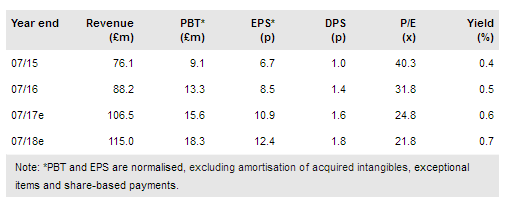

Yougov's (LON:YOU) FY17 year-end trading update confirms that positive trading momentum continued in the second half for Data Products and Services. Results should be ahead of our previous forecasts and well ahead of market growth. The results reflect the growth in high-margin products as well as margin improvements in custom research in addition to some currency benefit. We have moved our PBT numbers up by 5% for FY17e and 9% for FY18e. The shares continue to trade at a premium to the global sector, although that is being eroded by YouGov’s faster growth.

Strategy continues to produce the returns

Management’s emphasis on building a scalable business through productising its offering is fuelling premium organic growth as it gains traction in its markets, notably in the US. BrandIndex and Profiles are building across more geographic markets as well as increasing client numbers and we anticipate this continuing through FY18e. Data Services (principally Omnibus) is also increasing its global reach, with UK growth more muted but still ahead of the market. Custom Research is being concentrated on its more profitable aspects, particularly using the group’s own panel, so that the top line is static (in constant currency terms) but the operating margin is moving ahead. The success of the MRP modelling of the seat-by-seat results of the UK general election is significant for its validation of the methodology rather than for any immediate financial impact. This has many potential applications, not only in marketing but also in broader planning contexts.