Mall-based specialty retailer, Zumiez Inc. (NASDAQ:ZUMZ) seems to be on positive track with respect to comparable sales (comps) and sales numbers.

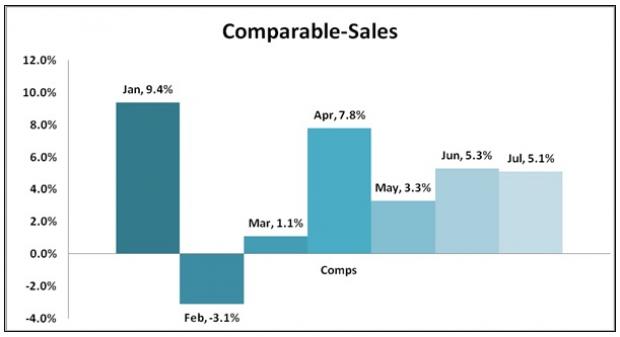

The company recorded a 5.1% rise in comps for the four-week period ended Jul 29, 2017, against a 2.9% decline witnessed in the four weeks ended Jul 30, 2016. This marks the company’s fifth straight month of comps growth after a drop in February.

Further, total net sales for the same period (Jul 2017) increased 8.9% to $67.5 million from $61.9 million in the year-ago period.

Following the news, shares of Zumiez have rallied 3.1% during the after-market trading hours yesterday. In fact, this Zacks Rank #3 (Hold) stock has gained 5.9% in the last one month against its industry’s decline of 7.8%. Currently, the industry is placed at the bottom 30% of the Zacks classified industries (179 out of 256). Below is comps trend for the last seven months of 2017:

We note that the broader Retail sector is on transformation mode – with store-based retailers now ditching their traditional stores and embracing omni-channel concepts, which provide a more seamless shopping experience both online and in-stores.

Also, the industry is facing major challenges from a strong U.S. dollar, volatile commodity costs and global uncertainty. As a result, Zumiez continues to battle soft mall traffic, volatile consumer spending and macroeconomic volatility.

Nevertheless, we commend Zumiez’s efforts to stay afloat amid a tough retail landscape, as evident from its focus on omni-channel development. Notably, the company marked its seventh straight quarter of posting bottom-line surprises, in first-quarter fiscal 2017. Also, its strategic initiatives, authentic lifestyle positioning and commitment to customer service position it to gain market share in the long term.

Apart from Zumiez, Costco Wholesale Corporation (NASDAQ:COST) also came up with July comps results. Comps for the four-week period ended Jul 30, 2017 increased 6.2%.

Stocks to Consider

Better-ranked stocks in the industry include Fossil Group, Inc. (NASDAQ:FOSL) and J.Jill, Inc. (NYSE:JILL) carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Fossil has a long-term earnings growth rate of 3.5% and pulled off an average positive earnings surprise of 4.8% in the trailing four quarters.

J.Jill, with a long-term earnings growth rate of 19.8% has delivered positive earnings surprise of 33.3% in the last reported quarter.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Fossil Group, Inc. (FOSL): Free Stock Analysis Report

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

J.Jill, Inc. (JILL): Free Stock Analysis Report

Costco Wholesale Corporation (COST): Free Stock Analysis Report

Original post

Zacks Investment Research