- Instead of post-pandemic normalization, Yum! Brands set a new normal with its asset-light franchise model

- International growth is firing on all cylinders led by 46% KFC system growth in the Middle East

- Strong U.S. dollar will make a (-$100 million) full-year 2022 impact

- Yum! Brands stock is trading down (-5.5%) at 28X forward earnings with a 1.77% annual dividend yield

Popular fast-casual restaurant franchisor Yum! Brands (NYSE:YUM) stock has been on a tear since its Q3 2022 earnings release. Its famous brands include Taco Bell, KFC, Pizza Hut, and Habit Burger Grill, with over 53,000 restaurants worldwide throughout 157 countries. It was spun off from PepsiCo (NASDAQ:PEP) in 1997 as Tricon Global Restaurant Inc and changed its name to Yum! Brands in 2002.

Taco Bell and KFC are its strongest brands, still showing revenue growth, while Pizza Hut and Habit Burger's revenues fell. While traditional restaurant groups with dining rooms like Darden Restaurants (NYSE:DRI), Brinker International (NYSE:EAT), and Bloomin Brands (NASDAQ:BLMN) got hurt during the pandemic, Yum! Brands fast food restaurants managed to thrive with their drive-through, carryout, and mobile ordering options.

The accelerated spike in topline seen during the reopening for most businesses has now pulled back during the normalization period. Yum has not seen much normalization; a new normal has materialized as e-commerce, digital sales rise to $6 billion, and a digital mix exceeds 40%.

Growth Engine Still Revving

The company opened 979 gross units across 74 countries in Q3 2022. It transferred ownership of its Russian KFC restaurants to an existing KFC Russia as it left Russia altogether in response to the Ukraine conflict. Relevant, accessible, and distinctive brands (RED) and their unrivaled culture are their main growth drivers.

KFC system sales rose 12%, with 7% same-store sales and 7% unit growth. Strong growth was in the Middle East market, with 46% system sales growth strength across all channels. Same with India, with a 45% system sales growth driven by its 7-minute Express takeaway guarantee. Africa saw 31% systems growth.

Taco Bell represents 34% of its operating profit, with system sales rising 9% and same-store sales up 6% with 5% unit growth. Additionally, Taco Bell saw international sales grow 26% with 30% unit growth and 5% same-store sales growth as it opened up 111 new units in the quarter, up almost double from a year ago.

Q3 Earnings Mixed

On Nov. 3, 2022, Yum! Brands released its third-quarter fiscal 2022 results for the quarter ending September 2022. The company reported a non-GAAP diluted earnings-per-share (EPS) of $1.09 versus $1.15 consensus analyst estimates, missing by $0.0306. In addition, revenues grew 2.1% year-over-year (YoY) to $1.64 billion, beating consensus analyst expectations for $1.62 billion.

The company added 979 gross units resulting in 644 net-new units. Worldwide system sales, excluding Russia, rose 7%. The strong U.S. dollar resulted in a (-$39 million) hit to divisional operating profit. The company expects Taco Bell to lead unit growth internationally. It expects to grow core operating profit in the mid-single digit range for 2022.

Yum! Brands CEO David Gibbs commented,

“I’m pleased to report another robust quarter for Yum!, with system sales growth of 10% excluding Russia, driven by solid demand for our iconic brands, increased digital adoption, and continued momentum on unit development.

Our three global brands delivered widespread system sales growth, demonstrating that our globally diversified business, led by world-class teams and franchisees, can thrive in any environment.”

Weekly Bull Flag Set-Up or Reversal Breakdown?

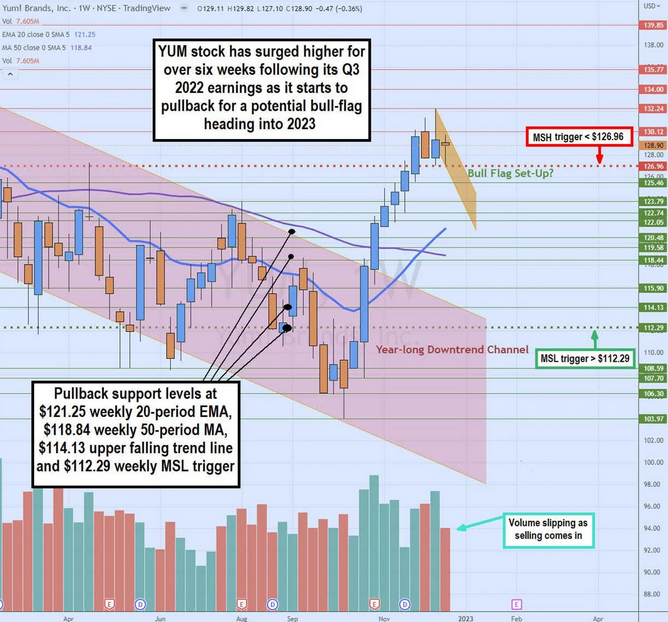

DRI stock has been on fire since it made a weekly market structure low (MSL) trigger breakout through $112.29 at the end of October 2022. Shares have since ground higher with higher highs for seven consecutive weeks before forming a market structure high (MSH) at $132.24 on Dec. 12 and forming a weekly MSH sell trigger on the breakdown through $126.96 as volume starts to drop.

The weekly 20-period exponential moving average (M.A.) is uptrend support at $121.25, followed by the 50-period weekly M.A. support at $118.84. Therefore, if an MSH sell triggers, watch for the pullback supports before a breakout back up through the MSH trigger level to form a bull flag. However, it is also possible for the trend to reverse lower toward the weekly MSL buy trigger at $112.29. Pullback supports are $121.25, $118.84, $114.13, and $112.29.

Analyst Ratings

Argus analyst John Staszak upgraded shares of YUM to a Buy from Hold with a target price of $142. He feels the relatively inexpensive menus combined and accelerated restaurant openings with drive growth underscored by the eventual reopening of the Chinese economy. In addition, he expects growth to rise from its exclusive delivery service deal for KFC and Taco Bell with GrubHub (NYSE:GRUB) owned by Just Eat Takeaway.com NV (OTC:JTKWY).