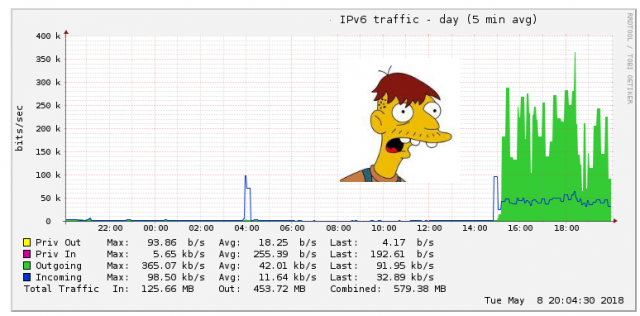

What was my Tuesday like? Oh, I can probably answer that with a network traffic graph.

Suffice it to say we’re deep into an Apollo 13 style launch right now, so I think I just had my 90th birthday (or it feels like it). The “trouble list” is shrinking by the hour, and THANK YOU THANK YOU THANK YOU for your patience and understanding. Honest.

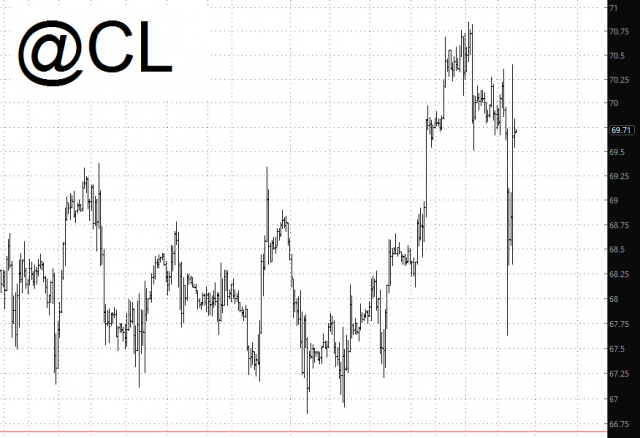

So let’s take a moment to reflect on the meat of the activity Tuesday. Crude oil, as we know, was at the mercy of rumors, innuendo, headlines, and straight-up balderdash all day long. By and large, it went down a little, but good heavens it was a roller coaster day. It’s all thanks, of course, to the U.S. jettisoning the Iran nuclear deal.

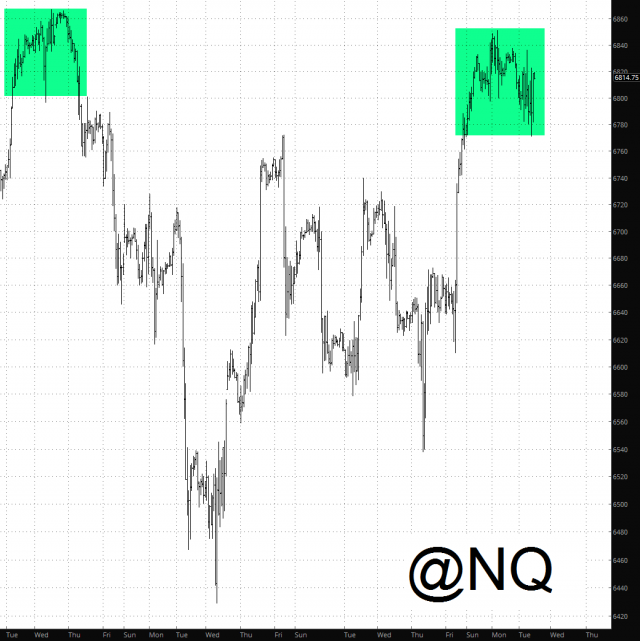

Equities, in turn, were likewise schizophrenic. I will note, however, that (for the moment at least) they remain in “Sheesh, it couldn’t be THIS obvious” mode.

What saved my bacon on Tuesday were interest rates, which continue to creep a little higher. I was particularly helped by my XLU short position (by way of being short the ETF as well as long in-the-money January 2019 puts). The failed bullish breakout on bonds (tinted in green below) remains intact.