Zumiez Inc. (NASDAQ:ZUMZ) just released its third-quarter financial results, posting earnings of $0.48 per share and revenues of $245.8 million. Currently, Zumiez is a Zacks Rank #2 (Buy) and is down 7.11% to $22.25 per share in after-hours trading shortly after its earnings report was released.

ZUMZ:

Matched earnings estimates. The company posted earnings of $0.48 per share, matching our earnings estimates of $0.48 per share.

Beat revenue estimates. The company saw revenue figures of $245.8 million, topping our consensus estimate of $242.88 million.

Zumiez third-quarter revenues popped 11% year-over-year. The chain’s comparable sales jumped 7.9% year-over-year. The company also posted net income of $11.9 million.

Zumiez now expects Q4 sales in the range of $291 million to $297 million. The company also projects EPS to range between $0.78 and $0.84.

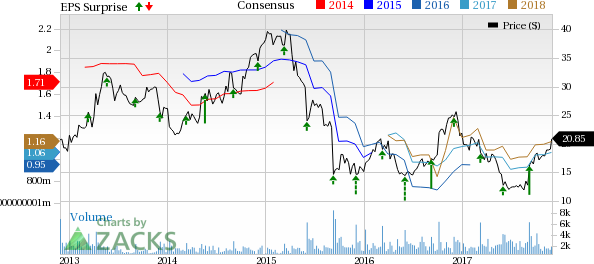

Here’s a graph that looks at ZUMZ’s Price, Consensus and EPS Surprise history:

Zumiez is a leading specialty retailer of apparel, footwear, accessories and hardgoods for young men and women who want to express their individuality through the fashion, music, art and culture of action sports, streetwear, and other unique lifestyles.

Check back later for our full analysis on ZUMZ’s earnings report!

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

Original post

Zacks Investment Research