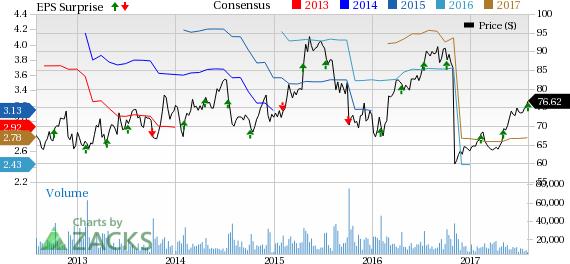

Yum! Brands, Inc. (NYSE:YUM) posted better-than-expected second-quarter 2017 results with both earnings and revenues surpassing the Zacks Consensus Estimate.

Earnings and Revenue Discussion

Adjusted earnings of 68 cents per share surpassed the Zacks Consensus Estimate of 61 cents by 11.5%. Further, earnings increased 21% year over year owing to lower share count.

Meanwhile, total revenues of $1.45 billion were down over 4% year over year primarily due to lower company sales. However, revenues came above the Zacks Consensus Estimate of $1.41 billion by nearly 3%.

Comps Discussion

From Jan 2016, the company’s India business integrated its three restaurant brands into the global KFC, Pizza Hut and Taco Bell divisions. Notably, on Oct 31, 2016, Yum! Brands’ completed the spin-off of the China business into an independent, publicly-traded company. Post-separation Yum! Brands now reports under three segments – KFC, Pizza Hut and Taco Bell.

Going forward, the company aims to drive growth at KFC, Pizza Hut and Taco Bell brands via its strategic transformation plan, following the separation of the company’s all-important China division. Notably, the company’s transformation and growth strategy entails employing greater focus on the development of its three iconic global brands, increasing its franchise ownership, and creating a leaner and more efficient cost structure.

Comps at the KFC division were up 3% same as the year-ago quarter figure but higher than last quarter’s growth of 2%. Growth was witnessed across the U.S. as well as developed and emerging markets internationally.

Pizza Hut comps decreased 1% same as the year-ago quarter figure but comparing favorably with last quarter’s dip of 3%. Comps grew 2% in international emerging markets but declined 3% in the U.S. Meanwhile, comps at international developed markets remained flat.

Taco Bell comps increased 4%, comparing favorably with comps decline of 1% a year ago but lower than the 8% rise in the preceding quarter.

While restaurant margins improved at KFC and Taco Bell, it declined at the Pizza Hut division.

Yum! Brands currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

McDonald's Corp. (NYSE:MCD) reported second-quarter adjusted earnings per share of $1.73, beating the Zacks Consensus Estimate of $1.62 by 6.8%. Earnings also increased 19% year over year.

Chipotle Mexican Grill, Inc.’s (NYSE:CMG) second-quarter 2017 adjusted earnings of $2.32 per share outpaced the Zacks Consensus Estimate of $2.16 by 7.4%. The figure also increased significantly from the prior-year quarter earnings of 87 cents, given a substantial rise in revenues.

Darden Restaurants, Inc.’s (NYSE:DRI) fourth-quarter fiscal 2017 adjusted earnings of $1.18 per share outpaced the Zacks Consensus Estimate of $1.15 by 2.6%. Further, the bottom line increased 7.3% year over year on the back of higher revenues and lower share count.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Yum! Brands, Inc. (YUM): Free Stock Analysis Report

Chipotle Mexican Grill, Inc. (CMG): Free Stock Analysis Report

McDonald's Corporation (MCD): Free Stock Analysis Report

Darden Restaurants, Inc. (DRI): Free Stock Analysis Report

Original post

Zacks Investment Research