The global markets were hit hard as even traditional safe havens did not work. Many countries are on lockdown and most likely, we are already in a global recession. The 10 year plus bull market has ended officially with indexes down over 20% from its all-time highs.

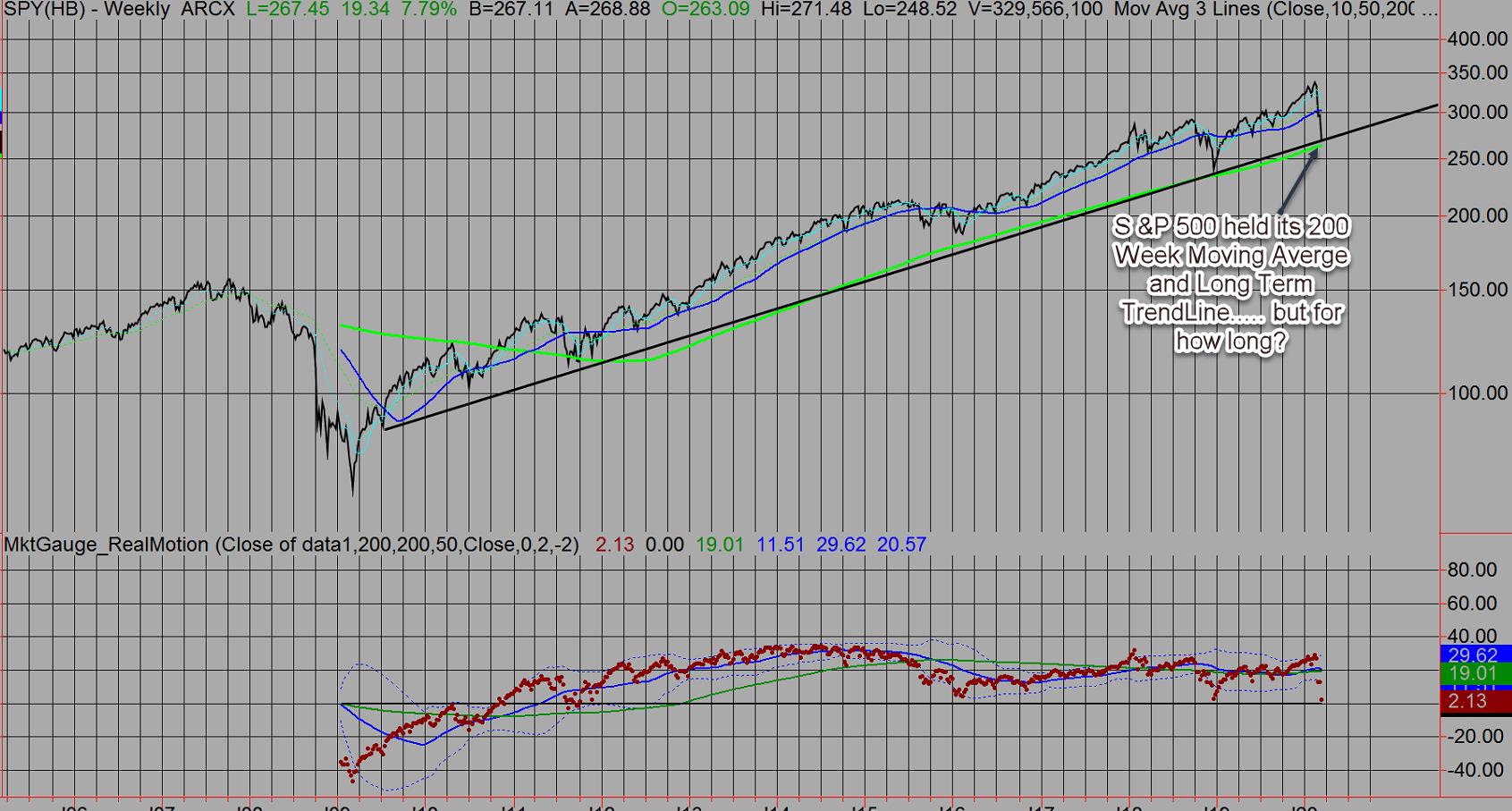

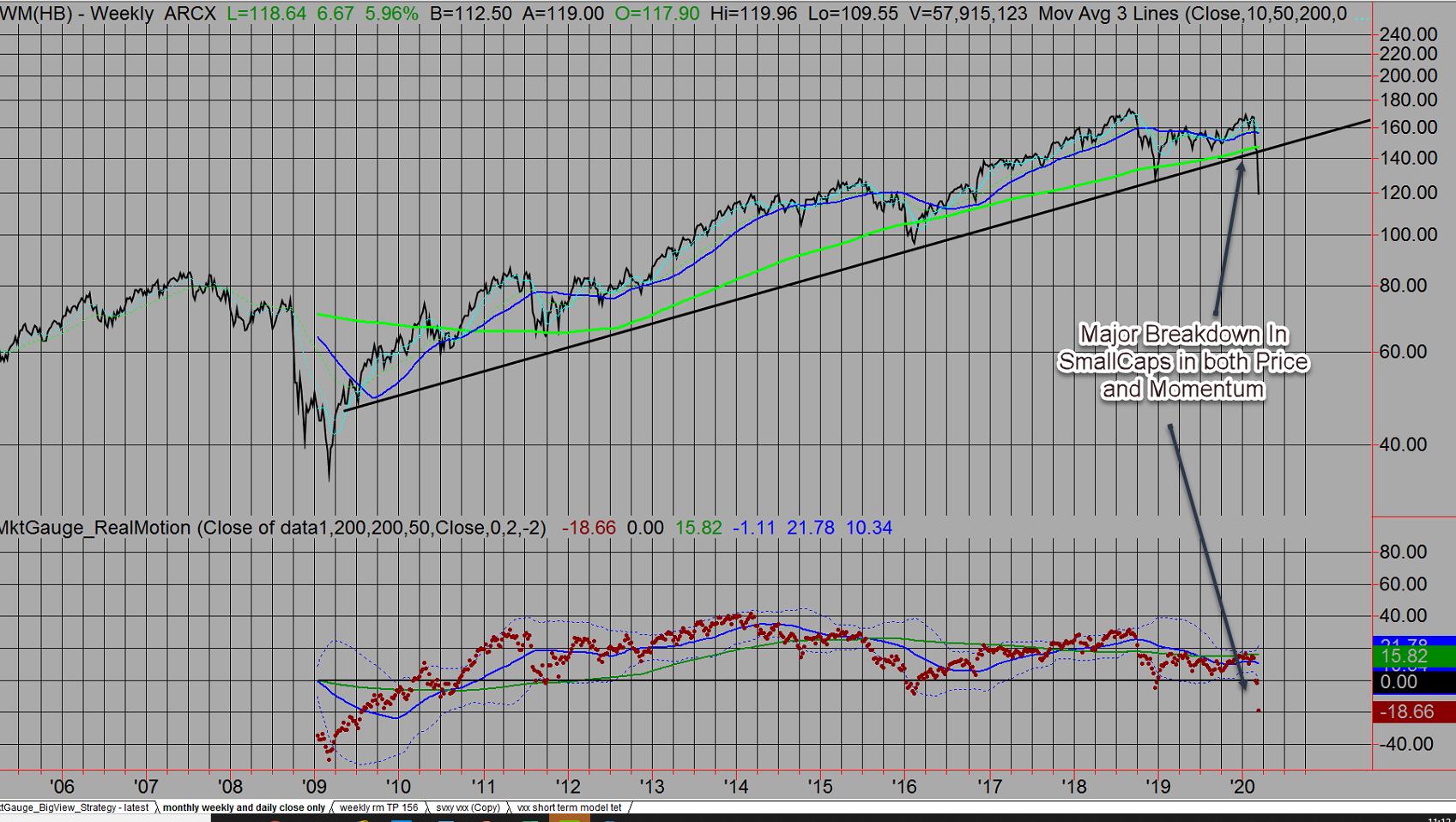

However, the long-term trend starting from the lows in 2009, has only been broken in IWM and the Dow, while both the SPY and QQQ indexes either held their trendlines or key long-term moving averages. This means that the trend for equities on an intermediate-term (weeks or months) is down but has not fully capitulated yet on a longer-term basis.

Even players like Bridgewater lost 20% so far this year as traditional intermarket relationships broke down.

This past week’s highlights:

- Risk Gauges are still in risk-off mode but improved slightly as Utilities underperformed stocks

- Credit Markets are showing extreme stress

- Chinese stocks firmed on a relative basis as the virus seems contained on the mainland

- Market Internals and Sentiment are stabilizing at current deeply oversold levels

- Brother Biotech (NASDAQ:IBB) is holding up best among sectors

- Volume is showing major Institutional selling and even Fridays monster rally was not an accumulation day

- Volatility (VXX) exploded once again and deeply overbought:

- All asset classes got hit hard including Fixed Income, Gold and Commodities as many players sold anything liquid to raise cash

The action plan is to sell into short term rallies (the intermediate uptrend is broken) because at the same time we are deeply oversold on a shorter-term basis.