Yingli Green Energy Holding Company Ltd. (NYSE:YGE) , also known as Yingli Solar, has incurred an adjusted net loss of $2.70 per American Depositary Share (ADS) in third-quarter 2017, wider than the Zacks Consensus Estimate of a loss of $2.61. The company had reported a loss of $2.18 per ADS in the year-ago quarter.

Revenues

Total revenues were $252.3 million, up 15.3% year over year. Revenues also surpassed the Zacks Consensus Estimate of $242 million by 4.3%.

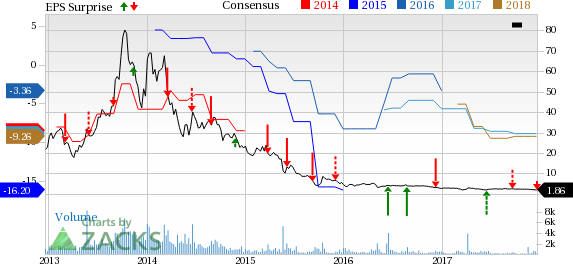

Yingli Green Energy Holding Company Limited Price, Consensus and EPS Surprise

Highlights of the Release

Total photovoltaic (PV) module shipments were 597.7 megawatts (MW) in third-quarter 2017 compared with 365.3 MW a year ago.

Gross margin in the reported quarter deteriorated 390 basis points (bps) year over year to 1.6%. Operating expenses were up a whopping 647.7% year over year to $344.7 million.

Operating loss in the quarter under review was $340.7 million, compared with the year-ago quarter’s operating loss of $34 million.

Interest expenses totaled $24.2 million in the reported quarter compared with $24 million in the year-earlier quarter.

Financial Highlights

The company had cash & cash equivalents of $66 million as of Sep 30, 2017, compared with $125.1 million as of Dec 31, 2016.

Long-term debt, excluding current portion, was $460.7 million as of Sep 30, 2017, up from $363.5 million as of Dec 31, 2016.

Guidance

For the fourth quarter, Yingli Green expects PV module shipments in the range of 700-800 MW. The company has raised the shipment expectation to the range of 2.8-2.9 gigawatts (GW) from the earlier 2.5-2.8 GW for 2017.

Peer Releases

First Solar Inc. (NASDAQ:FSLR) reported third-quarter 2017 adjusted earnings of $1.95 per share, beating the Zacks Consensus Estimate of 85 cents by 129.4%.

Canadian Solar Inc. (NASDAQ:CSIQ) posted third-quarter 2017 adjusted earnings of 22 cents per share, in line with the Zacks Consensus Estimate.

SunPower Corp. (NASDAQ:SPWR) reported third-quarter 2017 earnings of 21 cents per share. The Zacks Consensus Estimate was pegged at a loss of 36 cents.

Zacks Rank

Yingli Green carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

First Solar, Inc. (FSLR): Free Stock Analysis Report

SunPower Corporation (SPWR): Free Stock Analysis Report

Yingli Green Energy Holding Company Limited (YGE): Free Stock Analysis Report

Canadian Solar Inc. (CSIQ): Free Stock Analysis Report

Original post

Zacks Investment Research