Zions Bancorporation (NASDAQ:ZION) reported second-quarter 2017 earnings of 73 cents per share, surpassing the Zacks Consensus Estimate of 62 cents. Moreover, the figure was significantly higher than 44 cents earned in the prior-year quarter.

The results largely benefited from top-line growth and decline in provisions, partially offset by higher adjusted non-interest expenses. While credit quality showed exceptional improvement, the balance sheet was mixed.

Net income attributable to common shareholders came in at $154 million, up 69.2% from the year-ago quarter.

Revenues Rise, Costs Escalate

Net revenues were $660 million for the quarter, up 11.7% year over year. Moreover, the figure beat the Zacks Consensus Estimate by 3.1%.

Net interest income increased 13.5% year over year to $528 million. The rise was mainly attributable to increased interest income, partially offset by higher interest expenses. Further, net interest margin improved 13 basis points (bps) year over year to 3.52%.

Non-interest income amounted to $132 million, up 4.8% from the year-ago quarter. The improvement reflected an increase in all fee income components except loan sales and servicing income.

Adjusted non-interest expenses increased 3.6% from the year-ago quarter to $399 million. However, efficiency ratio was 59.8%, down from 64.6% a year ago. A fall in efficiency ratio indicates an improvement in profitability.

Balance Sheet: A Mixed Bag

As of Jun 30, 2017, total loans, net of allowance, increased 2.2% from the end of the prior quarter to $43.1 billion. However, total deposits decreased 2.1% sequentially to $52.4 billion.

Credit Quality Improves

The ratio of nonperforming assets to loans and leases as well as other real estate owned decreased 18 bps year over year to 1.12%. Further, net charge-offs were $7 million, down 82% from the year-ago quarter.

Also, provisions for credit losses fell 67.8% from the year-ago quarter to $10 million.

Capital Ratios Deteriorate, Profitability Improves

Under the Basel III rules, Tier 1 leverage ratio was 10.5%, as of Jun 30, 2017, down from 11.3% at the end of the prior-year quarter. Tier 1 risk-based capital ratio was 13.4%, in line with the year-ago quarter.

Return on average assets was 1.03% as of Jun 30, 2017, up from 0.77% as of Jun 30, 2016. Also, as of Jun 30, 2017, tangible return on average tangible common equity was 10.2%, up from 6.3% a year ago.

Our Viewpoint

Zion’s revenue growth is commendable. Also, the company’s consistent growth in loans and rising profitability ratios are impressive. Moreover, we are encouraged by exceptional improvement in the company’s credit quality.

However, a risky loan portfolio along with concentration risk and higher expenses could hurt the company’s financials.

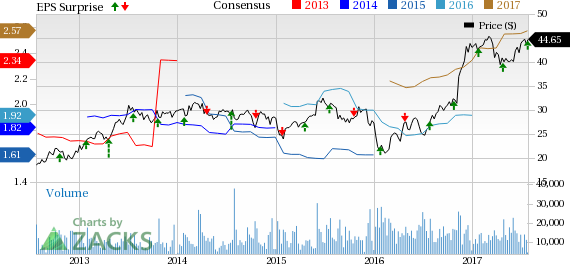

Zions Bancorporation Price, Consensus and EPS Surprise

Currently, Zions carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance and Upcoming Release of Other Stocks

East West Bancorp, Inc.’s (NASDAQ:EWBC) second-quarter 2017 earnings of 81 cents per share came in line with the Zacks Consensus Estimate. Higher revenues primarily led to earnings growth. Growth in loans and deposit was a major support. However, a rise in expenses and increase in provisions were the undermining factors.

First Republic Bank’s (NYSE:FRC) second-quarter 2017 earnings per share came in at $1.06, missing the Zacks Consensus Estimate of $1.09. Higher revenues led to bottom-line improvement from the year-ago quarter. In addition, considerable rise in loans and deposit balances were recorded. Non-performing assets also declined. On the other hand, higher expenses and provisions were headwinds.

SVB Financial Group (NASDAQ:SIVB) will announce second-quarter results on Jul 27.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Zions Bancorporation (ZION): Free Stock Analysis Report

SVB Financial Group (SIVB): Free Stock Analysis Report

East West Bancorp, Inc. (EWBC): Free Stock Analysis Report

FIRST REPUBLIC BANK (FRC): Free Stock Analysis Report

Original post

Zacks Investment Research