Expectations of further monetary stimulus depress yields. There are now 14 junk bonds in Europe with a negative yield.

The number of negative-yield euro-denominated junk bonds reached fourteen, up from zero at the beginning of the year as the ECB prepares still more stimulus.

- Ardagh Packaging Finance plc /Ardagh Holdings USA Inc.

- Altice Luxembourg SA

- Altice France SA

- Axalta Coating Systems LLC

- Constellium NV

- Arena Luxembourg Finance Sarl

- EC Finance Plc

- Nexi (MI:NEXII) Capital SpA

- Nokia (HE:NOKIA) Corp.

- LSF10 Wolverine Investments SCA

- Smurfit Kappa Acquisitions ULC

- OI European Group BV

- Becton Dickinson Euro Finance Sarl

- WMG Acquisition Corp.

Illogical Situation

It is illogical for any bond to trade with a negative yield.

Think of it this way: Negative-yield bonds imply it is better to have 99 cents ten years from now than a dollar today.

Yet, there are now 14 junk-rated companies with negative-yield bonds.

Zombification

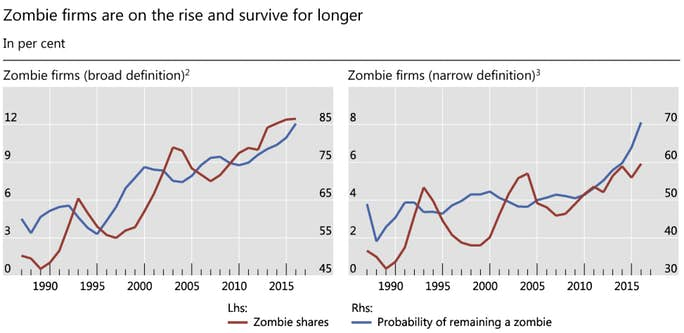

The lead image is from the September 2018 BIS Quarterly review on the Rise of Zombie Firms: Causes and Consequences

The rising number of so-called zombie firms, defined as firms that are unable to cover debt servicing costs from current profits over an extended period, has attracted increasing attention in both academic and policy circles. Using firm-level data on listed firms in 14 advanced economies, we document a ratcheting-up in the prevalence of zombies since the late 1980s. Our analysis suggests that this increase is linked to reduced financial pressure, which in turn seems to reflect in part the effects of lower interest rates. We further find that zombies weigh on economic performance because they are less productive and because their presence lowers investment in and employment at more productive firms.

Yield-Suppression Mistake

This kind of nonsense can only happen with outright central bank intervention suppressing yields.

It's also extremely counterproductive.

These corporate zombies only stay in business because of cheap rates. That are not productive companies or they would not be on the verge of collapse.

Fundamental Strength of Capitalism

A fundamental strength of capitalism is that failed companies go out of business making way for new ideas and better models.

Yet, here we are. The Fed, ECB, Bank of China, etc., all strive to keep failed companies alive. Zombification is on the rise.

Case For Gold

Due to collective and seriously misguided group-think, central banks are all doing the wrong thing.

The worst part of this story is that a recession has not even hit.

What will these group-think central bankers do then?

This is the case for gold.