Forex News and Events

South Africa’s headline inflation eased in March

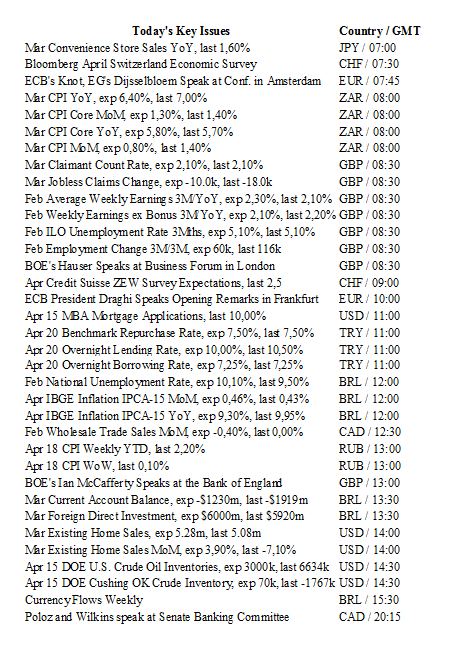

According to the latest CPI report from South Africa, inflation decelerated during the month of March. After hitting 7%y/y in February - the highest level in seven years - headline CPI eased to 6.3%y/y in March, beating median forecast of 6.4%. This improvement in the consumer price index came as a breath of fresh air for the SARB, especially given the fact that the last decision to hike the benchmark interest rate by 25bps to 7%, back in March, was a close calls as half of the MPC members expressed their concerned over the negative effects on the growth outlook. The SARB’s commitment to lower inflation towards the target band of between 3% and 6% seems to start paying off; however it would be a bit premature to anticipate that the battle against inflation has been won as food prices remain under significant upside pressure due to a severe drought. We anticipate the SARB to reiterate it hawkish view on the country’s monetary policy stance as renewed weakness in the rand cannot yet be ruled out. USD/ZAR moved slightly lower in reaction to the good news, edging slightly lower to 14.26. We remain cautious with regard to further rand appreciation as the last’s month rally is mainly due to the commodity prices rally and weakening dollar; there was little improvement in the domestic situation.

US existing home sales growth to rebound after 6-year low in February

Though markets are mainly focused on verbal interventions from Fed members, right now any and all data is being closely analysed for clues concerning the future Fed rate path. Recent releases show that the fundamentals of the US economy seem to have improved, inflation has been growing since the beginning of the year, and unemployment remains stable around 5%. In contrast, retail sales disappointed with a last negative release at -0.3% in March. On top of that, there are growing concerns that the housing market is buried too deep in a bubble as a result of the loose monetary policy of the past decade.

Existing home sales will be closely analysed today and are expected to rise by 4% to 5.28 million according to estimates. We believe that in the current environment, where rates are so low, there is no benefit for sellers as expectations for higher rates are pushing sales to decrease. Also, it is more difficult than before to get a mortgage. However, financial markets are still expecting low interest rates and steady unemployment to provide the necessary traction to underpin the housing market. Currency-wise, this underlines our opinion that the greenback is overvalued. We believe that US difficulties are not fully priced in and as a result we remain long EUR/USD until 1.2000.

EUR/USD range-bound ahead of ECB

Germany ZEW expectations index rose to 11.2 in April indicating that investors are significantly more optimistic over the outlook for the German economy. While the global economic backdrop deteriorates parts of the Euro-area remain resilient, yet downside risks are obvious. Friday’s Markit Eurozone PMI reads should also support stabilization from steady declines. Finally, February Eurozone balance of payments data indicates that European investors’ appetite for foreign debt has recovered. The selling of euro has been critical in offsetting the exodus from the USD, slowing EURUSD bullish momentum. The data improvement should be welcome news for Draghi and the ECB. Expectations for this week’s ECB monetary-policy meeting are limited. With March 10th solid policy announcement (increase in monthly purchases to €80 bn, a cut of the depo rate and main lending rate to -0.40% and 0% and new TLTROs) still fresh in traders’ minds, the market will be focused on any mention of foreign exchange. The ECB is avoiding discussing the euro but steady appreciation could potentially derail Europe’s delicate growth environment. Failure to mention the euro or provide measures to debase the single currency should trigger a mild euro rally. Overall this meeting is too close to recently launched stimulus to make any claims or produce new policy strategies. However, with the strong euro, weak oil and consistent underperformance of inflation more easing is likely. We expect that the market will need to wait until December’s meeting (coinciding with the central bank’s forecast changes) for any further stimulus (including unorthodox use of helicopter money). The lack of real dovish action/comments and growing dissension between the ECB and Bundesbank, which will hamper Draghi’s options, should give EUR/USD the freedom to test 1.1465 range highs.

USD/CAD - Bearish Breakout.

The Risk Today

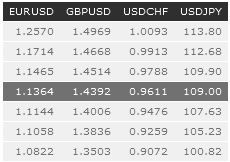

EUR/USD EUR/USD has failed to break 1.1400. The pair is moving within an uptrend channel. Hourly support can be found at 1.1144 (24/03/2016 low) and resistance at 1.1465 (12/04/2016 high). Stronger support is located a 1.1058 (16/03/2016 low). Expected to show further increase. In the longer term, the technical structure favours a bearish bias as long as resistance at 1.1746 ( holds. Key resistance is located at 1.1640 (11/11/2005 low). The current technical appreciation implies a gradual increase.

GBP/USD GBP/USD is riding downtrend channel near hourly resistance at 1.4514 (18/03/2016 low). Hourly resistance is given at 1.4320 (04/04/2016 high). Expected to show further bounce back. The long-term technical pattern is negative and favours a further decline towards key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY USD/JPY is trading between hourly support at 107.68 (07/04/2016 low) and hourly resistance at 109.90 (07/04/2016 high). The medium-term momentum is clearly bearish. Selling pressures are still on. Expected to show further weakening. We favour a long-term bearish bias. Support at 105.23 (15/10/2014 low) is on target. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now less likely. Another key support can be found at 105.23 (15/10/2014 low).

USD/CHF USD/CHF is edging lower inside the downtrend channel without massive volatility. Hourly support can be found at 0.9499 (12/04/2016 low). Hourly resistance is located by upper bound of the downtrend channel and by 0.9788 (25/03/2016 high). Expected to show further decline as short-term buying pressures do not seem strong. In the long-term, the pair is setting highs since mid-2015. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias.

Resistance and Support: