Everybody wants a bargain. If you are looking for a TV you go to an electronics store like Best Buy (NYSE:BBY). If you are looking for a good stock then you go to…. well Best Buy again. This stock has moved in a tightening range over the past 3 years, but for the next few months it could give a very positive move higher.

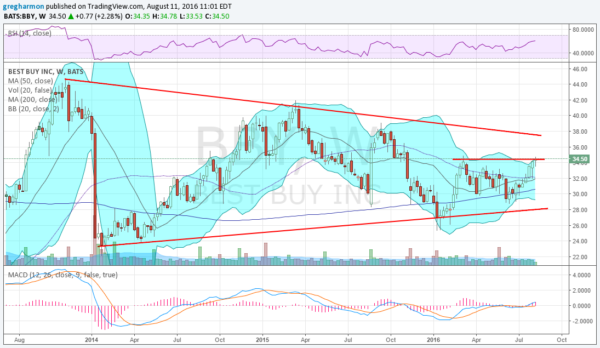

The chart below of the weekly price action shows why. The longer pattern in play is a symmetrical triangle. With the price making a series of higher lows and higher highs since August 2013, the tightening range yields a triangle. Notice that the price has bounced from the top to the bottom to the top and then the bottom again. Currently it is rising toward the top. A straight up move from here would give a 10% return.

The momentum indicators support continuation higher. The RSI is rising and in the bullish zone while the MACD is positive and moving higher. The trigger would be a move over the resistance in place from the March 2016 high. A close this week over 34.75 will do that.

But there is potential for more as well. Should the price break through the top of the triangle it would give a target $21 above the break-out point. That is a whole lot more than 10%. The triangle carries the power for the biggest moves about 2/3 of the way into the apex. Right now it is about 58% through, so after a 10% move higher it would be close to the best case. So go in for a small deal and maybe leave with a blockbuster deal.