Commercial stage global biotech company Zai Lab (NASDAQ:ZLAB) stock has cratered (-82%) from a 52-week high of $178.91. The biotech generates revenues from licensing established medications to market in China in addition to its own cancer treatment pipeline of medications. The model of licensing drugs to finance its own research has led to higher royalty pre-payment amongst falling healthcare reimbursement rates. This explains why revenues have climbed but losses have mounted even quicker. However, the Company has 11 products in the pipeline ranging from psoriasis treatments to lung cancer drugs. Zai Lab projects it will have 15 products in the market by 2025 and a slew of pivotal study and clinical results released in 2022. The Company has nearly $1.3 billion in cash and cash equivalents. Prudent investors looking for exposure in a potential multi-bagger in the cancer therapy space can watch for opportunistic pullbacks in shares of Zai Lab.

Q1 Fiscal 2022 Earnings Release

On May 10, 2022, Zai Lab released its fiscal first-quarter 2022 results for the quarter ending March 2022. The Company reported an adjusted earnings-per-share (EPS) loss of (-$0.86) excluding non-recurring items versus consensus analyst estimates for a loss of ($1.23), beating estimates by $0.37. Revenues rose to $46.7 million year-over-year (YOY) to $45.72 million. Zai Lad CEO Samantha Du commented:

“Our first-quarter results reflect Zai’s solid foundation and track record of consistent execution, and were marked by progress across the entire portfolio. Today, Zai’s broad, proprietary pipeline consists of 11 assets with global rights. Building upon last year’s proof of concept achievement for ZL-1102, our anti-IL-17A Humabody® for chronic plaque psoriasis, Zai recently unveiled preclinical data from four key oncology programs at the 2022 AACR Annual Meeting. With these assets just beginning to enter first-in-human and proof-of-concept clinical studies, we are in the exciting early days of demonstrating Zai’s commitment to its in-house discovery and translational research. And of course, this proprietary pipeline complements the advancements within our later-stage partnered pipeline, which is expected to produce numerous pivotal study readouts throughout 2022.”

Conference Call Takeaways

CEO Du provided updates on five of the 11 internally developed products with global rights. She updated the 2022 strategic priorities that are aimed to position Zai as a leader in the net wave of biopharma innovation. The Company will be filing the NDA for efgartigimod in China by mid-2022. The registrational study for bemarituzumab for first-line gastric cancer in Greater China is set commence in mid-2022. The Company also expects top-line data for KarXT from its Phase 3 EMERGENT-2 trial by Q3 2022. Continued R&D to advance its proprietary pipeline with global rights, moving ZL-1102 to full development and driving significant growth for the current four marketed product in China.

Breakthrough Therapy Tags

On June 10, 2022, China’s National Medical Products Administration granted two breakthrough designations for Zai Lab’s repotrectinib treatment for patients suffering non-small cell lung cancer (NSCLC). The designations were back by the phase 1 and 2 trial of TRIDENT-1. The designation is to treat patients with ROS1-positive metastatic NSCLC that have already received a prior line of ROS1 tyrosine kinase inhibitor and a prior treatment with EXP-2. It is also for patients who experience NSCLC spread to other parts testing positive for fusions in the ROS1 gene having received a prior line of ROS1 TKI with no EXP-4, chemotherapy or immunotherapy.

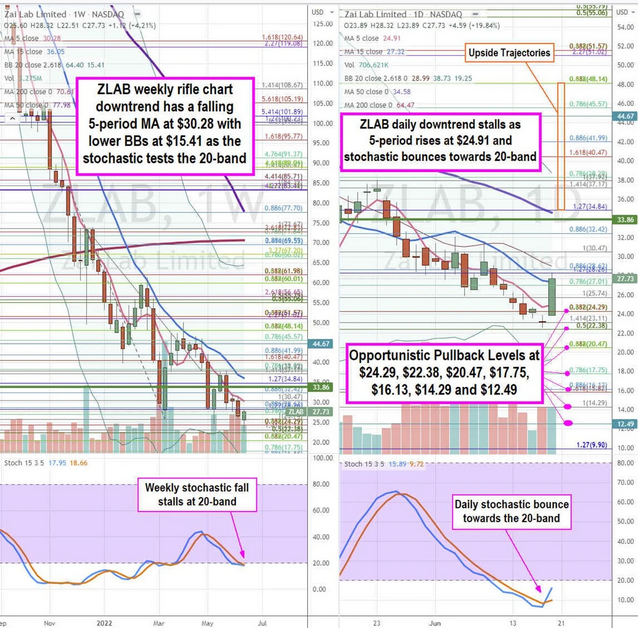

ZLAB Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for ZLAB stock. The weekly rifle chart put in an initial bottom near the $22.38 Fibonacci (fib) level before staging a rally. The weekly downtrend has a falling 5-period moving average (MA) at $30.28 followed by the 15-period MA at $36.05. The weekly lower Bollinger Bands (BBs) sit at $15.41. The weekly stochastic has fallen to and stalled at the 20-band. The weekly market structure low (MSL) buy triggers on the $33.86 breakout. The daily rifle chart downtrend is attempting a reversal on the stochastic bounce back up towards the 20-band. The daily 5-period MA is rising at $24.91 and 15-period MA flattens at $27.32. The daily 50-period MA sits at $34.58 and 200-period MA at $64.46 with daily upper BBs at $38.73. Prudent investors can watch for opportunistic pullback levels at the $24.29 fib, $22.38 fib, $20.47 fib, $17.75 fib, $16.13 fib, $14.29 fib, and the $12.49 fib level. Upside trajectories range from the $34.84 fib up towards the $48.14 fib level.