Zillow Group, Inc. (NASDAQ:ZG) just released its fourth-quarter and full year 2017 financial results, posting adjusted earnings of $0.19 per share and revenues of $282.3 million. Currently, Zillow is a Zacks Rank #3 (Hold), and is down over 8% to $42.44 per share in after-hours trading shortly after its earnings report was released.

ZG:

Matched earnings estimates. The company posted adjusted earnings of $0.19 per share, matching the Zacks Consensus Estimate of $0.19 per share.

Beat revenue estimates. The company saw revenue figures of $282.3 million, topping our consensus estimate of $277.04 million.

The online real estate company posted record quarterly revenues in Q4 as sales jumped 24% year-over-year. Zillow also reported record full-year revenues of nearly $1.1 billion, which marked a 27% climb from 2016. Zillow boasted that more than 151 million average monthly unique users visited Zillow Group brands in the fourth-quarter.

The company’s non-GAAP earnings climbed from $0.14 per share in the year ago period. Looking ahead, Zillow expects to report first-quarter 2018 sales between $291 million and $296 million, and full-year revenues in the $1.302 billion to $1.317 billion range.

These estimates are a bit soft compared to our consensus estimates, which call for $1.30 billion for the full-year 2018 and $299.16 million for the coming quarter.

"We successfully transitioned advertisers to an auction-based pricing model, launched RealEstate.com, and continued to grow our emerging marketplaces, including two strategic acquisitions,” CEO Spencer Rascoff said in a statement.

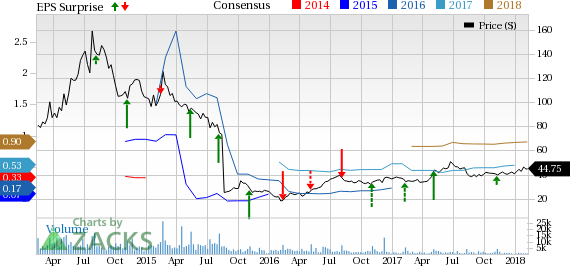

Here’s a graph that looks at Zillow’s Price, Consensus and EPS Surprise history:

Zillow Group, Inc. provides real estate and home-related brands on the Web and mobile. The company focuses on home lifecycle which include renting, buying, selling, financing and home improvement. Its portfolio of consumer brands consists of Zillow(R), Trulia(R), StreetEasy(R) and HotPads(R).

Check back later for our full analysis on Zillow’s earnings report!

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think. See This Ticker Free >>

Zillow Group, Inc. (ZG): Free Stock Analysis Report

Original post

Zacks Investment Research