Zoom Video Communications Inc (NASDAQ:ZM) provides unified communications platforms in the Americas, the Asia Pacific, Europe, the Middle East, and Africa. There are offerings Zoom Meetings that offer HD video, voice, chat, and content sharing through mobile devices, desktops, laptops, telephones, and conference room systems; Zoom Phone, an enterprise cloud phone system; and Zoom Chat enables users to share messages, images, audio files, and content in desktop, laptop, tablet, and mobile devices.

It also provides Zoom Rooms, a software-based conference room system; Zoom Conference Room Connector, a gateway for SIP/H.323 endpoints to join Zoom meetings; Zoom Events, which enables users to manage and host internal and external virtual events; OnZoom, a prosumer-focused virtual event platform and marketplace for Zoom users to create, host, and monetize online events; and Zoom Webinars to provide video presentations to large audiences from many devices

ZM Q3 2024 reports earnings at 4:050 PM ET Monday, Nov 25, 2024

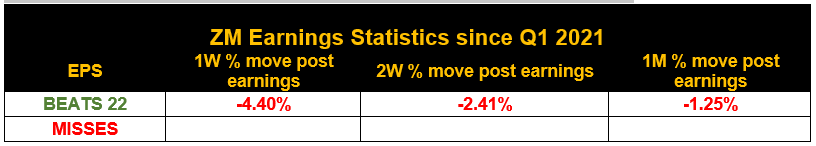

- 22 beats since Q1 2021

- 0 Misses since Q1 2021

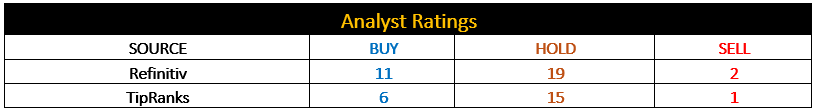

Analyst Ratings:

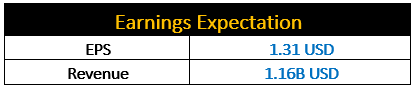

Earnings Expectation:

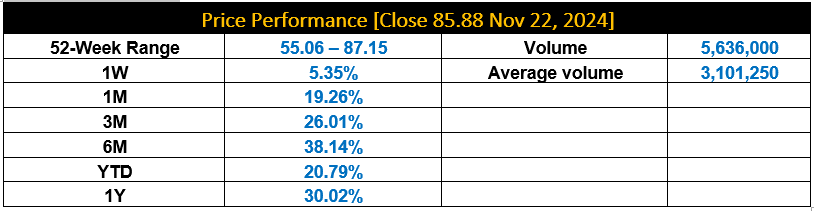

Price Performance:

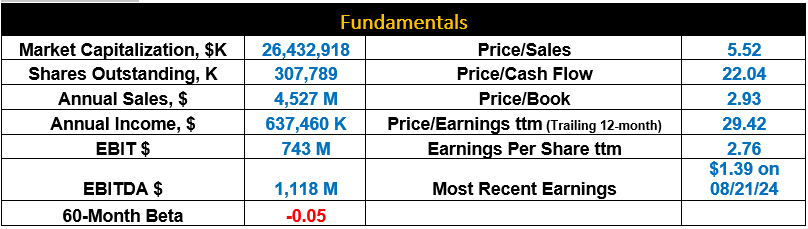

Fundamentals:

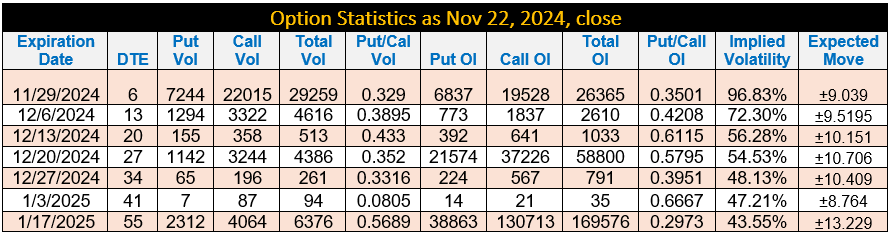

Option Statistics:

Key Highlights:

- Most Zoom users from the pandemic era are likely to use the product and help drive the growth.

- The company is benefiting from the hybrid work environment as well as time & cost saving meeting venues.

- Cisco (NASDAQ:CSCO) and Microsoft (NASDAQ:MSFT) are the key competitors and can bundle an array of solutions which may play against Zoom growth.

- For the long term, investor Zoom has a strong balance and generates significant cash flow.

Technical Analysis Perspective:

- From the long-term perspective, ZM dropped from all time high of 588.84 during the pandemic to the lowest level around 55 in Aug 2024.

- Stock is forming a rounding base like pattern from April 2022 until today.

- Prices have penetrated a long-term falling trend line from all time high around February - March 2023.

- ZM needs to break above 89 - 90 to pave the way for additional rise to 98 – 100 psychological resistance post earnings.

- A rejection of 89 – 90 barriers would suggest a continuation of coiling price action between 89 to 60.

ZM Monthly Chart:

ZM Weekly Chart:

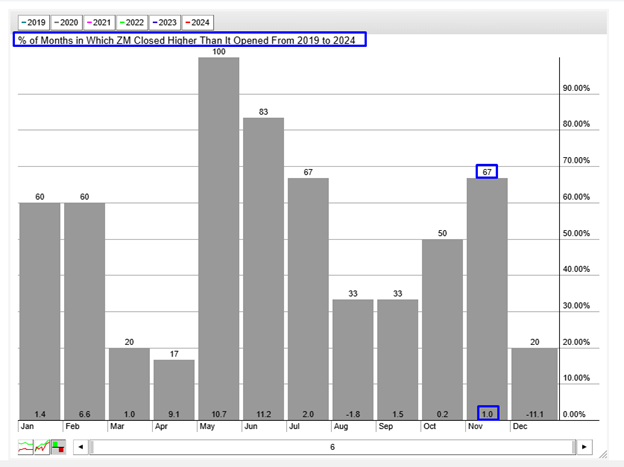

ZM Seasonality Chart

- ZM closes 1% higher in November 67% of the time since 2019.

Conclusion:

ZM appears to be forming a long-term rounding base for the last 32 months. A strong and sustained break above 89 – 90 barriers would suggest a sharp rise to 98 – 100. Otherwise, the range trade between 90 to 60 will continue.

Motivational Quotes – VALUE INVESTING

The stock market is a device for transferring money from the impatient to the patient by Warren Buffet.

***

Ali Merchant is a seasoned financial market professional with expertise in Technical Analysis, Treasury & Capital Markets, Trading, Sales, Research, Training, Fund & Relationship Management, Fintech, and Digitalization. He is a CMT charter holder and an active member of CMT Association, USA, American Association of Professional Technical Analysts, and CMT Association of Canada. He has worked on various roles and organizations in North America and the GCC, such as ABN Amro bank, Thomson Reuters (NYSE:TRI), Refinitiv, MAK Allen & Day Capital Partners (WA:CPAP), and Bridge Information Systems.

He is the founder of TwT Learnings, provides financial market training. Follow us on “X” formerly Twitter “@twtlearning.”