Zimmer Biomet Holdings, Inc. (NYSE:ZBH) reported second-quarter 2017 adjusted earnings per share (EPS) of $2.08, up 2.9% year over year. Adjusted earnings were also ahead of the Zacks Consensus Estimate by 2 cents. Reportedly, net earnings came in at 90 cents per share, marking a massive increase from the year-ago loss of 16 cents a share.

Revenue Details

Zimmer Biomet’s second-quarter net revenues came in at $1.95 billion, marking a 1.1% rise (up 2.1% at constant exchange rate or CER) year over year. The recently included LDR Holding contributed 240 basis points (bps) to the top line. Excluding the contribution from LDR Holding in the quarter, revenues declined 1.3% year over year. Revenues, however, remained in line with the Zacks Consensus Estimate.

Revenues generated in the Americas during the quarter, touched $1.21 billion (up 2.5% year over year at CER) while the same in EMEA (Europe, the Middle East and Africa) grossed $438 million (up 1.8%). In the Asia-Pacific, the figure was $307 million (up 6.8%).

Segments

Revenues derived from Knees were down 1.3% year over year at CER to $680 million. Hips recorded sales of $470 million, down 0.2% from the prior-year quarter. Revenues from S.E.T. (Surgical, Sports Medicine, Foot and Ankle, Extremities and Trauma) were up 3.6% year over year to $423 million.

Among the other segments, Spine & CMF recorded an improvement of 33.5% to $194 million while Dental was down 5.7% to $110 million in the quarter. Other revenues dropped 7% to $77 million.

Margins

With 17.6% reduction in cost of products sold to $527.7 million, Zimmer Biomet’s gross margin expanded 610 bps to 72.9% in the second quarter. Selling, general and administrative expenses were up 2.2% at $748 million while research and development expenses increased 1.7% to $90.1 million. However, adjusted operating margin expanded 564 bps to 30.1% on 24.3% surge in operating profit to $588.6 million during the quarter.

Cash Position

Zimmer Biomet exited the second quarter with cash and cash equivalents of $450 million, down from $1.04 billion as of the first-quarter end. Total long-term debt was $10.7 billion compared with $11.5 billion at the end of the first quarter.

Year to date, operating cash flow was $715.9 million compared with $652.4 million in the year-ago period. The company also paid $48.4 million in dividends during the second quarter.

2017 Outlook

Based on a dull topline show, Zimmer Biomet has lowered its full-year 2017 guidance. The company currently expects to register revenue growth at CER in the range of 1.8–2.7% (earlier prediction was 3.2–4.2%). This includes a contribution of approximately 120 bps from the LDR transaction. The current Zacks Consensus Estimate for revenues is pegged at $7.87 billion.

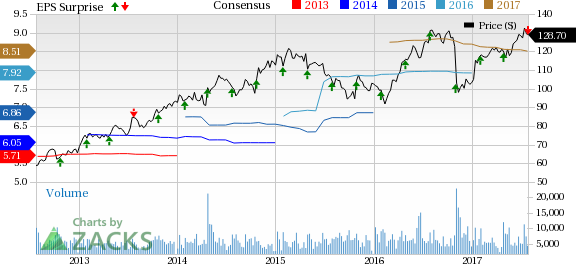

The adjusted EPS expectation has been forecast within the range of $8.20-$8.30, lower than the earlier range of $8.50-$8.60 for the year. The current Zacks Consensus Estimate for 2017 EPS is pegged at $8.51, much ahead of the current guidance.

Our Take

Zimmer Biomet ended the quarter on a mixed note. While earnings topped the Zacks Consensus Estimate, revenues remained in line with the same. We are disappointed by the company’s declining sales performance within several of its core segments. The trimemd 2017 guidance also added to our concerns indicating little chances of recovery ahead. Nevertheless, improved gross and operating margin performance was encouraging.

We look forward to the expected synergy from the LDR Holding acquisition, which should broaden and complement the company’s musculoskeletal offering. We are also impressed by the strong strategic and financial goals which the combined entity expects to reach, now that the deal has been closed.

Zacks Rank & Other Key Picks

Currently, Zimmer Biomet carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical sector are PetMed Express, Inc. (NASDAQ:PETS) , Becton, Dickinson and Company (NYSE:BDX) and Thermo Fisher Scientific Inc. (NYSE:TMO) . Notably, PetMed sports a Zacks Rank #1 (Strong Buy), while Becton, Dickinson and Company and Thermo Fisher Scientific carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

PetMed has a long-term expected earnings growth rate of 10.00%. The stock has soared around 108.5% over the last three months.

Becton, Dickinson and Company has a long-term expected earnings growth rate of 11.25%. The stock has rallied around 14.4% over the last three months.

Thermo Fisher Scientific has a long-term expected earnings growth rate of 12.25%. The stock has gained around 8.4% over the last three months.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Thermo Fisher Scientific Inc (TMO): Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH): Free Stock Analysis Report

Becton, Dickinson and Company (BDX): Free Stock Analysis Report

Original post

Zacks Investment Research