We view the failure of Ziopharm’s (ZIOP) palifosfamide in metastatic soft tissue sarcoma (STS) as incrementally positive for CytRx’s aldoxorubicin. It eliminates a potential competitor in the first-line setting and critically, confirms doxorubicin as the ‘gold standard’ comparator for its ongoing Phase IIb study in front-line STS. Our CytRx valuation of $120m ($4.0/share) remains unchanged following the palifosfamide news as we currently value aldoxorubucin in second-line STS only. However, this could change if front-line Phase IIb data are positive in H213.

Ziopharm’s palifosfamide fails in first-line STS…

Ziopharm has terminated the development of palifosfamide in metastatic STS following the failure of its Phase III PICASSO-3 study. Results showed that front-line treatment with palifosfamide plus doxorubicin failed to significantly improve progression free survival (PFS) vs doxorubicin alone (6.2 vs 5.2mths). Patients on combination therapy also showed a doubling in the rate of febrile neutropenia.

…Eliminating potential competitor to aldoxorubicin

There are now two products in mid-to-late stage development for first-line STS – Threshold’s TH-302 (Phase III) and CytRx’s aldoxorubicin (Phase IIb). Further clarity on the competitive landscape in first-line STS could emerge mid-2013, when Threshold conducts an interim PFS futility analysis for TH-302. Assuming TH-302 is not futile, the next datapoint will be an interim overall survival (OS) analysis around end-2013. For aldoxorubicin, headline PFS data from the head-to-head study vs doxorubicin is expected in H213. Critically, the failure of palifosfamide not only eliminates a first-line competitor, but also confirms doxorubicin as the ‘gold standard’ comparator drug.

Aldoxorubicin second-line Phase III to start Q313

We view 2013 as a transformative year for CytRx as it delivers important clinical data, regulatory milestones and Phase III starts for its oncology pipeline. The major value inflection points, in our view are: (1) FDA agreement (SPA) in Q213 for the aldoxorubicin Phase III trial in second-line STS, (2) aldoxorubicin Phase IIb data in first-line STS, and (3) tamibarotene Phase II data in advanced lung cancer in Q413.

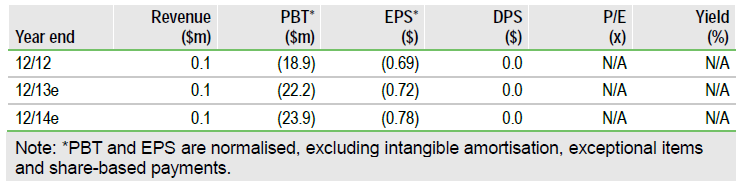

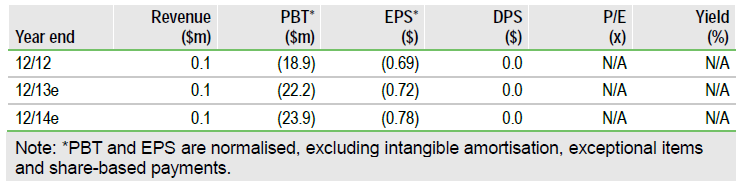

Valuation: Risk-adjusted NPV of $120m

We value CytRx at $120m, or $4.00/share, based on a risk-adjusted NPV analysis. The failure of palisfosfamide does not impact our rNPV at present as we currently attribute value to aldoxorubicin in second-line STS only. However, this could change if headline Phase IIb data in front-line STS is positive in late Q313.

To Read the Entire Report Please Click on the pdf File Below.

Ziopharm’s palifosfamide fails in first-line STS…

Ziopharm has terminated the development of palifosfamide in metastatic STS following the failure of its Phase III PICASSO-3 study. Results showed that front-line treatment with palifosfamide plus doxorubicin failed to significantly improve progression free survival (PFS) vs doxorubicin alone (6.2 vs 5.2mths). Patients on combination therapy also showed a doubling in the rate of febrile neutropenia.

…Eliminating potential competitor to aldoxorubicin

There are now two products in mid-to-late stage development for first-line STS – Threshold’s TH-302 (Phase III) and CytRx’s aldoxorubicin (Phase IIb). Further clarity on the competitive landscape in first-line STS could emerge mid-2013, when Threshold conducts an interim PFS futility analysis for TH-302. Assuming TH-302 is not futile, the next datapoint will be an interim overall survival (OS) analysis around end-2013. For aldoxorubicin, headline PFS data from the head-to-head study vs doxorubicin is expected in H213. Critically, the failure of palifosfamide not only eliminates a first-line competitor, but also confirms doxorubicin as the ‘gold standard’ comparator drug.

Aldoxorubicin second-line Phase III to start Q313

We view 2013 as a transformative year for CytRx as it delivers important clinical data, regulatory milestones and Phase III starts for its oncology pipeline. The major value inflection points, in our view are: (1) FDA agreement (SPA) in Q213 for the aldoxorubicin Phase III trial in second-line STS, (2) aldoxorubicin Phase IIb data in first-line STS, and (3) tamibarotene Phase II data in advanced lung cancer in Q413.

Valuation: Risk-adjusted NPV of $120m

We value CytRx at $120m, or $4.00/share, based on a risk-adjusted NPV analysis. The failure of palisfosfamide does not impact our rNPV at present as we currently attribute value to aldoxorubicin in second-line STS only. However, this could change if headline Phase IIb data in front-line STS is positive in late Q313.

To Read the Entire Report Please Click on the pdf File Below.