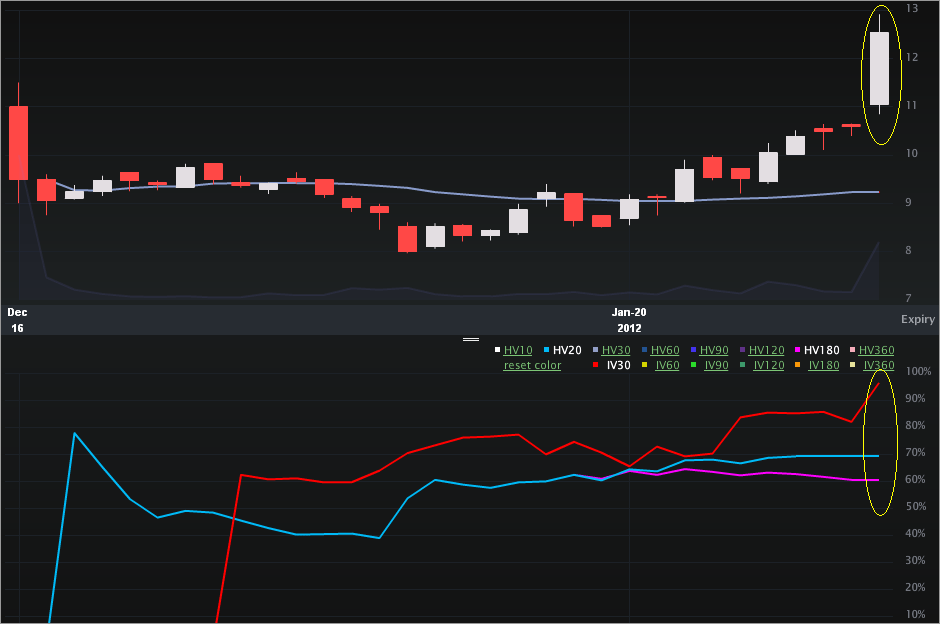

Finally, the Charts Tab is below. The top portion is the stock price, the bottom is the vol (IV30™ - red vs HV20™ - blue vs HV180™ - pink).

There's not a lot of history to go off of here, but we can see the recent pop in stock, above the IPO price. At the same time, we can see the implied rising, that is vol and stock are rising together.

I guess a fair question is, has anything actually changed in our knowledge of ZNGA that would affect the valuation so abruptly (i.e. 20% in a day)? I'm not saying the company isn't worth $12.50 a share -- I have no idea, maybe it's worth $100 / share (or $5 / share), I'm just wondering why the change in enterprise value today? That FB disclosure has no impact / adjustment on ZNGA's already public disclosures. No?

This is trade analysis, not a recommendation.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Zynga (ZNGA) - Stock and Vol Pop on Facebook Disclosures, But... Has Anything Really Changed?

Published 02/03/2012, 12:59 AM

Updated 07/09/2023, 06:31 AM

Zynga (ZNGA) - Stock and Vol Pop on Facebook Disclosures, But... Has Anything Really Changed?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.