Americans love their coffee (me included).

But let me ask you...

Is getting that morning buzz more important than building up your retirement nest egg?

New research suggests that, for many of us, the answer is a resounding YES.

And that's scary.

If there's ever been a sign that our nation's obsession with Starbucks (Nasdaq: NASDAQ:SBUX) is getting out of hand, this is it...

According to data from S&P Global Market Intelligence, the company is sitting on $1.2 billion in unspent customer funds. We're talking about money that's been loaded onto prepaid gift cards - or added via the Starbucks mobile app.

That's more than the total annual deposits accepted by some banks!

What's even crazier is that it's up from $621 million reported near the end of 2014...

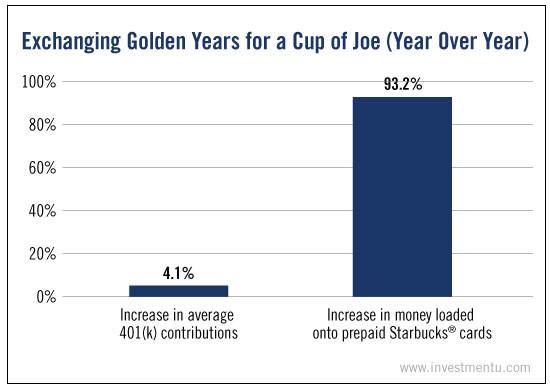

A 93.2% jump.

It's that number that we want to focus on today.

Well, that number as it compares to this one... 4.1%.

That's how much the average 401(k) contribution increased between Q4 2014 and Q4 2015 according to Fidelity. Which suggests that we Americans consider White Chocolate Mocha Frappuccinos a better investment than our own futures.

We're boosting our deposits on a "coffee card" faster than our deposits to our retirement accounts.

That's scary.

Okay, okay... put down the pitchfork. I know I'm making a bit of a leap here, but hear me out.

In response to a recent Bankrate survey, 53% of people said they don't invest because they "don't have the money."

Fair enough. But at the same time... roughly 60 million people visit Starbucks each week.

Many of those individuals are repeat customers. They're the driving force behind the company's wildly successful loyalty rewards program. For our purposes, let's assume you're one of them and that you visit Starbucks twice a week. And let's also say that, each time, you order a tall iced coffee.

Over the course of a month, you'd spend $18 (minus tax). Over the course of a year, you'd drop well over $200.

Maybe that seems like a lot of money to you. Maybe not. But I can tell you this: For that same amount, you could buy four shares of Starbucks stock at recent prices.

(Over the past year, Starbucks shareholders have earned a 3.5% return, plus a 1.43% dividend yield. Since May 2008 - when the company first introduced its loyalty rewards program - the stock has risen more than 600%.)

I don't point this out to shame you into investing every spare dollar - or to suggest that you don't deserve the occasional caffeinated confection.

But these numbers are proof of a concerning issue...

That too many of us are ignoring the first and most important step in investing: saving. And in the vast majority of cases, it's not because we "don't have the money"...

It's because we'd prefer to spend it on a $5 coffee that's covered in whipped cream and a caramel drizzle.

Alexander Green summed up this concept well:

As I pointed out in a column a few weeks ago, anyone who invested $190 a month for 40 years - and earned nothing more than the stock market's average annual return for the past 200 years (10%) - would have accumulated a sum of more than $1 million...

Yet the majority of us did nothing of the sort.

Some were too poor... Others believed the government or their employer would take care of their retirement... Still others were simply uninformed about the power of equity ownership and compounding...

However, many of us were not indigent, ignorant or wishful thinkers. We couldn't invest because we didn't save. And we didn't save because we chose immediate consumption over delayed gratification.

Clearly Starbucks has tapped into a major profit stream with its gift cards and loyalty rewards program. But it's sad that more people are fanatical about overpriced coffee than they are about padding their retirement account.